AAPL Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iii} of 3.

Direction: Upside in wave {iii}.

Details: Aggressive count to the upside with a double 1-2. As long as we keep trading above 200$ we can foresee further long term upside.

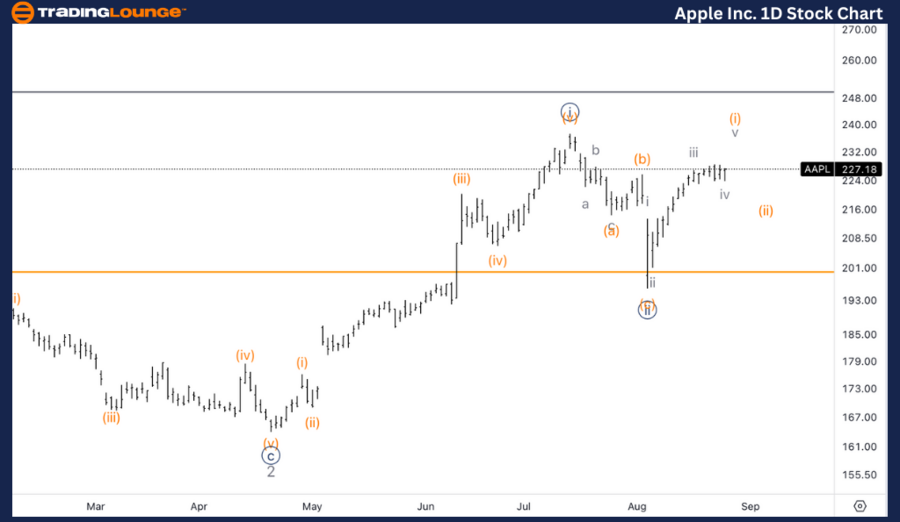

AAPL Elliott Wave technical analysis – Daily chart

AAPL is currently in wave {iii} of 3, following an aggressive count that suggests a double 1-2 formation. As long as AAPL remains above the $200 level, further long-term upside is anticipated. This bullish scenario suggests that AAPL is poised to continue its upward trajectory, driven by strong momentum within wave {iii}.

AAPL Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (i) of {iii}.

Direction: Top in wave (i).

Details: Looking for one more leg higher towards 230$, the top of MinorGroup1, to then correct within wave (ii) of {iii}.

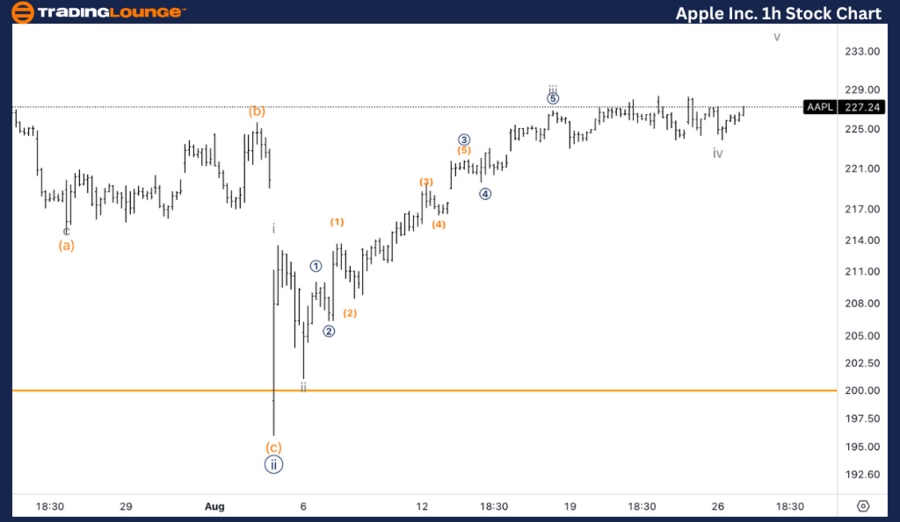

AAPL Elliott Wave technical analysis – One-hour chart

The 1-hour chart suggests that AAPL is nearing the completion of wave (i) within the larger wave {iii}. We anticipate one more leg higher towards the $230 level, which aligns with the top of MinorGroup1. Following this, a corrective phase within wave (ii) of {iii} is expected. This correction could present a buying opportunity before the next leg higher.

Welcome to our latest Elliott Wave analysis for Apple Inc. (AAPL). This report provides a detailed overview of AAPL's price movements using Elliott Wave Theory, aiming to help traders identify potential opportunities based on the current wave structure. We will analyze both the daily and 1-hour charts to offer a comprehensive understanding of AAPL's market behavior.

Apple Inc. (AAPL) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stays below 1.1200 ahead of US data

Following a short-lasting recovery attempt, EUR/USD stays below 1.1200 on Tuesday. The cautious mood ahead of CB Consumer Confidence data from the US helps the US Dollar hold steady and doesn't allow the pair to gain traction.

GBP/USD pulls away from 29-month-high, trades above 1.3200

GBP/USD enters a consolidation phase above 1.3200 after touching its highest level since March 22 near 1.3250 earlier in the session. The US Dollar holds steady and cap's the pair's upside as investors await mid-tier data releases from the US.

Gold slides toward $2,500 on reduced haven demand, better US data

Gold trades marginally lower in the $2,510s on Tuesday as tensions in the Middle East dissipate, reducing haven demand for the yellow metal. This comes after Israel and Hezbollah’s tit-for-tat missile exchange fails to escalate, though ongoing threats from Iran hover.

Markets in a waiting pattern with a potential explosion in volatility – Why?

The weakness of the Dollar tok a breezer but might continue these coming days. il prices steadied further after the strong support level holds the price from falling further. Geopolitical tensions and the end of the month might call for more upside potential here.

Three fundamentals for the week: Focus on the fragility of the US economy Premium

US Consumer confidence data will provide a gauge of how consumers are feeling. Jobless claims are in focus after Fed Chair Powell's dovish speech. Investors will look to the core PCE index to confirm that inflation is falling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.