- Apple stock continues to head for all-time highs on Wednesday.

- AAPL targets new highs above $145.09 from January.

- Mega-tech FAANG peer-group GOOGL, FB and AMZN have already set record highs.

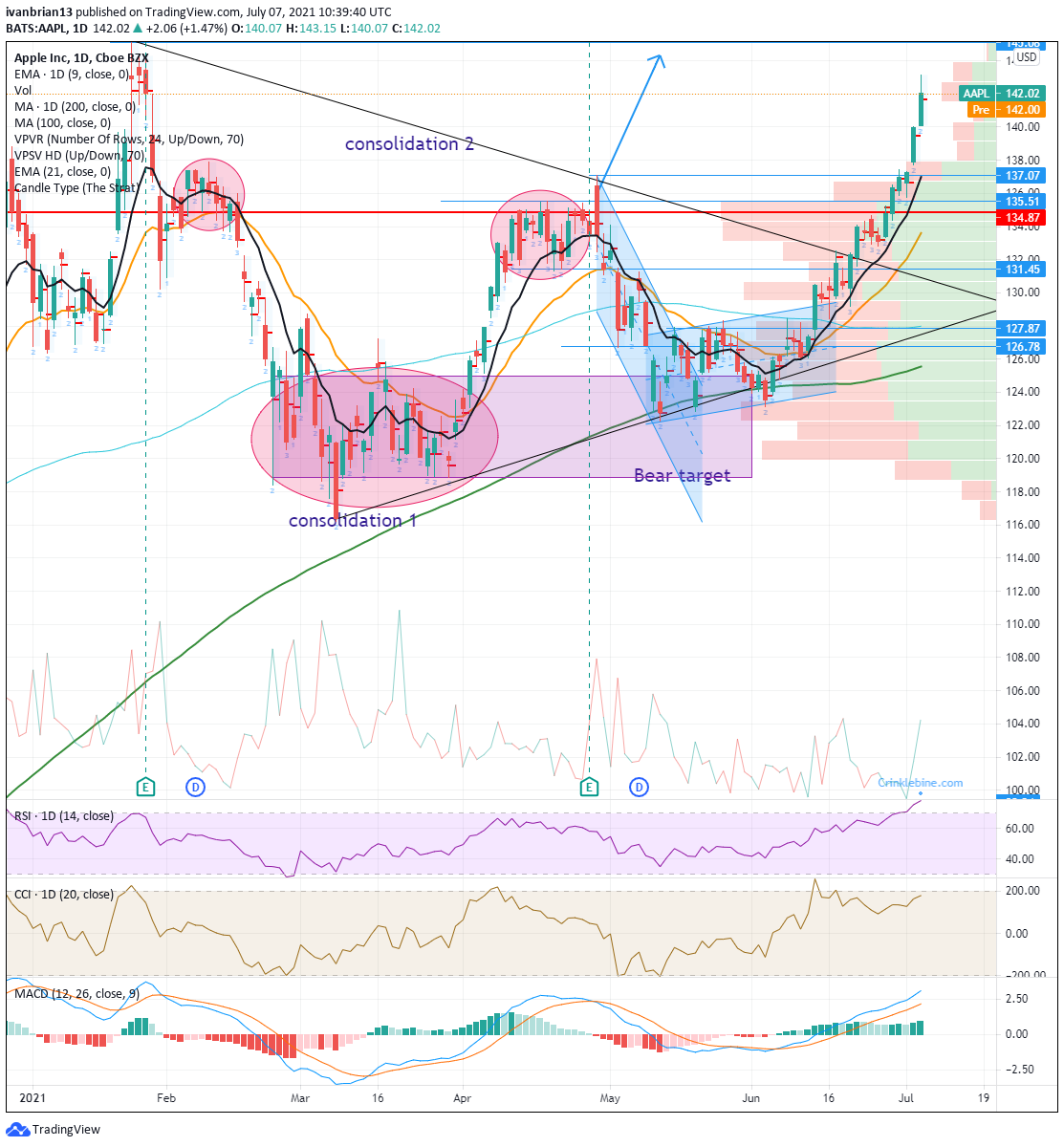

Update: Can we do it on Wednesday and set a new all-time high for Apple (AAPL) shares. The stock is clearly on track as it rises 1.5% to $144.22 in the first half hour of trading. The move has been fueled by breaking through $135 and $137 into areas of light resistance. Fundamentals were not the problem and now the technical picture has caught up with peers Facebook and Amazon.

Apple stock continues to trend very strongly toward making fresh all-time highs. Tuesday saw the mega-tech leader add another 1.47% to a steady rise and AAPL stock closed only $3 away from fresh record highs. The shares closed at $142.02 with the previous all-time high from January 25 at $145.09.

Apple shares are now up nearly 13% in the last month, lucky for some, especially those who are long. Apple still has to break all-time highs, though, while Facebook (FB), Alphabet (GOOGL) and Amazon (AMZN) have all recently powered to new all-time highs. The chart below compares the mega tech names in question. Apple is catching up but there is no reason why it should be lagging.

The last results were stellar, beating analyst's estimates by over 40% and Apple also added that it was increasing its dividend and stock buyback program. As we can see from below since the results period at the end of April when all of FB, AAPL, AMZN and GOOGL released strong results Apple has underperformed Facebook by a huge margin, FB is up 17% since Q1 results, Apple is up 6%. GOOGL is up over 10% on the period.

All of these mega-tech names released results strongly ahead of Wall Street estimates. As mentioned, Apple beat estimates by 42%, GOOGL and AMZN beat estimates by over 60% while Facebook matched Apple with a 40% beat. Apple, though, also increased its buy-back and dividend program. Its performance has lagged counterparts, but it might not be for long as the trend is clearly headed higher.

Apple stock forecast

Now that the last big resistance at $137 before all-time highs has been taken out, it paves the way for an easier ascent for AAPL stock. The volume profile has dropped off significantly above this $137 level. The trend has gained strength above $135 and then again above $137. This is exactly what should happen given the volume profile drops off each time above these resistance levels.

There is very little volume and price resistance to stop AAPL from breaking record highs above $145.09. The one worrying aspect is the Relative Strength Index (RSI) has moved into overbought territory. So, this needs to be watched, but as we have previously mentioned it does not mean a stock price must drop. The RSI is based on the speed of movement so the price can rise more slowly or sideways and the RSI will move back to neutral, the price does not have to fall for the RSI to retreat. But apart from this, the trend remains very strong and the risk-reward continues to favour a move to new all-time highs.

- The trend is clearly strong, with 6 green days in a row.

- Apple peer group is also making record highs, AMZN, FB, and GOOGL and Apple needs to play catch up.

- The Nasdaq and S&P remain bullish with a matching strong trend in place.

- The volume profile is thin at current levels meaning resistance is not strong.

Ok, so that's four reasons, you got one for free!

The $137 mark remains key support for the short-term push higher. This is the previous strong resistance and also now where the 9-day moving average sits. A break below and the trend would be in doubt. This is where I would have my stop if I was long, but every trader is different but please do have some risk management plan in place.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637612501086250245.png)

-637612504502165240.png)