- AMD's stock price has been stabilizing on higher ground amid the latest coronavirus headlines.

- Demand for its chips from Microsoft and Sony put the firm in pole position to gain ground.

- Another downtrend in stocks due to COVID-19 may pass over AMD.

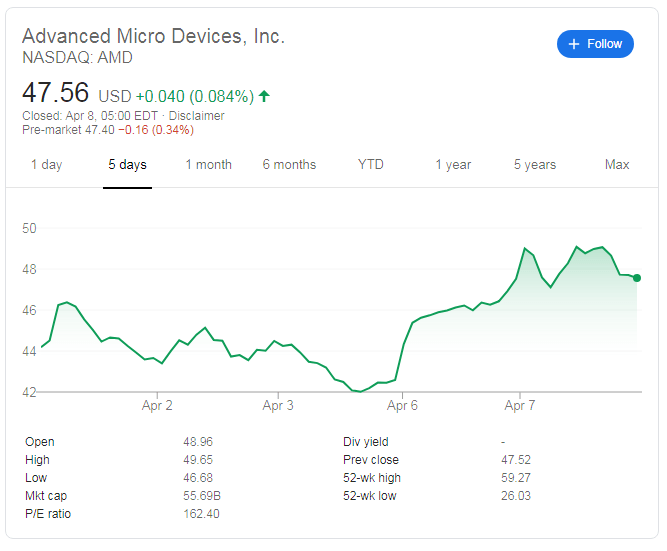

AMD's stock price has been fluctuating in the high $40s in the first days of the fourth quarter, seeming to hesitate below the $50 level. The Santa Clara California based firm – one of the veterans in Silicon Valley, produces chips that are used by various firms.

While stock markets tumbled amid the coronavirus crisis, Advanced Micro Devices, as the company is fully known, held its ground. In recent days, global equities have stabilized, and AMD's share are looking for a new direction.

AMD Stock News

Several recent developments point to the upside. Both Microsoft and Sony are set to launch new gaming consoles using AMD chips later this year. Both products can be shipped and used at home – and are unaffected by stay-at-home orders.

Intel, AMD's fierce competitor in the Valley, has been lagging behind and allowed AMD to capture market share, according to Hans Mosesmann, managing director at Rosenblatt Securities. A recent increase in revenues may be only the beginning.

With COVID-19 cases continuing to rise, lockdowns are likely here to stay for some time, and stocks may fall, and the chipmakers stock prices have room to grow.

The firm led by Lisa Su is has seen a 52-week low of $26.03 and peaked at $59.27. It is set to report earning for the first quarter later on.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD clings to recovery gains below 0.6550 on weaker USD, upbeat mood

AUD/USD holds sizeable gains below 0.6550 in the Asian session on Monday. A sharp pullback in the US bond yields prompts some US Dollar profit-taking after US President-elect Trump named Scott Bessent as Treasury Chief. Moreover, the upbeat market mood supports the risk-sensitive Aussie.

USD/JPY trims losses to regain 154.00 as USD sellers pause

USD/JPY trims losses to retest 154.00 in the Asian session on Monday. Retreating US Treasury bond yields drags the US Dollar away from a two-year top high and drives flows towards the lower-yielding Japanese Yen, though the BoJ uncertainty could limit losses for the pair.

Gold: Is the tide turning in favor of XAU/USD sellers?

After witnessing intense volatility in Monday's opening hour, Gold's price is licking its wounds near $2,700. The bright metal enjoyed good two-way trades before sellers returned to the game after five straight days.

Elections, inflation, and the bond market

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.