AMC Stock Price: AMC Entertainment jumps 5.73% to settle above $40 mark

- NYSE:AMC extends advance on Thursday as Wall Street runs on earnings reports.

- #AMCSqueeze is trending again as the SEC investigates Citadel.

- A slew of new releases in theaters should keep AMC’s momentum going.

Update October 15: NYSE:AMC extended its rebound from five-day lows of $36.12 into the second straight day on Thursday. AMC shares gained 5.70% on the day, clinching fresh ten-day highs at $41.10 before reversing to $40.07 at the close. Thursday’s turnaround on Wall Street underpinned the sentiment around AMC shares, as top American banks reported strong corporate earnings for the third quarter. Further, the US PPI missed expectations and arrived at 8.6% YoY in September, easing off the inflationary worries and providing additional optimism.

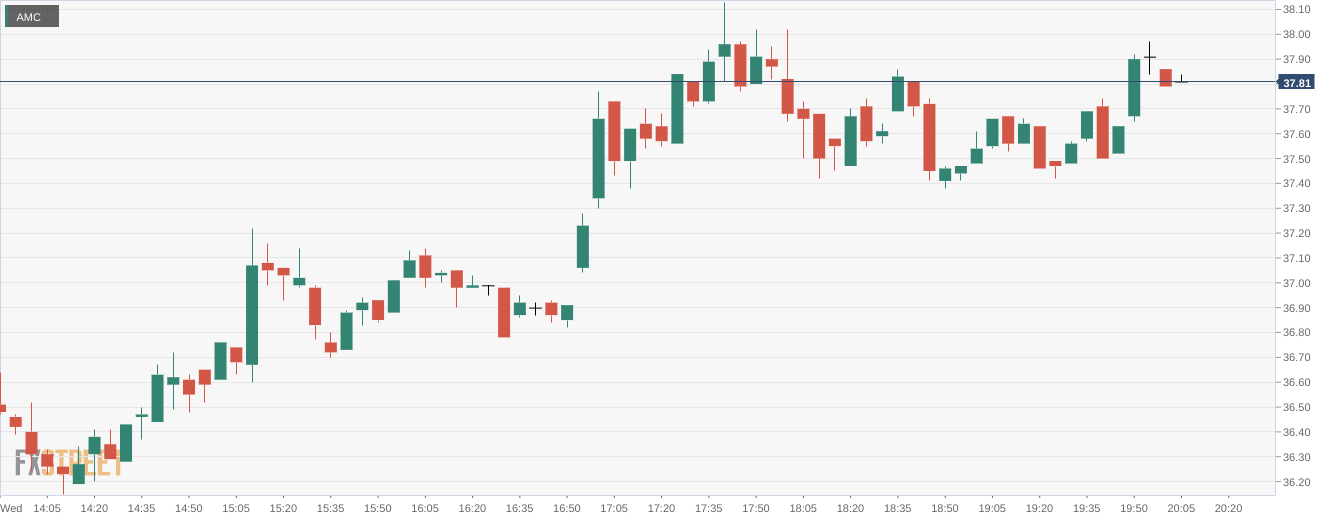

NYSE:AMC has extended its recent trend as the stock continues to find support after free-falling for the past month. On Wednesday, shares of AMC gained a further 2.96% and closed the trading session at $37.91. There has been some mounting momentum for the meme stock as of late, as the buzz in internet chat rooms and Reddit boards is pointing towards another attempt at a short squeeze. Rising alongside AMC was the original meme stock GameStop (NYSE:GME) which gained 4.66% during Wednesday’s session. Other meme stocks didn’t fare as well after squeezing on Tuesday, as Koss (NASDAQ:KOSS), SmileDirectClub (NASDAQ:SDC), and Camber Energy (NYSEAMERICAN:CEI) all traded lower.

Stay up to speed with hot stocks' news!

AMC apes were once again able to get the hashtag #AMCSqueeze trending on social media on Wednesday. The surge in mentions came as the result of an announcement that the SEC is initiating an investigation into Citadel Securities, which is public enemy number one for retail investors. The investigation will look into Citadel’s business practices, which may include things like short selling stocks as well as its relationship with pay to order flow brokerages like Robinhood (NASDAQ:HOOD).

AMC stock forecast

AMC’s stock should be helped out by strong quarter over quarter and year over year comparisons from the third and fourth quarters of 2020. A slew of new Hollywood movies are set to hit theaters over the next couple of weeks, including the new Halloween Kills film that is kicking off the Halloween season. It should be another big weekend next week as the long awaited Dune film will hit theaters starting on October 22nd.

Previous updates

Update: NYSE:AMC closed Thursday at $40.7 per share, up by 5.73%. Wall Street posted a nice comeback on the back of solid Q3 earnings reports from big names. At the same time, US government bond yields edged lower, with the dollar down to the benefit of high-yielding rivals. The NYSE Composite finished the day up 206 points or 1.25%, with all US major indexes settling in the green.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet