Looking at the big picture, we saw that $AMD completed a long-term bullish cycle. This cycle began in July 2015 and ended in March 2024. According to Elliott Wave theory, a 3-wave correction usually follows a 5-wave advance. That is exactly what happened. After the March 2024 high, AMD stock prices began to fall. They started forming a double zigzag structure. However, the structure is still incomplete. Based on our projection, this pullback could extend to 81.84–57.06 in the coming months.

To refine this long-term forecast, we analyzed the daily, H4, and H1 charts for our members. In December 2024, the stock broke a major low within this corrective structure. This confirmed an incomplete bearish impulse sequence. Since the bearish sequence is clear, we prefer selling bounces in 3, 7, or 11 swing setups at the blue box.

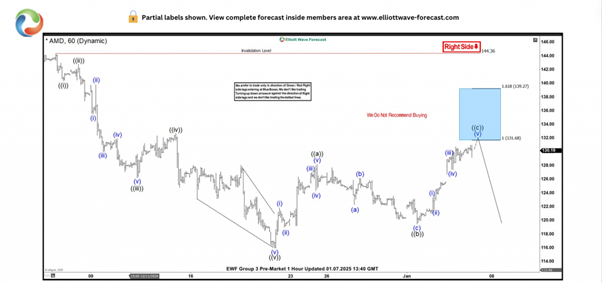

AMD Elliott Wave chart – 01.07.2025 update

On January 7, 2025, we shared the 1-Hour chart with members. Wave 3 ended on December 20, followed by wave 4. We observed that wave 4 was forming a 3-swing (zigzag) structure. As usual, we measured the blue box for wave 4. At this level, we expected selling pressure to increase and push prices lower toward wave 5. Therefore, members prepared to sell AMD stocks at 131.68. They set a stop-loss slightly above 139.27 and aimed for a target of 112.2.

AMD Elliott Wave chart – 01.08.2025 update

On the same day we shared the chart, the price hit the blue box. The next day, we updated members with a new chart. As shown, the price dropped immediately from the blue box and reached the risk-free area.

We advised members to close half of their position for profit. Then, we recommended adjusting the remaining position to breakeven. While we still expect the target to be reached, we are mindful of the market’s dynamic nature. For this reason, we decided to secure some profit.

AMD: What next?

The price is currently falling in wave 5 of (V). We cannot determine where wave 5 will end yet. However, it is highly likely to reach the target at 112.27.At that price or lower, AMD should complete wave (A), a 5-wave decline. According to the Elliott Wave principle, a 3- or 7-swing bounce should follow for wave (B).We plan to sell wave (B) at the blue box. Blue boxes are shown on the chart to help members identify where to buy or sell and set stops. This approach makes trading simple for them.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

AUD/USD hangs near multi-year low as traders await US NFP report

AUD/USD consolidates just above its lowest level since October 2022 as traders move to the sidelines ahead of Friday's release of the closely-watched US NFP report. In the meantime, rising bets for an early RBA rate cut, China's economic woes, US-China trade war fears, geopolitical risks and a softer risk tone act as a headwind for the Aussie.

USD/JPY bulls turn cautious near multi-month peak ahead of US NFP

USD/JPY moves little following the release of household spending data from Japan and remains close to a multi-month top amid wavering BoJ rate hike expectations. Furthermore, the recent widening of the US-Japan yield differential, bolstered by the Fed's hawkish shift, undermines the lower-yielding JPY and acts as a tailwind for the currency pair amid a bullish USD.

Gold price consolidates below multi-week top; looks to US NFP for fresh impetus

Gold price enters a bullish consolidation phase below a four-week top touched on Thursday as bulls await the US NFP report before placing fresh bets. In the meantime, geopolitical risks, trade war fears and a weaker risk tone might continue to act as a tailwind for the safe-haven XAU/USD.

Crypto Today: BTC traders hold $90K support as SUI, LTC, TIA see green

The cryptocurrency market’s losing streak entered its third day; aggregate market cap declined 10.9% to hit $3.1 trillion. Bitcoin price stabilized around the $91,800 area as bulls moved to avoid further downside.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.