Apple Stock Price: Apple recovers from lows as the tech sector seems unstoppable

- Apple shares are trading 1% higher on Tuesday after a torrid start to the session on Tuesday.

- The Nasdaq index has also bounced off its lows of the day after more tech firms pare losses.

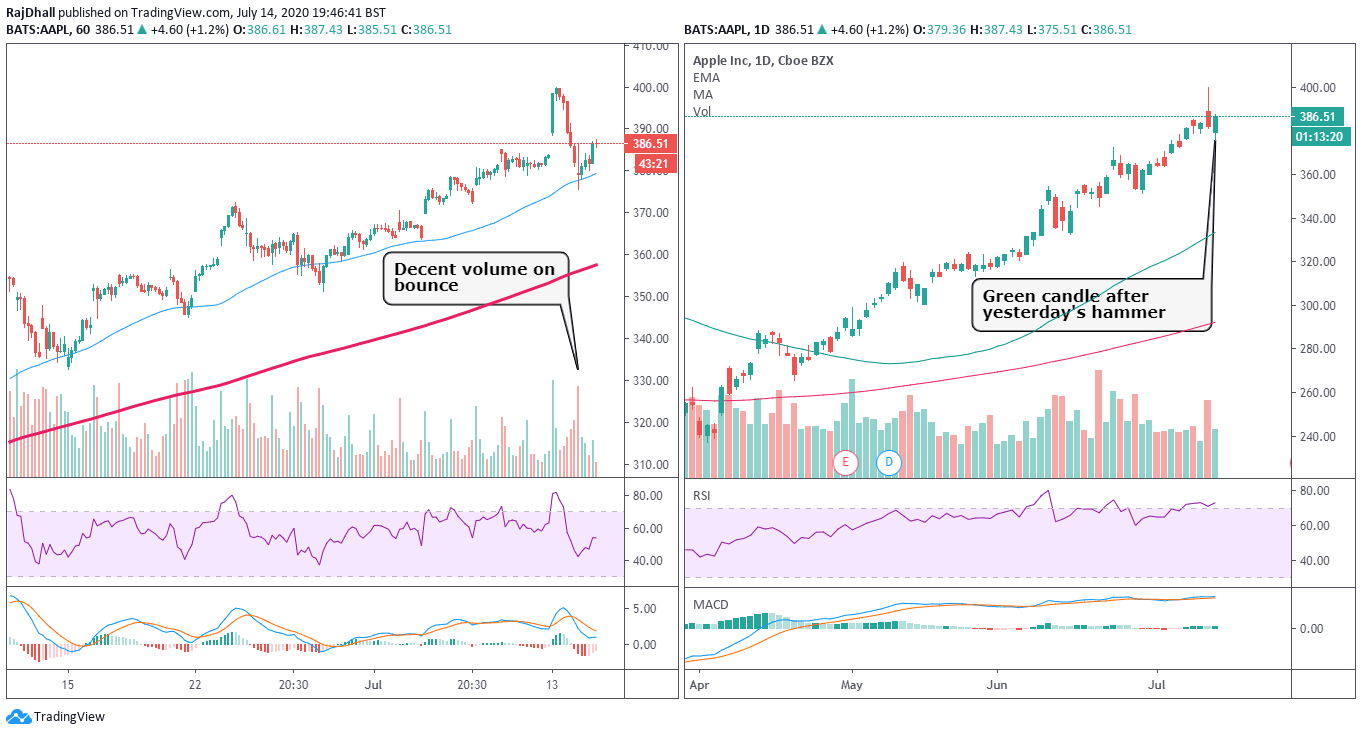

Apple stock 1-hour and daily chart

The Apple (NYSE:APPL) stock price has picked itself up from the floor on Tuesday after a scary start to the session. The whole Nasdaq index sold off at the open as it seems shareholders were dumping their holdings of the companies with the biggest market caps in the index. Now the Nasdaq has also recovered to trade only 0.14% lower and the price has recovered to print at 10598.0 from a low of 10372.0.

Looking at the 1-hour chart on the left and its clear to see there has been good backing from the market. As the price hit the 55 Simple Moving Average the buyers came surging back in. The 400.00 level does seem to be some kind of psychological resistance but if the bulls get hold of the market again then there could be another test. On the daily chart on the right-hand side, it's interesting to see a recovery after a shooting star candle formed yesterday. Lots of technical (candlestick) traders may have been fooled by this move as the candle is normally a very bearish one.

The companies latest earnings update will come on 30th July 2020, the current EPS estimate is at 2.43 and I am sure investors will want an update on the state current store closures. The current revenue forecast is around USD 63 bln understandably lower than the pre-COVID-19 figure from Q1 which came in at USD 91.8 bln. The Q2 earnings update was even lower as the company posted revenues of USD 58.3 billion and anything lower than this could see the share price fall.

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.