Apple Stock Forecast: AAPL retraces to channel support ahead of Fed

- Apple shares still slide as broad markets close lower before Fed.

- AAPL stock price languishes, but NFLX and FB outperform.

- AAPL largely in sideways range but finds support at trend channel.

Apple shares closed lower again on Tuesday just when it looked like some momentum might be returning to the stock. As previously mentioned, it has all been one way for the Apple stock price since the release of very strong results, with the shares sliding to find strong support in the mid-$120s. Apple has increased its buy-back program and also increased its dividend payment, but the AAPL share price has languished. Monday finally saw things begin to pick up as Apple shares broke out to the upside from the recently identified trend channel. A slight retracement on Tuesday was not unexpected with the Fed looming large in the minds of traders.

Markets adopted a risk-off tone across the board as traders grow increasingly worried the Fed may be forced to taper earlier than expected. Recent inflation data is strong and the recent Producer Price Index (PPI) spiked to record levels. This release on Tuesday and a poor Retail Sales number are the last data sets the Fed will be considering, so inflationary pressures will be fresh in the minds of Fed members.

Apple stock forecast

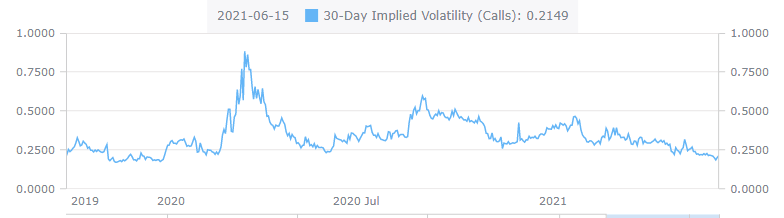

Volatility in Apple has been steadily declining since the pandemic, March 2020 spike means it may be a good time to make use of the relative cheapness of buying call options to try and take advantage of any price acceleration.

Source: Alphaquery.com

The chart above from Alphaquery shows data just for calls, but the story is similar for puts. This is a relatively cheap time to be buying volatility. That is not to say it will not keep going lower, but using options does have the benefit of knowing your maximum loss on a position. Calls are trading at around 25% volatility. By contrast, AMC calls are nearing 300% volume for some strikes, hence buying them is expensive.

Apple shares remain well-supported with the point of control (highest volume price, i.e. equilibrium) being at $126.44 for 2021. The 200-day moving average sits at $124, so this area is strongly supportive. Apple shares have not traded below the 200-day moving average since March 2020. A break of $135 and more specifically $137 sees volume drop off sharply, meaning a price move above these levels will not have as much resistance to stop further gains. A call spread (buying near strike, selling far) will reduce the cost of what is a bullish strategy while admittedly limiting profits. But this may be the smart play as Apple is unlikely to explode higher like some of the meme stock names.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637594317612279740.png&w=1536&q=95)