America Airlines (AAL) starts new impulse higher [Video]

![America Airlines (AAL) starts new impulse higher [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Transportation/pic-airplane-engine-637435357526453004_XtraLarge.jpg)

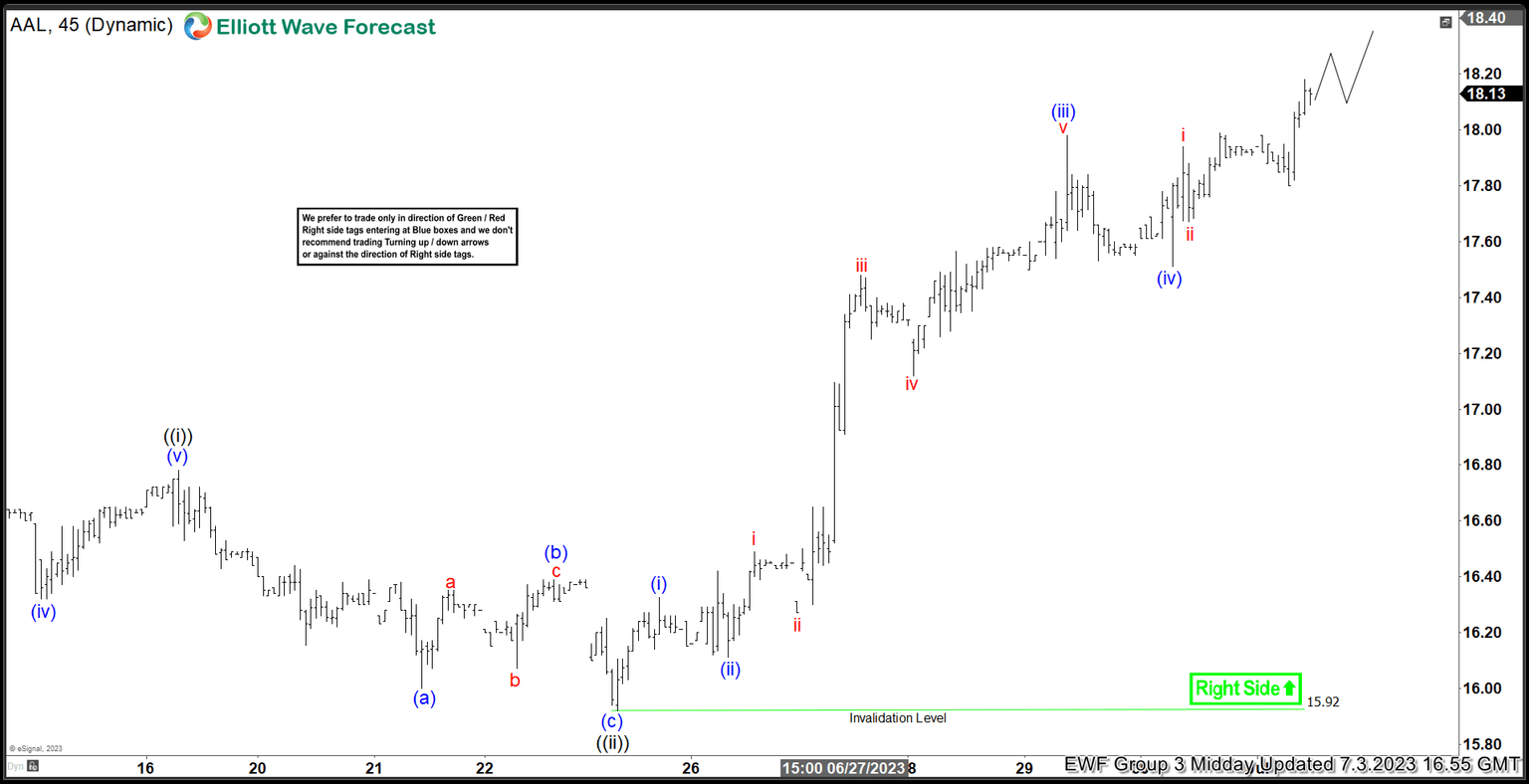

Short term view in AAL (America Airlines) suggests the rally from 5.24.2023 low is ongoing as a 5 waves impulse Elliott Wave structure. Up from 5.24.2023 low, wave ((i)) ended at 16.78 and dips in wave ((ii)) ended at 15.92. Internal subdivision of wave ((ii)) unfolded as a zigzag structure. Down from wave ((i)), wave (a) ended at 16, wave (b) ended at 16.39, and wave (c) lower 15.92. This completed wave ((ii)) in higher degree.

America Airlines (AAL) 45 minutes Elliott Wave chart

The stock has turned higher in wave ((iii)). Up from wave ((ii)), wave (i) ended at 16.32 and dips in wave (ii) ended at 16.11. The stock resumes higher again in wave (iii). Up from wave (ii), wave i ended at 16.49 and pullback in wave ii ended at 16.27. The stock resumes higher in wave iii towards 17.48 and dips in wave iv ended at 17.12. The stock extends higher in wave v towards 17.98. This completed wave (iii) in higher degree. Pullback in wave (iv) ended at 17.51. Up from wave (iv), wave i ended at 17.94 and pullback in wave ii ended at 17.67. Near term, as far as pivot at 15.92 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

AAL Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com