- AMC stock closes adds roughly 30% in two days amid renewed hunger for meme stocks.

- AMC and meme stocks roar back, with GME up 30% on Tuesday.

- The trend looks set to continue on Wednesday, with Gamestop up 15% premarket.

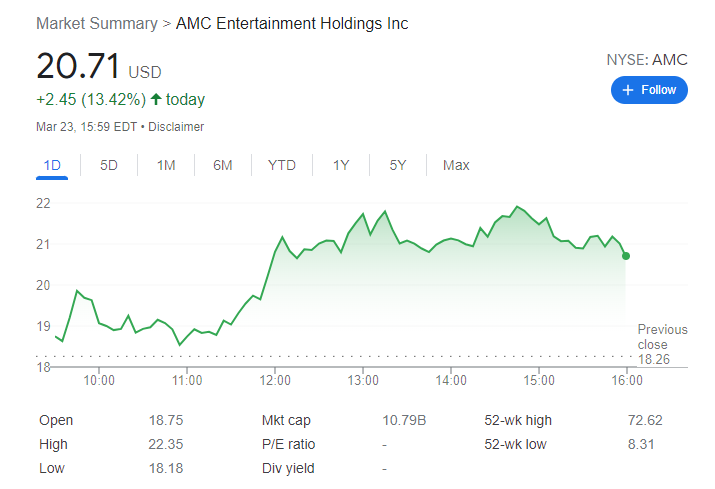

Update: AMC Entertainment ignored the poor performance of most of its US counterparts and edged sharply higher, adding over 10% for a second consecutive day to end the day at $20.71. The company staged a huge comeback after bottoming this week at $15.28 per share. Whereas meme stocks are back or enjoying some temporal recovery is something yet to be seen. Still, there’s lot of room for AMC to recover as it 52-week high stands at $72.62. AMC stock peaked on the day at $22.35, its highest in two months.

Wall Street opened in the red amid concerns related to the Russian-Ukraine conflict leading to oil and gas shortages, hence boosting inflation and growth concerns. US indexes extended their losses throughout the session, trimming weekly gains and settling near fresh lows. Heading into the close, the Dow Jones Industrial Average is down roughly 450 points, while the Nasdaq Composite shed 1.32%. The S&P 500 is currently at around 4,470, down 0.91% for the day.

Previous update: AMC stock has moved against the current market trend on Wednesday. One hour into Wednesday's session, shares are trading up 3.5% at $18.90. Meanwhile, all three major US indices are lower. The Nasdaq is off by 0.5%. Shares spiked to $20.43 about half an hour after the open, up 11.9%, but quickly sold off. AMC, therefore, is retaining its reputation for volatility. The cost of $19 calls that expire this Friday has risen 54% this morning to $1.03 per share. $16 puts with the same expiry have dropped 53% to $0.07 per share. President Joe Biden is in Europe to discuss the situation in Ukraine with his European counterparts. Due to Germany's reliance on Russian oil, Western sanctions on that sector are unlikely to increase. Biden, however, is upping the ante by trying to extend sanctions to more than 300 individual members of the Russian lower house of parliament.

AMC stock roared back into life on Tuesday as the stock of AMC Entertainment Holdings posted strong gains to eventually close at $18.26. AMC stock reached a high of $18.91 before retracing slightly on the close. It was still an impressive day as traders pushed it and GME back to the top of stock performance charts.

Both stocks also featured heavily on WallStreetBets and other social media sites. Once again, much of the talk centered on the potential for a short squeeze. It will be interesting to see if shorts increase or decrease on the back of this move. Our hunch is that shorts will take the opportunity of this most recent spike to add to short positions. With the volume now being so high, the days to cover are much lower as liquidity has increased dramatically. This makes it easier to increase short positions.

AMC Stock News

There was nothing company-specific to really drive Tuesday's price performance. The biggest news came out late on Tuesday by fellow meme stock king GameStop (GME). The news hit that GME CEO Ryan Cohen has bought 100,000 shares through his RC Ventures entity. This news saw GME stock up 15% in Wednesday's premarket. This should keep the momentum going for retail and meme stocks on Wednesday. We expect it to slow down as the week progresses. These are momentum plays, not fundamental investments. AMC CEO Adam Aron continued his bullish commentary taking to Twitter to unveil upcoming movie releases:

Moviegoing was slow in Jan and Feb, but then came The Batman. And now: the floodgates open! 3/25 The Lost City, 4/1 Morbius, 4/8 Sonic the Hedgehog 2 & Ambulance, 4/15 Fantastic Beasts & Father Stu, 4/24 Massive Talent. And then, summer blockbusters start coming over and over !!! pic.twitter.com/9Py9nOg8yw

— Adam Aron (@CEOAdam) March 23, 2022

The last set of results for AMC were not too good. A revenue beat arrived, but an EPS loss hit the shares. So revenue will need to grow exceptionally strongly to keep the stock momentum going. It will fall eventually, so just be prepared to get off when it does.

AMC Stock Forecast

This was an impressive move but does not change the bearish picture on the medium to longer-term view. To do that, AMC stock needs to break $21.04. We can see the Ichimoku cloud showing red, indicating a negative trend is still in place. Tuesday's rally takes AMC right up to the Ichimoku resistance, but the trend remains firmly red.

AMC stock chart, daily

Now we have outlined the bearish long-to-medium term picture above. The fundamentals or valuation metrics also dictate a bearish outlook. However, we realize many of you are momentum players. The 15-minute AMC chart below shows the strong double bottom at $13.03 that started this rally. Here the Ichimoku cloud is green, signifying a strong short-term uptrend. The breakout occurred at $17, so AMC needs to hold this to remain bullish on the shorter-term horizon. There is small support at $18.25 based on the volume profile.

AMC stock chart, 15-minute

Prior Update: AMC momentum looks set to continue on Wednesday but volatility is certainly a feature. AMC opened up above $19 for a 4% gain but quickly retraced to trade basically flat on the day. But bulls quickly stepped in and pushed the stock 5% higher to $19.20. All this took place in just the first five minutes of trading. Volatility then still a feature of the meme stock space. Fellow meme king GameStop is also displaying some volatility as it looks to also maintain the bullish momentum. GME stock is currently up 12% on Wednesday. Both GME and AMC remain top of the charts on the usual social media sites as retail traders look to established meme stocks. The overall market is not performing as well with the Nasdaq, S&P 500, and Dow Jones all opening lower.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Monday for some insight into the interest rate outlook.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold price bulls seem non-committed around $2,620 amid mixed cues

Gold price struggles to capitalize on last week's goodish bounce from a one-month low and oscillates in a range during the Asian session on Monday. Geopolitical risks and trade war fears support the safe-haven XAU/USD. Meanwhile, the Fed's hawkish shift acts as a tailwind for the elevated US bond yields and a bullish USD, capping the non-yielding yellow metal.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.