Apple Stock Price and Forecast: Why is AAPL stock going up?

- Apple stock bounces as the main market does the same.

- Buy the dip! Just keep buying the dip!

- AAPL is now just under all-time highs.

Apple steadied itself from recent losses and has now put in three straight days of gains, in the process taking the stock back toward $150 and near all-time highs at $151.68. The overall market had looked a little bearish last week as fears over the Delta variant and the Fed tapering set in. Added to this was some weak economic data with Goldman Sachs slashing US GDP forecasts in half and US retail sales coming in well behind estimates. All this set a bearish trend in motion, but as ever it appears it was just a dip and normal service is now resumed. If that is the case then Apple stock should break all-time highs and trend higher.

Tapering generally means higher rates, which usually do not favour high growth Nasdaq tech stocks. Apple does not fit in this basket. It certainly is high growth, but it has huge current cash flows, not future expected ones. The reason high growth stocks suffer the most in a rising rate environment is that these future cash flows are discounted to present value using the predicted interest rates. The higher rates go then the higher the discount for those projected future cash flows. Apple is a cash generator of enormous proportions, so clearly it is not your typical Nasdaq tech stock. It is a beast!

Apple key statistics

| Market Cap | $2.5 trillion |

| Enterprise Value | $2.3 trillion |

| Price/Earnings (P/E) | 29 |

|

Price/Book | 38 |

| Price/Sales | 9 |

| Gross Margin | 41% |

| Net Margin | 25% |

| EBITDA | $112 billion |

| 52 week low | $103.10 |

| 52 week high | $151.68 |

| Average Wall Street rating and price target |

Buy $165 |

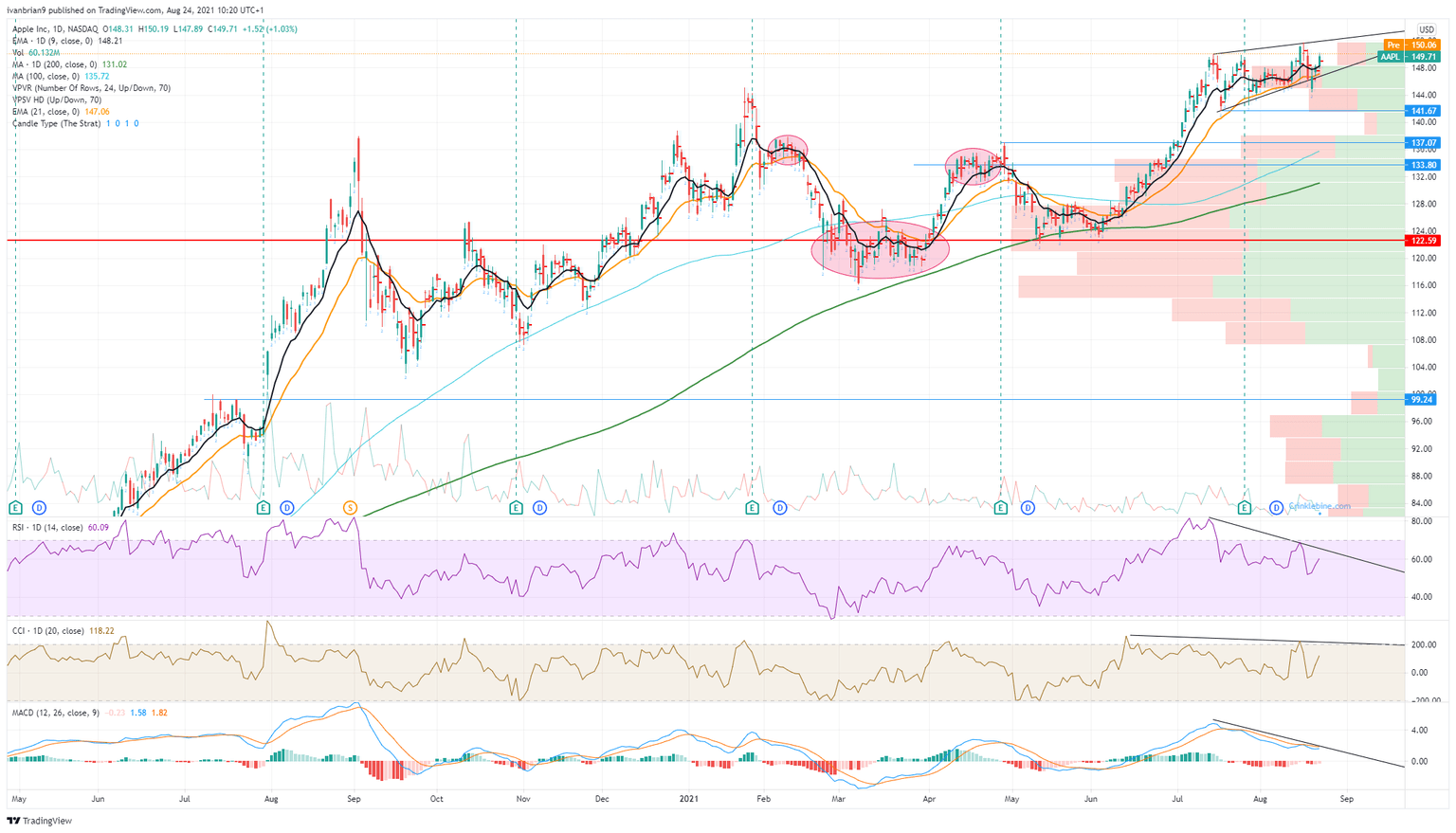

Apple stock forecast

The big unknown in all of this is when does the Fed begin to taper. We have spoken previously here at FXStreet of the massive correlation between the Fed's asset purchases and balance sheet and the stock market. Logically then, a tapering should see a sell-off or at least cooling. Apple, despite its healthy and strong business, is unlikely to remain bullish if the overall market turns bearish. So in the medium to longer-term, some caution is needed. However, in the short term, Apple has returned to its bullish pennant or wedge formation. We can put last week's dip down to a false break. The top of the wedge is at $152, the first resistance. We are still exhibiting some bearish divergences though in the Relative Strength Index (RSI), Commodity Channel Index (CCI) and Moving Average Convergence Divergence (MACD). All three are trending lower despite Apple stock trending higher. A breakout is needed to confirm the bullishness. $141.67 remains key, and above here the bullish trend is still healthy. A break of $141.67 and the move should accelerate to $133.80 due to the volume shelf.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637653937674403035.png&w=1536&q=95)