Are tariffs effective? A deep dive into the auto sector

One way to answer this question is to look at the auto sector. This is where things get interesting. Car manufacturing is a truly global operation, with the world’s biggest brands basing their production centers in multiple countries, not just their country of origin. If that was the case, it would be much easier for President Trump’s tariff programme to target.

Instead, we have a hodge podge of rules that mean tariffs will impact different EU auto makers in different ways. For example, Volkswagen and BMW. Volkswagen usually makes cars in the US for the US market. Last week, the President granted a 1-month tariff delay to car makers who adhere to the US – Mexico – Canada agreement, or USMCA. Theis means that if a car maker that is based in the US makes cars with at least 75% of its parts also originating from the US, then this will also exempt those car makers a 25% tariff.

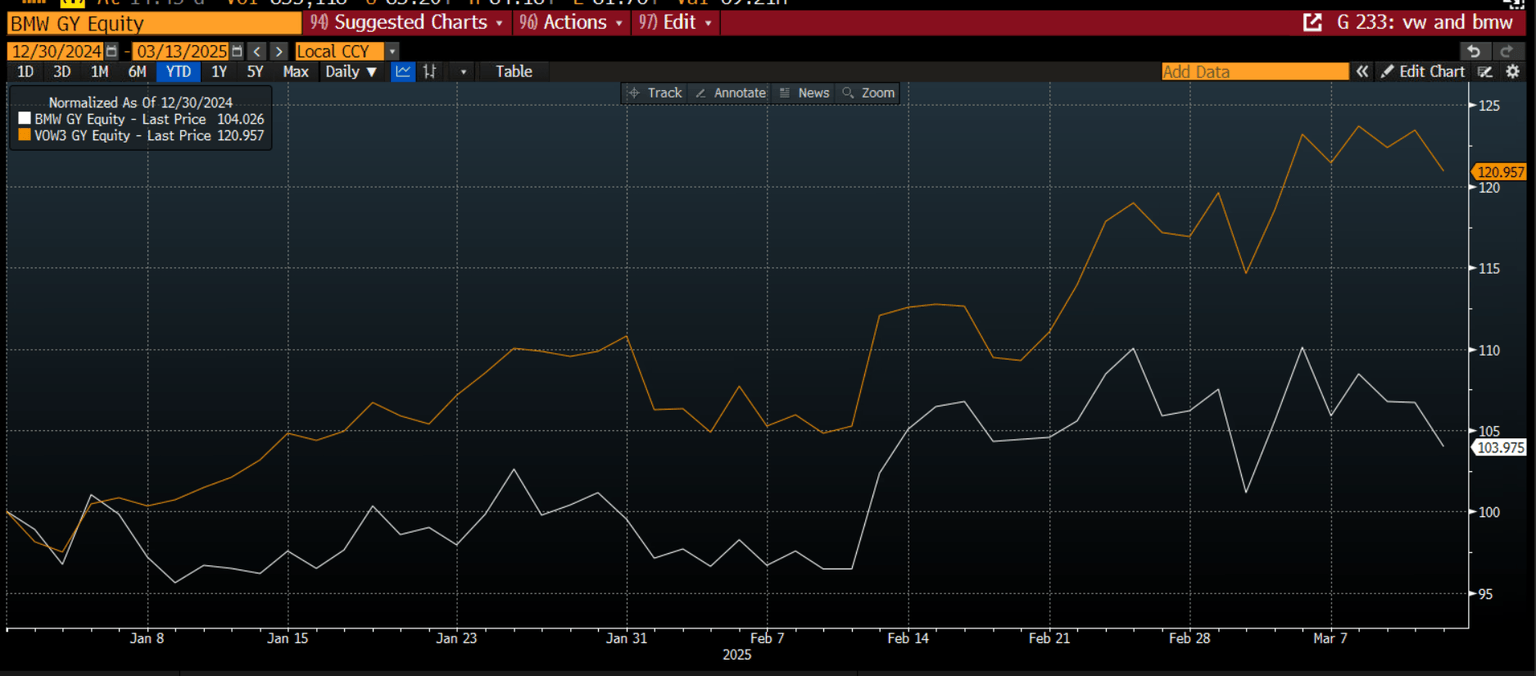

For now, Volkswagen is exempt from Trump’s tariffs at least for the next month. What happens after that, who knows. BMW, however, does not adhere to the USMCA rules. BMW said that the situation around American tariffs is volatile and complex, however it confirmed that the cars that it sells in the US would be hit with a 25% tariff. This explains the recent outperformance of VW vs. BMW, as you can see below.

BMW and VW, normalized to show how they move together

Source: XTB and Bloomberg

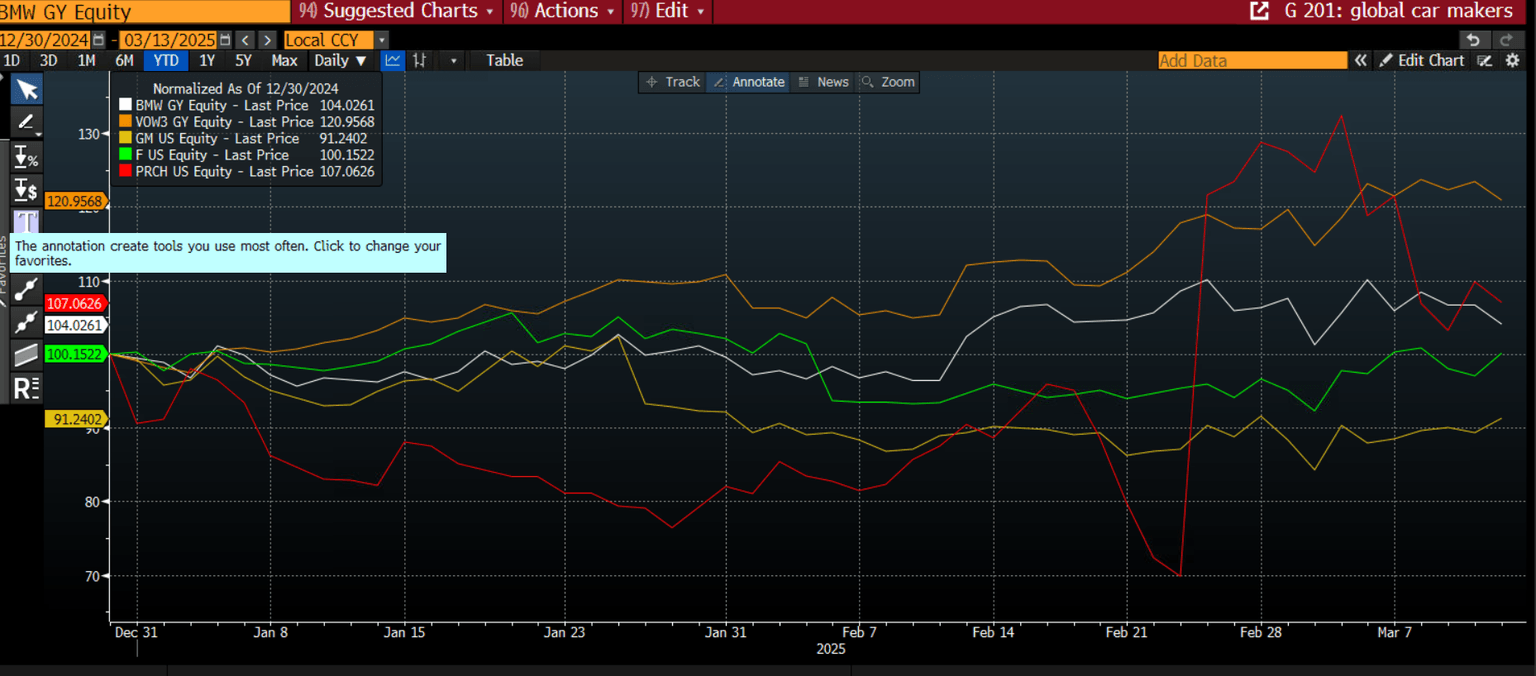

It is also unclear that Trump’s tariff threats and desire to see American cars on the streets of Europe is benefiting the stock price of American cars. The EU have been clear that they will not stand idly by and allow President Trump to tax their exports without doing the same to US products. As you can see, so far this year Ford and GM are under performing European car manufacturers.

Although GM and Ford are picking up from the lows compared to earlier this year, it suggests that, from an equity market perspective, the US’s mission to impose tariffs on foreign auto brands might be a futile exercise.

US and European car makers, normalized to show how they move together YTD

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.