- Apple shares continue on their target of new record highs.

- Big tech names and Facebook (FB) especially all register gains.

- Apple targets $137 resistance on its way to new highs.

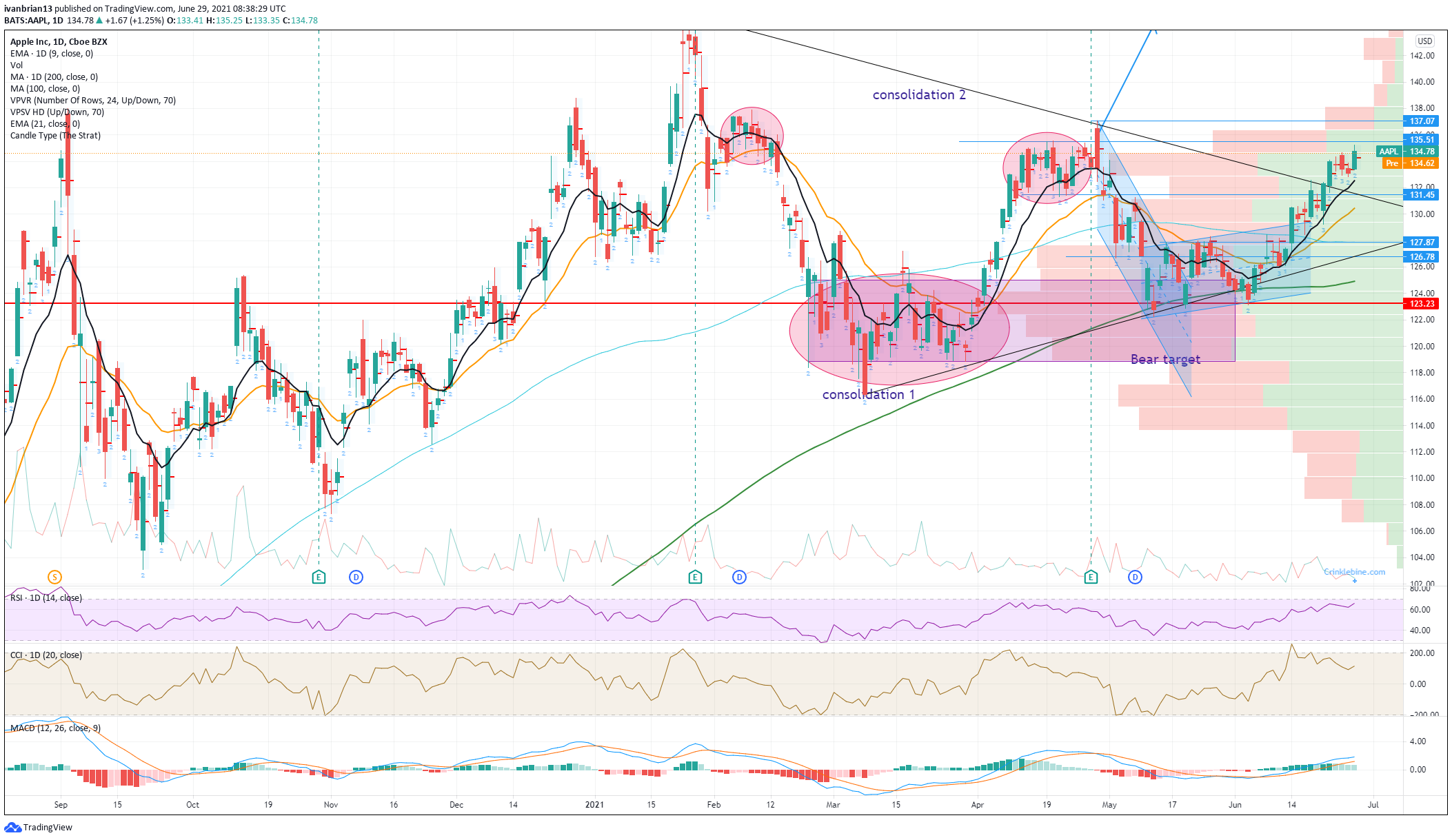

Another day of solid gains for AAPL stock on the way to test the next resistance level at $137.07. Apple shares have been on a steady bullish trend since the middle of May as the stock had retreated from what is now resistance at $137. The earnings release was good, and AAPL shares had an initial pop to $137 before sliding gradually down to the low $120s. This was a very strong support region with AAPL stock having consolidated at this level previously in February and March. It was also the zone where the 200-day moving average sat, so further adding to its strength zone. Apple stock has not traded below its 200-day moving average since March 2020 and the pandemic induced sell-off. Since then it has pretty much been comfortably above the average.

The post-earnings high at $137 is the first test. Those earnings as we have mentioned before were very strong and not the reason for the sell-off in the stock. There is a well-worn line in financial markets: "buy the rumour, sell the fact". Even rumours of Apple's results did not see them coming in 40% ahead of most analysts forecasts. Not too many also foresaw Apple increasing its dividend and increasing its buyback program. That was the reason for the initial enthusiasm and the spike to $137. Thereafter, a general fear of inflation set upon markets and caused the Nasdaq, in particular, to move lower.

Now, however, the tide has turned, the Nasdaq is making record high after record high. Big tech names are booming, Facebook (FB) yesterday joined the trillion dollar club and most other FAANG names are sitting just at or near record highs. Yesterday's price action in Apple as we can see from the chart below was a bull flag on the intraday with a strong opening surge followed by a period of consolidation. Setting the scene for further gains.

Apple key statistics

| Market Cap | $2.25 trillion |

| Enterprise Value | $2.1 trillion |

| Price/Earnings (P/E) | 30 |

|

Price/Book |

35 |

| Price/Sales | 8.5 |

| Gross Margin | 40% |

| Net Margin | 23.4% |

| EBITDA | $100 billion |

| Average Wall Street rating and price target | Buy $159 |

AAPL stock forecast

The triangle breakout is still working according to plan with Mondays move engulfing the previous candles from Thursday and Friday and reigniting the bullish trend. Some indecision had been creeping in but this new move has dispelled that. This is a perfect strong trend with the 9-day moving average guiding the move higher. This would be a first dip zone to try buying, $132.53. A break of that and most classic technical analysis will look for the 21-day moving average, but that is now a bit too far below. A dip to there ($130.45) would put the trend in question.

Breaking $137 is the real prize for bulls with the move looking to accelerate as volume dries up above this price. There should not be too much trouble moving to new record highs once $137 is broken.

Risk reward firmly skewed to the upside. Apple is above the key moving averages and trending nicely as confirmed by the momentum oscillators (Commodity Channel and Relative Strength Indices, CCI and RSI). The triangle breakout is a classic bullish move and the target would be the size of the entry leg, in this case $25. The breakout occurred at $132, so the target is set at $157.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD below 1.0400 as mood sours

EUR/USD loses its traction and retreats to the 1.0380 area in the second half of the day on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD nears 1.2500 on renewed USD strength

GBP/USD turns south and drops toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. In the absence of high-tier macroeconomic data releases, the US Dollar benefits from the souring risk mood and weighs on the pair.

Gold falls below $2,600 amid mounting risk aversion

Gold fell below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637605528357482750.png)