- Apple shares bounce on a strong day for equities.

- AAPL stock closes at $148.89, up 2%.

- AAPL poised near all-time highs at $150.

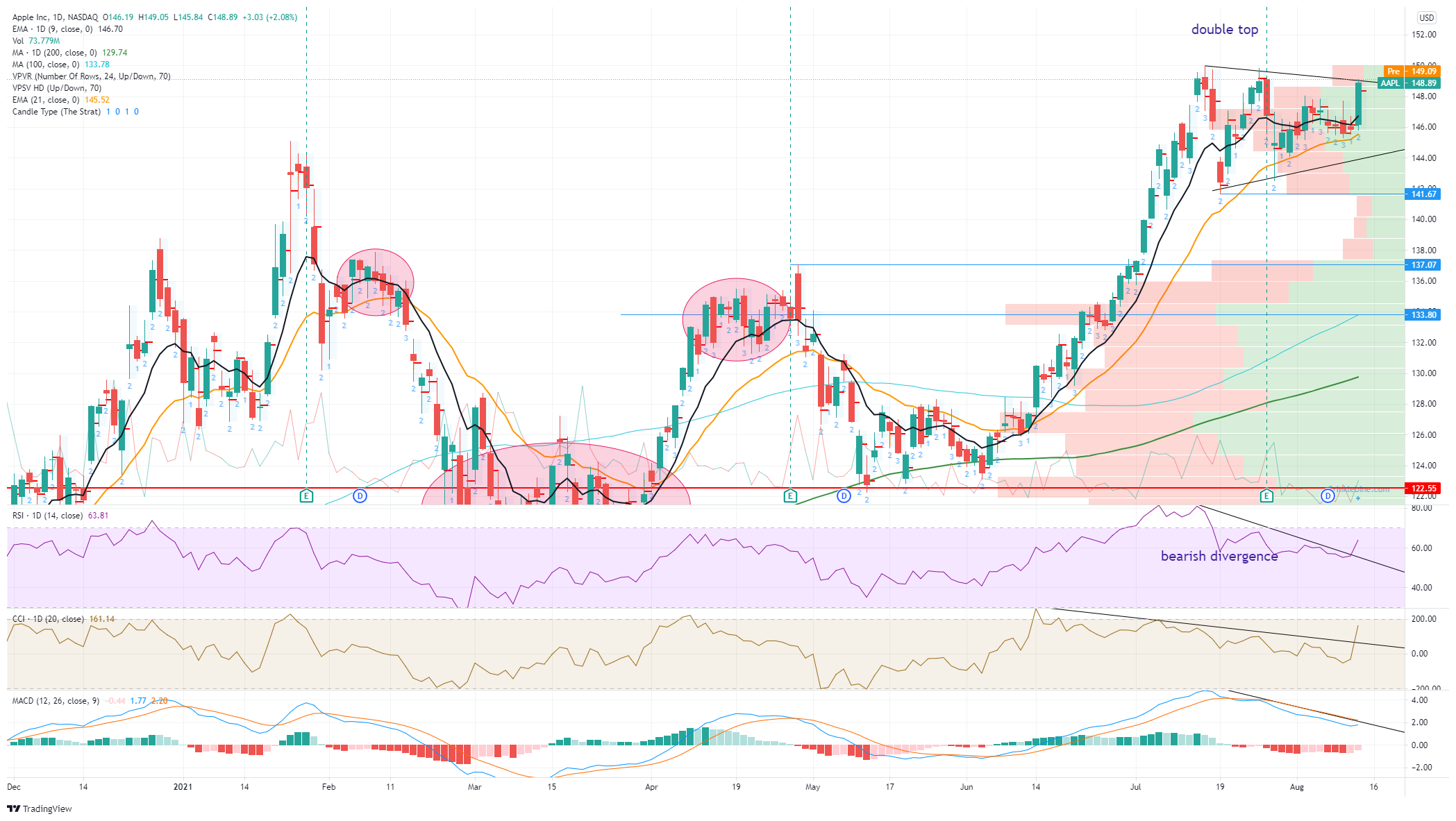

Apple stock put in a pretty decent performance on Thursday with a strong surge to end the day up slightly over 2%. In the process, Apple pushed closer to all-time highs at $150 and puts our double top thesis in jeopardy. We have, however, cautioned that the double top was yet to trigger and would need a break of $141.67 to confirm it. This has yet to happen, so all bets are off. On Thursday we identified the small flag or pennant formation that has been forming lately due to the restricted volatility and small daily ranges. We also mentioned that eventually, a consolidation phase like this one leads to a breakout. The consolidation is a coiled spring waiting for a catalyst to move powerfully in either direction. In this case, a pennant or flag formation is a continuation phase, and the recent phase has been bullish. Based on this, technical analysts would expect Apple to break out and make fresh all-time highs above $150. However, we are not yet fully convinced of this at FXStreet. On Thursday we mentioned two nice potential option plays to benefit from a breakout in either direction: "A $135 put for August 27 costs about $0.30 cents per share. If Apple breaks $141.67 it should move pretty quickly toward $133.80. If you are bullish and see a breakout to new highs then a $155 call for August 27 costs $0.19 cents per share".

How have we done? The move on Thursday has seen our $155 call treble in value, yes a 200% gain in one day to $0.60. Our $135 put has dropped from $0.30 to $0.23, so a 7 cent loss versus a 41 cent gain on the call, so a 34 cent combined gain on the strangle strategy or 68% gain in one session. Happy days!

Apple key statistics

| Market Cap | $2.5 trillion |

| Enterprise Value | $2.3 trillion |

| Price/Earnings (P/E) | 29 |

|

Price/Book |

38 |

| Price/Sales | 9 |

| Gross Margin | 41% |

| Net Margin | 25% |

| EBITDA | $112 billion |

| 52 week low | $89.14 |

| 52 week high | $150 |

| Average Wall Street rating and price target |

Buy $165 |

Apple stock forecast

We remain more bearish on our view, but yesterday's move was an impressive one and warrants caution. However, we have not yet initiated our bearish call and are waiting for a break of $141.67 to unleash the bears. Thursday has seen a potential running of the bulls with a move up to the top of the flag trend line, see chart below. A break and all-time highs at $150 should break next, meaning our call is clearly wrong. Thursday also saw a breakout from the bearish divergences we had witnessed in the Relative Strength Index (RSI) and Commodity Channel Index (CCI). The Moving Average Convergence Divergence (MACD) remain bearish though. Our options strangle call from yesterday has worked extremely well though. Strangles (buying a put and buying a call) are a very useful strategy when you anticipate a breakout but are not sure which direction. Apple had a few days of very low activity with tiny moves, which meant options volatility dropped and made option prices cheap. It was the perfect time to buy some.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD climbs above 0.6200 amid broad USD weakness and trade jitters

The Australian Dollar extended its advance on Thursday, climbing toward the 0.6240 zone. The pair built on recent strength as the US Dollar Index slid further toward multi-month lows near the 101 area. This move came after markets digested the White House’s confirmation of a steep 145% tariff on Chinese goods, combined with a cautious Federal Reserve tone.

EUR/USD surges higher as tariff walk-back eases tensions further

EUR/USD roared into its highest bids in nearly two years on Thursday, breaching and closing above the 1.1200 handle for the first time in 21 months. Market tensions continue to ease following the Trump administration’s last-minute pivot away from its own tariffs, sparking a softening in US Dollar flows.

Gold rises to record high near $3,200 on US-China tariff war

Gold price surges to near an all-time high around $3,190 during the early Asian session on Friday. The weakening of the US Dollar and escalating trade war between the United States and China provide some support to the precious metal.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin miners are reportedly scrambling to import mining equipment into the United States following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637644467401487313.png)