- Apple trades calmly on Monday and closes barely unchanged.

- Tuesday sees risk assets get a boost from a reduction in Russia tensions.

- AAPL should gain as the dollar, gold and oil all go lower.

Apple (AAPL) traded barely unchanged on Monday and finished the session at $168.88 for a tiny gain of 0.14%. Volume was below recent averages as the market awaited clarity from geo-political events surrounding Russia. Tuesday sees some welcome clarity with reports of some Russian deployments returning to their bases from the Ukrainian border. Russian and German leaders are meeting today. Already equities in Europe are trading higher, and the dollar and gold are lower. Naturally, so too is oil. These are risk indicators and should see equities benefit on Tuesday, assuming the Russia-Ukraine news flow remains unchanged.

Apple Stock News

Benzinga picked up on a report from Wccftech.com on Monday detailing some Apple filings for new product launches. The rumoured product launch date is March 8. Specifications were released with the Eurasian Economic Database, according to the report. The event is rumoured to be on March 8 and will include new Apple products with much attention on the new iPhone SE3. Samsung also last week announced three new Galaxy phones and some tablets as it ramps up competition with Apple.

Apple Stock Forecast

The 100-day moving average at $161 worked as support in the recent leg lower, but for the strong bullish trend to continue we would not like to see another test of the level. Rather $167 should hold, paving the way for a test to record highs. Resistance at $176 is the interim to a record test.

Apple (AAPL) chart, daily

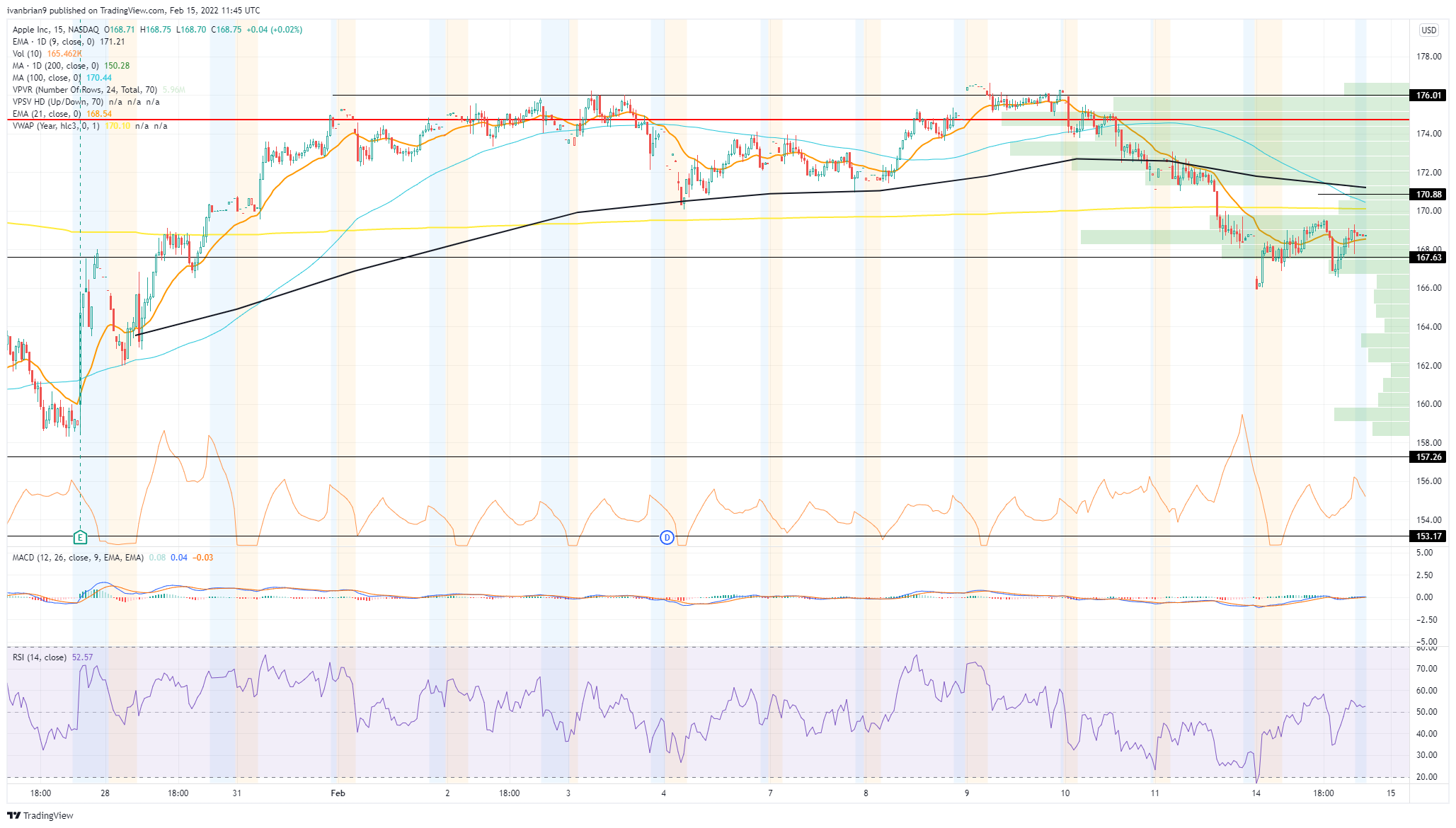

The quarter-hour chart gives us a better look at the short-term levels. $167 and above is where all the recent volume has taken place, hence why we want to see it hold. A break and a move to $157 is likely. Resistance at $176 is also clear. This is the short-term range pattern that can be played in the absence of any concrete geo-political or stock-specific developments.

Apple chart, 15-minute

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady below 0.6550 after PBOC's status quo

AUD/USD is trading in a tight range below 0.6550 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions keep the Aussie on the edge ahead of Fedspeak.

USD/JPY pares gains below 155.00 amid risk-off mood

USD/JPY is paring back gains below 155.00 in Wednesday's Asian session. A broadly softer US Dollar, a risk-off market mood and looming Japanese intervention risks limit the pair's upside. Mounting Russia-Ukraine tensions weigh on risk appetite, lending support to the safe-haven Japanese Yen.

Gold stays firm amid geopolitical concerns, nears $2,650

Gold price holds comfortably above $2,600, nearing $2,650 early Wednesday. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help Gold price hold its ground.

XRP on the verge of a rally to $1.96 as investors maintain bullish sentiment

Ripple's XRP trades at $1.11 on Wednesday, maintaining its position as the best-performing cryptocurrency in the top 20 cryptos by market capitalization, with over a 50% rise in the past week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.