ADI Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 3.

Direction: Top in 3.

Details: Looking for continuation higher towards medium level at 250$. We have a nice alternation between a sideways wave {iv} and a sharp wave {ii}.

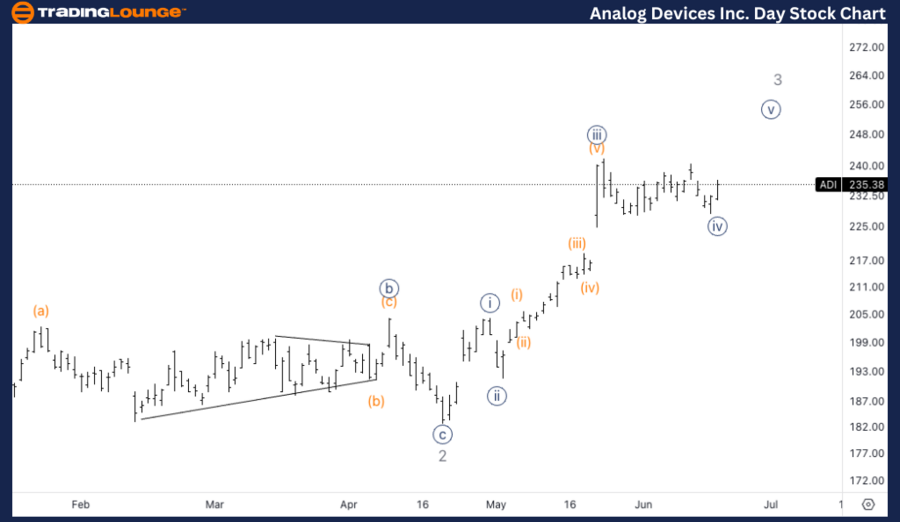

ADI Elliott Wave technical analysis – Daily chart

In our Elliott Wave analysis of Analog Devices Inc. (ADI), we observe an impulsive trend pattern characterized by a motive structure. ADI is currently positioned in Minor wave 3, indicating a continuation higher towards the medium level at $250. The wave structure shows a clear alternation between a sideways wave {iv} and a sharp wave {ii}, which is a typical feature in Elliott Wave theory, suggesting healthy trend progression. Traders should monitor for the top in Minor wave 3 and the potential transition into wave {v}, which could offer opportunities for profit-taking or strategic adjustments to long positions.

ADI Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {v}.

Direction: Upside in wave {v}.

Details: We seem to have completed the correction in wave {iv} with a clear three wave structure. Looking for continuation higher into equality of {v} vs. {i} at 254$.

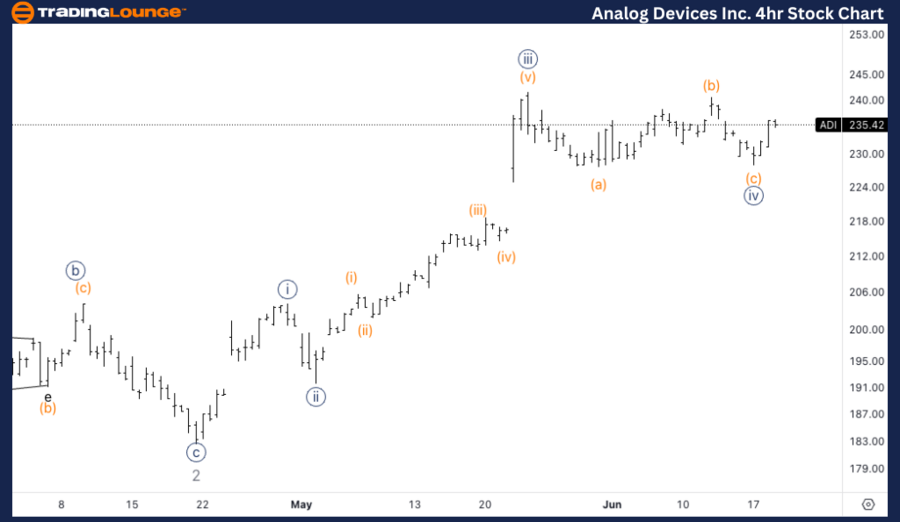

ADI Elliott Wave technical analysis – Four-hour chart

On the 4-hour chart, ADI continues to follow an impulsive trend mode within a motive structure, specifically in wave {v}. The recent correction in wave {iv} appears to have completed with a clear three-wave structure, indicating a possible resumption of the uptrend. The target for wave {v} is set at the equality of {v} vs. {i} at $254. Traders should look for confirmation of this upward movement as the wave {v} progresses towards the target level, which may present opportunities for entering long positions or adding to existing ones.

Welcome to our latest Elliott Wave analysis for Analog Devices Inc. (ADI) as of June 19, 2024. This analysis provides an in-depth look at ADI's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on ADI's market behavior.

Analog Devices Inc. (ADI) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.