APE Stock News and Forecast: Is it time to go bananas for APE stock?

- AMC stock closes down sharply on Monday.

- AMC plus APE on net close little changed from Friday.

- AMC shareholders received one APE share for every one AMC share held.

APE shares began trading on Monday with much confusion and speculation from investors and media commentators alike. The basic math of the equation was something like a 2-for-1 stock split. AMC holders got one APE share for every one AMC share held. So the logic dictated that the two APE and AMC shares combined should be somewhere close to the close of AMC on Friday.

IMPORTANT! Remember that with the APE already having had its first NYSE trade today, the value now of your AMC holdings consists of the prices of your AMC shares and your new APE units COMBINED. Add together an AMC share plus a new APE unit, compared to just an AMC share before. pic.twitter.com/zfbo0yXCDp

— Adam Aron (@CEOAdam) August 22, 2022

APE stock news

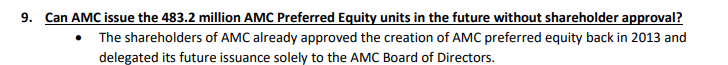

APE shares were so named after the growing band of AMC shareholders who identified with the short squeeze mentality of the original meme stock frenzy. AMC Apes, they called themselves, with AMC CEO Adam Aron as the chief APE or silverback. It was he who came up with the APE ticker and name for the new issue of preference shares, but many Wall Street insiders are alluding to the fact that these new APE shares could be used to raise capital without the need for shareholder approval. This is something Adam Aron has already alluded to and returned to in an investor relations Q&A on AMC's website.

To sum it up, the creation of APEs should help clarify for you who is in our current shareholder base and how many company issued shares there are. Beyond that, though, we believe APES should let AMC raise capital, pay debt and do more. Not good news for the doubters. #Checkmate

— Adam Aron (@CEOAdam) August 6, 2022

It only would be dilution if we decide after August 22 to issue more APEs, above and beyond the initial dividend amount. But as I tweeted earlier, if we were to do that smartly, that could be very good for AMC investors. Our track record at AMC is excellent on this score so far.

— Adam Aron (@CEOAdam) August 6, 2022

It would seem from those comments that there is the possibility of dilution, and Wall Street analysts have also mentioned that as a possibility. Adam Aron is correct that dilution in the past has worked well for AMC without hurting the share price. It is a bit of a double-edged sword though. AMC needs to raise capital, and APE shares could be a way of doing that. That would secure the long-term future of the company but at the possible expense of diluting shareholders. Which do you prefer: a struggling company or a well-capitalized one even if that means dilution?

APE stock forecast

Recent news from the sector has not been positive with competitor cinema chain Cineworld (CINE) possibly in line for Chapter 11 bankruptcy. AMC has a large debt pile and deferred leases but has more capital at its disposal and, as we can see above, the possibility of raising yet more capital. So AMC and CINE are not the same, but with threats of dilution a possibility, we will remain on the sidelines for now.

APE 15-minute chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.