Apple Stock News and Forecast: Apple set for more losses, $120 target remains intact

- AAPL stock fell nearly 3% on Monday as fears of recession draw nearer.

- Apple was also under pressure from Foxconn shutting its plant in Shenzen due to covid lockdowns.

- Yields are spiking, which is hurting all Nasdaq stocks.

Apple (AAPL) shares fell again on Monday as the ever-increasing bearish narrative looks to step up a gear. No matter what way you look at it, it is hard to make an argument for optimism right now. Interest rates are going higher, inflation is going higher and sanctions are hitting global growth. The world has entered a new phase of protectionism, which will hinder global trade and put increased pressure and costs on those companies that do operate on a global basis. The Fed will kick off the interest rate hiking cycle on Wednesday, and even if the situation in Ukraine resolves itself it seems investors will be left in an inflationary environment with equity valuations suffering as a result.

Apple Stock News

Monday saw more bad news for Apple as one of its main suppliers in China, Foxconn, had to close its plant in Shenzen due to the escalating rate of covid infections there. China is going to struggle to contain the Omicron strain as this is much more transmissible than earlier variants. The market may be looking at a longer lockdown in China, which is not a positive for Foxconn or Apple. The latest media reports suggest Foxconn is in talks with Saudi Arabia to build a plant there, but this is a long-term project. The analyst community remains overwhelmingly bullish on Apple. Our $120 price target is not a criticism of the business itself, merely a reflection of the time we live in.

Analysts are usually microeconomic forecasters who are rarely looking at the big macro picture. Apple stock is extremely profitable, an exceptional business, but it is not immune from the current macroeconomic environment and indeed the geopolitical environment. Even without the lockdowns in China, I would still have a $120 target on Apple. Sanctions will slow global growth and put increasing costs on air and sea freight. Inflation will hit consumer demand and rising yields will make equity investments less obvious. In effect this is the end of the TINA trade (there is no alternative).

Apple Stock News

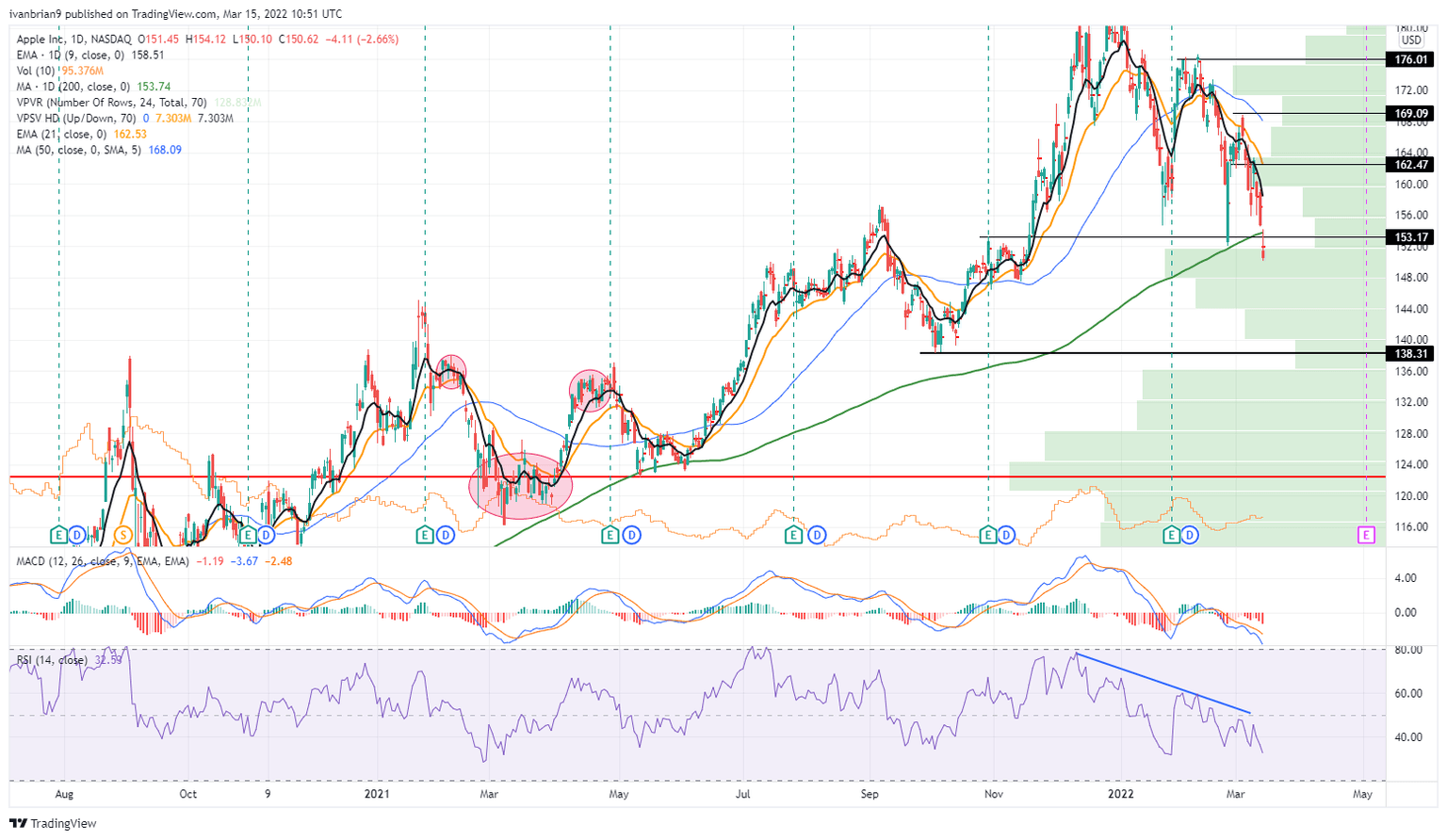

Adding to our bearish call is the very significant break of the 200-day moving average on Monday. This is strongly negative, and Apple is now bearish across all timeframes – the first time it has been in quite some time. $138 is the next target for support. AAPL still has a declining Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) confirming the price move. $120 is not that dramatic a call, it only takes Apple back to where it was this time last year.

Apple (AAPL) chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.