AMC Stock Price: AMC Entertainment Holdings Inc plunge below $10 looks imminent as all eyes on silver

- AMC Entertainment Holdings (AMC) shares are up again during Monday's pre-market trading.

- Retail traders still dominate the trading backdrop, squeezing short positions.

- AMC shares benefit from “the Gamestop effect”.

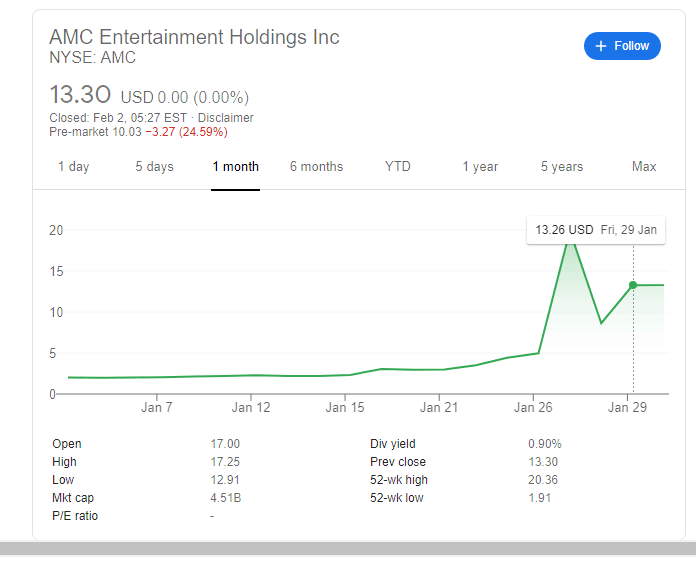

Update on February 2: AMC Entertainment Holdings Inc (NYSE: AMC) is set to kick off Tuesday's trading session with a resumption of the downtrend, crashing by another 23% toward $10. Will it fall to single-digit territory? The theater company has been in the shadows of GameStop (NYSE: GME) but has garnered impressive attention nonetheless. AMC's shares are still suffering from limitations on several platforms such as Robinhood, but the stock's greater problem is that retail taders have found a new toy – silver. XAG/USD hit the highest in eight years on Monday and the battle continues. Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Update on February 1: The weekend saw more traders join the /wallstreetbets Reddit forum with membership now nearing 8 million members. AMC and Gamestop dominated the discussion board with many new members favouring AMC over Gamestop (GME) as the relative share price allows less capital outlay to purchase AMC. The /wallstreetbets phenomenon does not look like evaporating any time soon and the stage is set for the battle to continue this week. AMC shares are currently 18% higher in Monday's pre-market trading.

Update: Shares in AMC rallied strongly on Friday, up nearly 50% during the pre-market session. AMC was one of the favourite stocks of the /wallstreetbets phenomenon as AMC had a large short interest and was squeezed higher as a result.

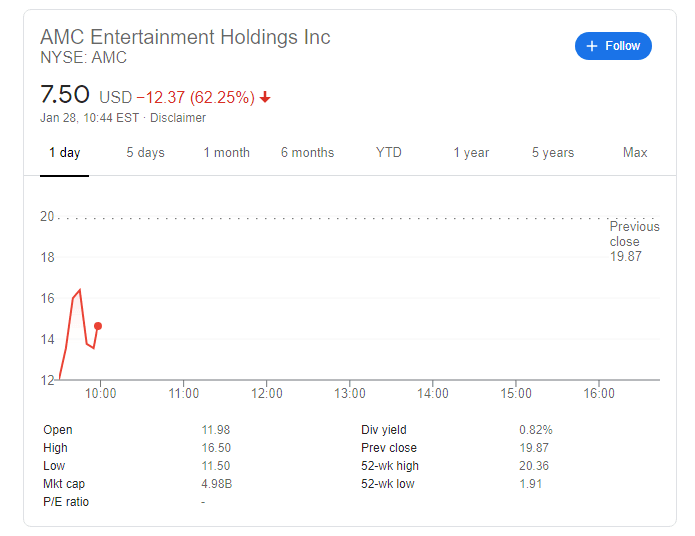

AMC shares had suffered on Thursday as multiple brokers put trading restrictions on a number of heavily traded retail interest stocks. Gamestop was the poster child of this trend. AMC shares fell 56% on Thursday. Robinhood co-founder and CEO appeared on CNBC on Thursday night and appeared to backtrack on the trading restrictions saying Robinhood plans to allow limited buys of these securities. “We’re doing what we can to allow trading in certain securities tomorrow morning,” the CEO said.

The brokerage company released a statement on Thursday saying “As a brokerage firm, we have many financial requirements, including SEC net capital obligations and clearinghouse deposits. Some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment. To be clear, this was a risk-management decision, and was not made on the direction of the market makers we route to.”

AMC shares are currently trading $13.49 in early pre-market trading on Friday, up 56%.

Update: AMC Entertainment Holdings Inc (NYSE: AMC) by over 60% after Robinhood put shares under "reduce only" mode, limiting new buying of the shares. The move allows short-sellers to gain ground in their battle against the army of Reddit retail traders organizing on wallstreetbets. The move comes after AMC raised some $300 million in a secondary offer. Both Robinhood and Interactive Brokers slapped measures related to AMC, and several other stocks, including GameStop./ More Gamestop (GME) tumbles as Robinhood puts shares on “reduce only” mode, buyers fight back

Update: AMC Entertainment Holdings Inc (NYSE: AMC) has closed Wednesday's trading with a whopping surge of 301.21% to $19.90, giving the theaters' firm a valuation of nearly $7 billion. AMC completed a secondary public offering worth a total of $304.8 million, with a price of over $4.81 per share. TD Ameritrade restricted trading on NYSE: AMC amid the frenzy, putting shares in the same list as Gamestop (GME) which also skyrocketed. Bulls organizing on Reddit's wallstreetbets have been defeating hedge funds that went short on these stocks. The frantic action around AMC and GME has raised alarm bells – signs of a late-stage rally which implies a broader downfall in stocks. Regulators and even the White House are monitoring developments. However, Federal Reserve Chair Jerome Powell seemed unmoved by action in stocks, focusing instead on the long road to recovery. Will NYSE: AMC continues higher on Thursday? Premarket trading suggests a fall may be on the cards. More: Gamestop (GME) Stock Price and Forecast: Are shares going to break $500 today?

NYSE:AMC has spent much of the COVID-19 pandemic teetering on the brink of bankruptcy as the largest movie theater chain in the world has been saved by an unexpected group of investors. On Tuesday, shares of AMC skyrocketed once again adding 12.22% to close the trading session at $4.96. AMC continued its ascent in after-hours trading as the stock surged an additional 35%, soaring towards its 52-week high of $7.78. Despite its recent resurrection, AMC is still down 34.90% over the past 52-weeks, but at least investors are slowly making some of those losses back.

See also: Brokers’ restrictions on GME and AMC set a dangerous precedent – FXStreet Editorial

The unexpected group of investors are a part of the Reddit forum r/WallStreetBets which provides investing tips, strategies, and play by play trades. This is not the first time the group has been in the spotlight as several members posted about a leverage glitch within the popular Robinhood trading platform. The group also led the charge on short squeezing noted short-seller Citron Research by coordinating a controlled squeeze to the GameStop (NYSE:GME) stock. AMC was a part of a move to “save AMC” as members succeeded in saving the cinema brand from bankruptcy. It is an interesting lesson in the power of social media and how easily manipulated the stock market can be.

AMC stock forecast

The ‘save AMC’ movement has actually worked as CEO Adam Aron announced that bankruptcy is no longer on the table, which is further fueling the stock price. AMC still has an upward battle ahead as people have still been hesitant to attend at cinemas even having reopened in some parts of the world.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet