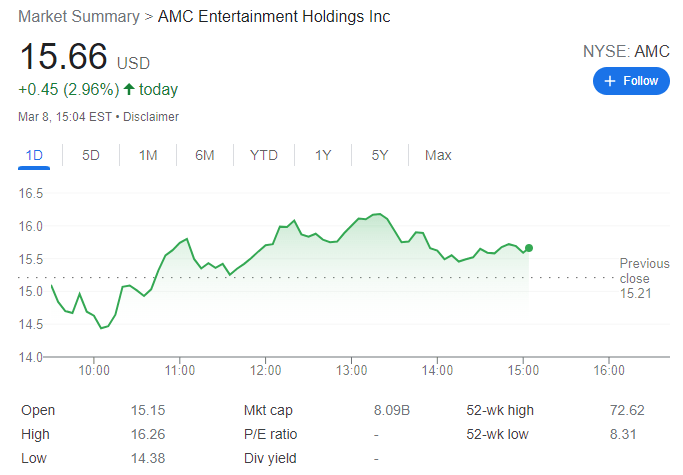

AMC Stock Price: AMC Entertainment recovers beyond $15.00 amid resurgent optimism

- AMC stock edged higher on Tuesday amid renewed optimism in the Russia-Ukraine front.

- AMC Entertainment had hoped for a bounce on the back of a strong Batman box office.

- Movie giant shares should see a bounce on Tuesday as risk-on returns.

Update: AMC Holdings trades at $15.66, up 2.96% in the final hour of trading, as Wall Street managed to turn green on the back of some optimistic headlines coming from the Russia-Ukraine front. Humanitarian corridors were opened Tuesday for cities such as Sumy and Mariupol. Also, Russia announced another corridor for Wednesday, which will allow the evacuation of Kyiv, Kharkiv and other cities. But the headline that spurred the latest bout of risk appetite came from Ukraine, as the country said it would no longer seek NATO membership.

How things will continue from now on is hard to predict, as if somehow war-related concerns ease further, the focus will return to mounting inflationary pressures and central banks' responses to it. The US will report February inflation figures next Thursday, and the annual figure is predicted to have reached 7.8% a multi-decade high. Meanwhile receding demand for safety has pushed government bond yields higher, with that on the US 10-year Treasury note currently at 1.87%, up twelve basis points in the day.

Previous update: Holy stock market, Batman! AMC Holdings stock is not responding to its third-best opening weekend since the COVID-19 pandemic began. Shares of the much-loved cinema chain dropped as much as 5.5% in the first half-hour of trading on Tuesday but have recovered to a -0.5% showing one hour into the session. AMC stock is trading near $15 a share. Then again the Nasdaq is having another poor session and is down 0.8% at the moment after Monday's 3% plunge. More than four million tickets were sold this past weekend for The Batman, AMC's latest hit. The caped crusader flick took in some $258 million from Thursday through Sunday. In the US, AMC said it had accomplished a higher than normal 29% of market share during the weekend.

AMC stock has given up some premarket gains as the market turns lower. Earlier Europen markets had been strong on the back of a proposed joint debt issuance but now things are once again turning bearish. AMC CEO Adam Aron said late on Monday that the use of cryptocurrency was a good thing for AMC Entertainment and that the company may consider launching its own crypto in the future if things go well. He also said they would stay very far on the right side of the law in relation to crypto regulation. AMC shares are trading at $14.96 now for a loss of 1.7%. Earlier AMC stock had been over 1% higher in Tuesday's premarket.

AMC stock fell heavily on Monday as investors continued to exit high-risk names as oil surged and commodity prices remained in orbit. Prospects for the global economy have dramatically worsened, and high growth stocks such as AMC took a disproportionate hit. In the current environment, any stock carrying a lot of debt will take a stronger beating as interest rates are set to rise, but growth looks likely to slow. A US recession is nearing as the US yield curve gets dangerously close to going negative.

See Wake Up Wall Street for all you need to know ahead of the stock market opening.

AMC stock news

AMC investors, traders – or apes as they like to be called – began Monday in a positive mood as weekend box office figures for Batman proved encouraging. However, AMC traders could not stem the bearish global tide, and the stock was well beaten down by the end of Monday. AMC stock closed at $15.21 for a loss of 8.2%. But Tuesday brings slightly more encouraging signs with some slightly more optimistic tones from Russian demands on Ukraine leading to risk assets recovering some ground. We would expect again a disproportionate bounce this time for AMC, and the stock should see a healthy gain on the open on Tuesday. We doubt this will hold for much longer than a few days as overall sentiment remains bearish.

AMC stock forecast

AMC is bearish below $21.04 and is likely to remain in a long-term bearish pattern. The target is a move back below $10. $14.54 is the next key support. A break is likely to see an acceleration in AMC stock to the downside.

AMC stock chart, daily

Tuesday is likely to see a recovery in risk sentiment. Already we note the safe-haven buying of bonds and dollars has faded with all weaker on Tuesday. This should see risk assets higher. The first step is to hold $14.54. This sets the day up for a green one. $16.62 is the next level for AMC to target and is finding resistance from Friday's volume profile. Once above $17.20, volume lightens, meaning a move to test $18 is possible. $18.20 is heavy resistance though and will be tough to break.

AMC 15-minute chart

Prior Update: AMC stock has given up some premarket gains as the market turns lower. Earlier Europen markets had been strong on the back of a proposed joint debt issuance but now things are once again turning bearish. AMC CEO Adam Aron said late on Monday that the use of cryptocurrency was a good thing for AMC Entertainment and that the company may consider launching its own crypto in the future if things go well. He also said they would stay very far on the right side of the law in relation to crypto regulation. AMC shares are trading at $14.96 now for a loss of 1.7%. Earlier AMC stock had been over 1% higher in Tuesday's premarket.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.