- NYSE:AMC gained 1.35% during Thursday’s trading session.

- Rival IMAX reports its earnings and an interesting partnership.

- Meme stocks were back on the rise on Thursday.

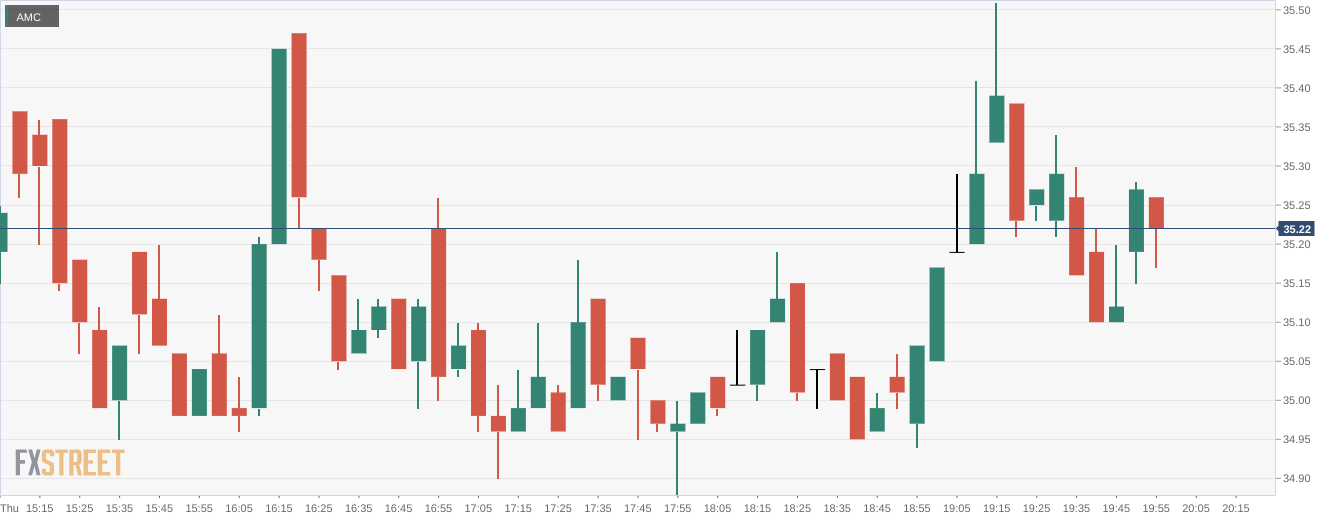

NYSE:AMC Apes are looking ahead to next week’s earnings report from AMC, as the company tries to continue its recovery following the COVID-19 pandemic. Shares of AMC gained 1.35% during Thursday’s session and closed the trading day at $35.23. With the move higher, AMC has recaptured the key 200-day moving average, which indicates that the stock has been trending higher in the long-term, despite a rocky month of September. AMC moved higher alongside the broader markets, as all three major U.S. indices closed Thursday in the green following a bearish day on Wednesday. The markets could be in for a rude awakening on Friday, as Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) missed consensus estimates during their earnings calls after the closing bell.

Stay up to speed with hot stocks' news!

One of AMC’s rivals, IMAX (NYSE:IMAX) reported its earnings on Thursday and saw a 52% year-over-year rise in quarterly revenues. This indicates that moviegoers are flocking back to theaters despite the ongoing threat of COVID-19. IMAX also reported that it is inactive negotiations with leading streaming platforms to feature exclusive content and movies at IMAX theaters. This could be one way that theaters attract customers back after the pandemic, although given the choice to stream at home, it may not be as lucrative as IMAX believes it to be.

AMC stock forecast

AMC wasn’t the only meme stock on the rise on Thursday. GameStop (NYSE:GME), ContextLogic (NASDAQ:WISH), Vinco Ventures (NASDAQ:BBIG), and Camber Energy Inc (NYSEAMERICAN:CEI) all finished the session in the green. As did Trump-related meme stocks Digital World Acquisition Corp (NASDAQ:DWAC) and Phunware, Inc. (NASDAQ:PHUN), gaining 12.13% and 0.21% respectively

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD tumbles to 14-month lows near 1.2250

GBP/USD accelerates its decline and hits the lowest level in over a year near 1.2250 in European trading on Thursday. The pair feels the heat from the UK bond market sell-off, with the 10-year Gilt yields at the highest since August 2008. Extended US Dollar strength and a bearish daily technical setup exaerbates the pain.

EUR/USD holds losses near 1.0300 ahead of Eurozone Retail Sales data

EUR/USD trades with mild losses for the third consecutive day at around 1.0300 in the European session on Thursday. Encouraging German Industrial Production data for November fail to lift the Euro amid a sustained US Dollar demand. Eurozone Retail Sales and Fedspeak are next in focus.

Gold price moves back closer to multi-week top; modest USD strength might cap gains

Gold price turns positive for the third straight day and draws support from a combination of factors. Geopolitical risks, trade war fears and retreating US bond yields lend support to the XAU/USD pair.

BNB poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.