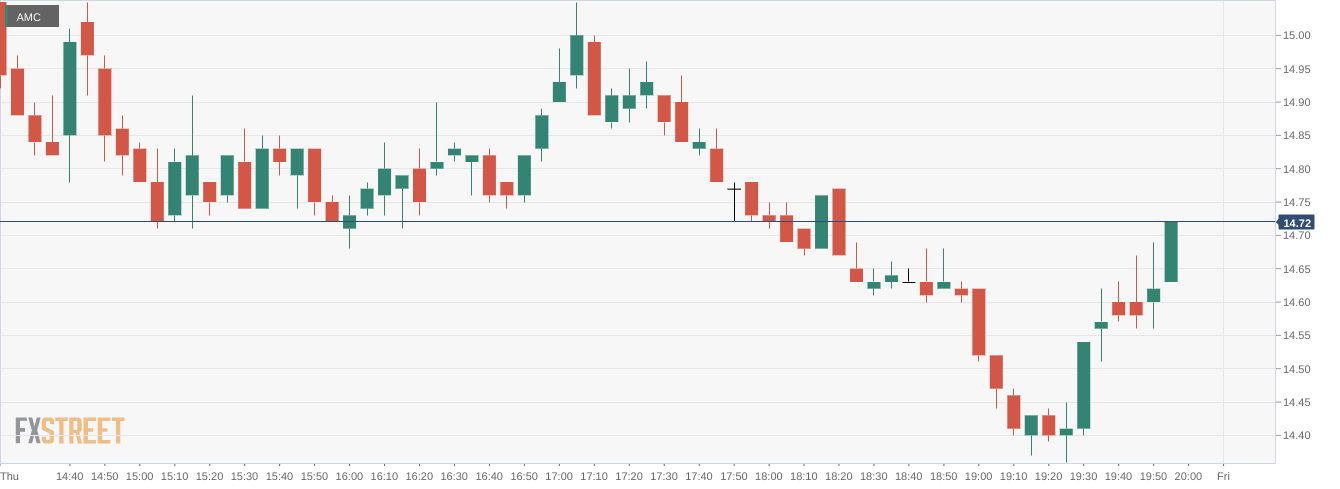

AMC Stock Price: AMC Entertainment drops lower during market meltdown

- NYSE:AMC fell by 6.55% during Thursday’s trading session.

- Hycroft Mining soars higher after reporting its earnings on Wednesday after the close.

- Coinbase launches its NFT Marketplace to little fanfare.

NYSE:AMC continued its downward trajectory in 2022 as the meme stock stood no chance against the tidal wave of selling that hit the markets on Thursday. Shares of AMC dropped a further 6.55% and closed the bloody session at $14.69. The meme stock has now lost 28% over the past month of trading and 45% year to date. There was little celebration on Wall Street for Cinco de Mayo as the markets saw their worst day of the year and one of the worst since March of 2020. The Dow Jones dropped by 1,063 basis points, while the S&P 500 and NASDAQ lost 3.56% and 4.99% respectively during the session.

Stay up to speed with hot stocks' news!

AMC’s recent investment in Hycroft Mining (NASDAQ:HYMC) hasn’t really paid any dividends for the company as of yet. On Wednesday after the close, Hycroft reported its first quarter earnings and on Thursday shares of the miner were up by 15.0%. Investors were pleased with the fact that AMC’s investment in Hycroft allowed the mining company to reduce its debts and even launch a new exploration program. The company also revealed it is getting set to launch a drilling program to optimize the potential output from its mine.

AMC stock forecast

AMC’s running mate GameStop (NYSE:GME) will be looking to launch its NFT marketplace at some point in the near future. This has been one of the major catalysts for the company’s ongoing digital transformation. Earlier this week, Coinbase (NASDAQ:COIN) launched the beta version of its NFT Marketplace and the initial fanfare was non-existent. Reports suggest that only 150 members signed up for the marketplace in what was a very underwhelming launch. If this is indicative of how GameStop’s launch will go, then we might see further downside in GameStop’s stock.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet