- Apple shares staged a strong rally to close up 2% on Monday.

- Nasdaq set the scene with a push to record highs.

- AAPL broke resistance and now targets $137.

Finally, Apple staged a strong rally as it had been languishing in a sideways range for the last couple of weeks. The post-earnings slump had led Apple lower to where it sat at a strong support zone since May. The shares had few catalysts to push them higher as the Nasdaq lagged the other main indices. Facebook (FB) gave some clues that a coming tech rally may be on the cards when it made new record highs last week, but still Apple failed to move.

However, the Nasdaq set fresh records and Apple duly roused itself. It is about time when one considers the strength of results back in late April, which caused the slide. Those results were 40% ahead of analyst expectations, but Apple slid despite that extensive beat and announced an increase to its share buyback program, as well as increasing its dividend.

Apple stock forecast

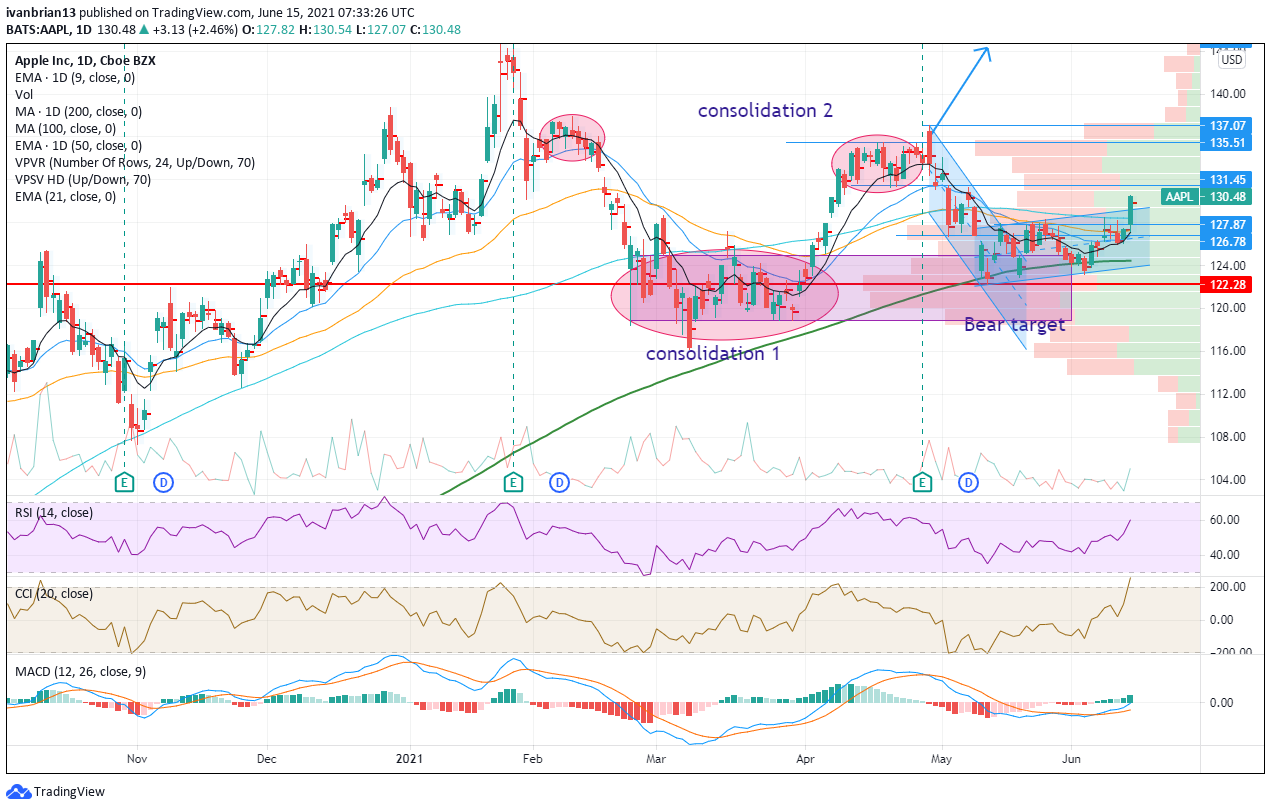

The chart shows just how strong the support zone was with a long consolidation phase back in March and April. The 200-day moving average also provided further support in this area. A mostly sideways range followed before Monday's strong break of the $128.87 resistance level. AAPL shares also broke the recent uptrend channel. This brings $131.45 as the first target of resistance to get through. This level is the bottom of the consolidation phase that was broken by the release of the results. Again, this is a strong consolidation zone, so breaking through this consolidation area will take time. $137.07 caps the range, being the high from April 29, the day after results. Volume, as can be seen by the volume profile on the right side of the chart, drops off considerably once above $137. This means the move through $137 to fresh highs should prove easier.

AAPL shares have now broken the key 9-day moving average, a key trend identifier for short-term trading. Remaining above this level generally means long positions offer the higher risk reward. The Relative Strength Index (RSI) and the Commodity Channel Index (CCI) are trending higher with price but are not yet overbought. The MACD (Moving Average Convergence Divergence) has crossed into bullish territory.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD struggles below 1.0500, awaits key US data

EUR/USD keeps its range trade intact below 1.0500 in the European morning on Wednesday. Traders prefer to stay on the sidelines, awaiting a series of US economic data, including the high-impact PCE inflation data for placing fresh directional bets on the pair.

GBP/USD holds higher ground above 1.2550 ahead of US PCE inflation data

GBP/USD trades on a stronger note above 1.2500 in Wednesday's early European session. The pair remains underpinned by a sustained US Dollar weakness and a negative shift in risk sentiment as traders turn cautious ahead of top-tier US data releases.

Gold price sticks to modest intraday gains, bulls seem cautious ahead of US PCE data

Gold price builds on the overnight bonce from the $2,600 neighborhood, or a one-week low and gains some follow-through positive traction for the second straight day on Wednesday.

US core PCE inflation set to hold steady, raising doubts on further Federal Reserve rate cut

The United States Bureau of Economic Analysis (BEA) is set to release the Personal Consumption Expenditures (PCE) Price Index data for October on Wednesday at 13:30 GMT.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637593412957102910.png)