- AMC stock put a halt to its weekly rally, shed some ground on Thursday.

- AMC Entertainment had been nearly 20% higher on Wednesday before retreating.

- AMC shares are still down on the year despite a surge in the past week.

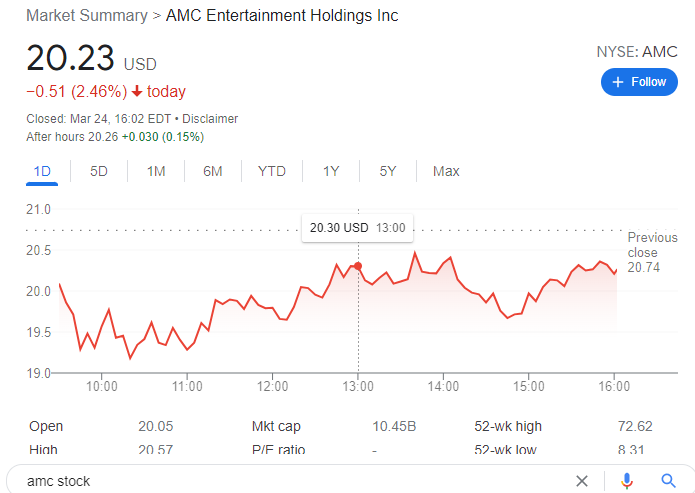

Update: AMC Entertainment shed some ground on Thursday, as meme stocks were vulnerable despite the better tone of Wall Street. The stock finished the day at $20.23 down 2.46%. US indexes edged higher, but gains were modest. There was no progress in sentiment-related developments, but on the contrary, the situation in Eastern Europe keeps worsening. The best performer was the Nasdaq Composite, as it managed to add 1.83%, while the Dow Jones Industrial Average was up 1% and the S&P 500 added 49 points.

Western nations have announced more sanctions on Moscow and allies, while US President Joe Biden gave a press conference on the matter, after talking with European counterparts. Among other things, he said that sanctions are not meant to deter Russia, but reaffirmed his stance of not involving in direct combat, as it would mean a global escalation of the country. Additionally, he said that he would like to spell Russia from G-20.

AMC stock has dropped 6.7% to $19.35 one hour into Thursday's session. Though shares of AMC Entertainment Holdings held a session high point of $20.30 this morning, it has seen a steady bevy of lower highs since then. 20 minutes into the session, AMC found respite at $19.30. Shares found their footing there before rebounding to $19.98 but then quickly dropped to $18.86, the session low. It appears that traders are finally taking profits from this meme stock gem after seven solid sessions of gains. GameStop (GME) is down even worse, -8.4%, at $129.16. All three major indices remain green but seem restrained. Continuing jobless claims reported this morning in the US were at their lowest level since 1970. This is normally a good thing, but many observers wonder if high employment will lead to further increases in inflation. Rising inflation alongside the Fed's rising interest rates would likely hurt equities further down the line.

AMC stock and GameStop (GME) stock were the top two trending stocks on social media on Wednesday in a return to the meme masters of the universe. Both stocks were also among the biggest gainers and most active shares in New York in what was a back-to-the-future day. GME stock was buoyed by news of Ryan Cohen boosting his stake in the video game retailer through his RC Ventures firm. AMC did not seem to have a catalyst but rather was the product of another surge in retail buying.

See retail favorite Mullen (MULN) news here

AMC Stock News: Can the momentum continue?

It has been an incredibly impressive week so far with AMC on a 7-day winning streak. AMC stock finds itself 37% higher than last week but still has a long way to go to capture previous highs. AMC remains nearly 50% lower than where it was six months ago. This has become a recurring feature of meme stocks. Momentum drys up before the share price falls. Then interest spikes and the share price does too, but usually to a lower level than the previous spike. It remains to be seen if this is a repeat case. It is becoming harder to sustain momentum in the current environment.

The huge increase in volume has meant taking short positions is now somewhat safer. The days to cover are the most important metric of short interest. This is the number of average volume days it will take to cover a short position. The massive surge in volume means taking larger short positions is easier as the stock is much more liquid. We expect this rally to have led to an increase in short positions rather than a decrease, and it then comes down to a battle between retail and shorts.

The score is tied. AMC apes took the first round in the squeeze from sub-$10 to $60, before shorts saw a massive decline from $60 down to $13. It will be an arm-wrestling match to see who is victorious. Or the shorts and AMC apes could square off at Wrestlemania as AMC and WWE announced Wednesday that Wrestlemania will be live in AMC theatres on April 2 and April 3. CEO Aron is never short to miss a quick promotional tweet, so how about AMC apes versus shorts at a theatre near you!

All this news of course shows that there was not much news behind the recent move in AMC. There was the by now well-publicized stake in Hycroft Mining (HYMC), and earlier some strong attendance numbers for The Batman, but nothing fundamental to change the valuation for AMC. This is momentum trading 101, so trade appropriately.

AMC Stock Forecast: $21.04 remains the level to beat

We identified $21.04 as the key resistance to change the whole narrative to bullish, and AMC stock did breach this level intraday. We can see from the volume profile bar in our second chart (15-minute) that there was a big battle at this level. Bears eventually won, and AMC closed significantly lower. AMC shares need to break it cleanly and close above $21.04. So that is Thursday's target for AMC apes and the line of scrimmage for shorts. Failure will see a move back to $13.03, and that will then become the key support. Break that price level and AMC will target $8.95.

AMC stock chart, daily

The AMC stock 15-minute chart below shows the trend is still bullish, but a move below $20.27 will see the trend move into a bearish one. $21.04 is a huge level as mentioned above with a large volume profile bar. There is decent support at $19 down to $18, but below $18 is a worrying volume gap until $15.

AMC stock chart, 15-minute

The author is long puts in AMC and HYMC.

PREVIOUS UPDATE: AMC stock looks likely to end its 7-day streak of gains on Thursday as the cinema chain and meme stock extraordinaire opened more than 3% lower despite all three major US indices turning green. AMC Entertainment declined 3.6% to $20 at the open and has since dropped below $20 several times in the first few minutes. $20 is important as a psychological figure, and traders will watch to see if AMC can quickly regain that significant price. The Nasdaq Composite Index is down 0.5% at the same time. Partner in crime GameStop is down 3.9% also. Positive news on the jobs front has given impetus to the market to move higher on Thursday. New jobless claims in the US reached a 50-year low at 187,000. 210,000 jobless claims were expected. High-quality and value names seem to take the focus away from speculative plays, and many retail traders are more focused on Nikola (NKLA), which is up more than 14%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes above 1.1350 on Easter Friday

EUR/USD enters a consolidation phase above 1.1350 on Friday as the trading action remains subdued, with major markets remaining closed in observance of the Easter Holiday. On Thursday, the European Central Bank (ECB) announced it cut key rates by 25 bps, as expected.

GBP/USD fluctuates below 1.3300, looks to post weekly gains

After setting a new multi-month high near 1.3300 earlier in the week, GBP/USD trades in a narrow band at around 1.32700 on Friday and remains on track to end the week in positive territory. Markets turn quiet on Friday as trading conditions thin out on Easter Holiday.

Gold ends week with impressive gains above $3,300

Gold retreated slightly from the all-time high it touched at $3,357 early Thursday but still gained more than 2% for the week after settling at $3,327. The uncertainty surrounding US-China trade relations caused markets to adopt a cautious stance, boosting safe-haven demand for Gold.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.