- AMC stock managed to post a modest advance on Monday.

- AMC shares gains 15% on the week after meme stocks recover.

- AMC Entertainment invested in gold miner Hycroft Mining.

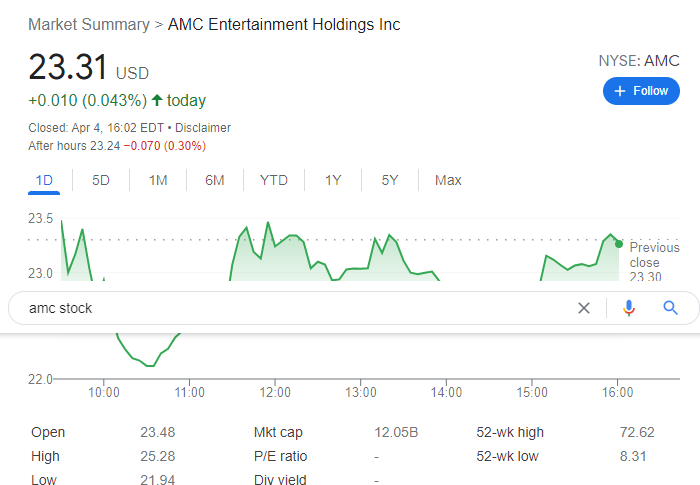

Update: AMC stock added 0.043% on Monday, ending the day at $23.31 per share. Global equities closed in the green on the first trading day of the week, regardless of mounting concerns about the Russia-Ukraine conflict. In the US, the Nasdaq Composite was the best performer, adding 1.74%, helped by news that Elon Musk has taken a 9.2% stake in Twitter. The share soared, ending the day roughly 28% up, as Tesla's CEO has now become the largest shareholder of the social media company. The Dow Jones Industrial Average added 103 points, while the S&P 500 ended the day 0.73% higher.

Meanwhile, investors' attention remains on Ukraine-Russia developments. As announced, Moscow has moved troops away from Ukraine’s northern region. However, Kyiv reported the massive assassination of civilians and war crimes, which resulted in western nations announcing plans to add sanctions on the Kremlin. French President Emmanuel Macron called to add sanctions on Moscow, while Germany and France decided to expel Russian diplomats from their countries. The US is also preparing more sanctions against Putin & Co. Ukraine’s President Volodymyr Zelenskyy said that considering what Russia has done in the country, it's difficult to negotiate with them.

Previous update: AMC stock has shed 4.6% in its first hour of trading for the week. The cinema chain is changing hands at $22.22 at the time of writing. This is not a risk-off, macro-related sell-off. The Nasdaq Composite is up more than a percentage point. It seems that the March 15 to March 28 rally is continuing to give way. If AMC shares are down at the close, then this will be the fourth consecutive session of losses. It tends to be that way for AMC – either steady gains or steady sell-offs. Recent investment Hycroft Mining (HYMC) is down more than 7% to $2. If Hycroft loses its footing at $2, then it could collapse all the way back to support around $1.30. The overall market is a bit mixed on Monday as investors concern themselves with how possible new sanctions from the European Union would affect their investments. Over the weekend, reports emerged that a massacre of non-combatants took place in the Ukrainian town of Bucha, which is leading to calls for further boycotts of Russian gas and oil and other sanctions.

AMC stock finished out the week on a losing note as the stock continued to give up some of its recent gains. However, AMC was still up a pretty healthy 15% on the week, but it could have been so much more. AMC Entertainment shares began the week at just over $20 and spiked to $34.33 before closing out the week at $23.30. Wild swings are not uncommon in this name, and last week certainly proved that.

AMC Stock News

AMC Entertainment surprised many with its investment in Hycroft Mining (HYMC), a Nevada-based gold miner. This came out of left field, but the investment was small compared to the cash AMC currently holds. The investment probably helped HYMC stave off potential bankruptcy as it was then able to tap investors with a capital raise. Back in November HYMC had said it may struggle and needed cash as it laid off nearly half of its workforce, but AMC and CEO Adam Aron rode to the rescue.

Aron has now become emboldened to try for more distressed debt deals as he looks to diversify from the movie theatre business. Certainly, AMC and Aron can round up huge amounts of publicity for stock and generate follow-on investors, which is one of the hardest parts of raising cash in capital markets. According to Fox Business, Aron may look for shareholder approval to use up to $500 million of AMC's $1.8 billion cash hoard on five or six deals in the mold of the HYMC deal.

Elon Musk buys stake in Twitter

AMC Stock Forecast

We had identified failing momentum across the meme stock space during the middle of last week. This was especially evident in AMC on Tuesday when AMC stock spiked up to $34 early in the session before falling sharply to close at $29. This also neatly brought AMC up to resistance from our trend line at $34 as well as the 200-day moving average. Hence, this was a strong level and failure to break above it was crucial. Now $21 looks like the key support level with some help from the 9-day moving average at $23.25 along the way.

AMC stock chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold surges to fresh record high above $3,400 Premium

Gold extends its uptrend and trades at a new all-time high above $3,400 on Monday. Concerns over a further escalation in the US-China trade war and the Fed’s independence smash the US Dollar to three-year troughs, fuelling XAU/USD's rally.

EUR/USD clings to strong gains near 1.1500 on persistent USD weakness

EUR/USD gains more than 1% on the day and trades at its highest level since November 2021 near 1.1500. The relentless US Dollar selling helps the pair push higher as fears over a US economic recession and the Federal Reserve’s autonomy grow.

GBP/USD tests 1.3400 as USD selloff continues

GBP/USD continues its winning streak, testing 1.3400 on Monday. The extended US Dollar weakness, amid US-Sino trade war-led recession fears and heightened threat to the Fed's independence, underpin the pair following the long weekend.

How to make sense of crypto recovery – Is it a buy or fakeout

Bitcoin (BTC), Ethereum (ETH) and XRP, the top three cryptocurrencies by market capitalization, extend their last week’s recovery on Monday, even as trader sentiment is hurt by the US President Donald Trump’s tariff policy and announcements.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.