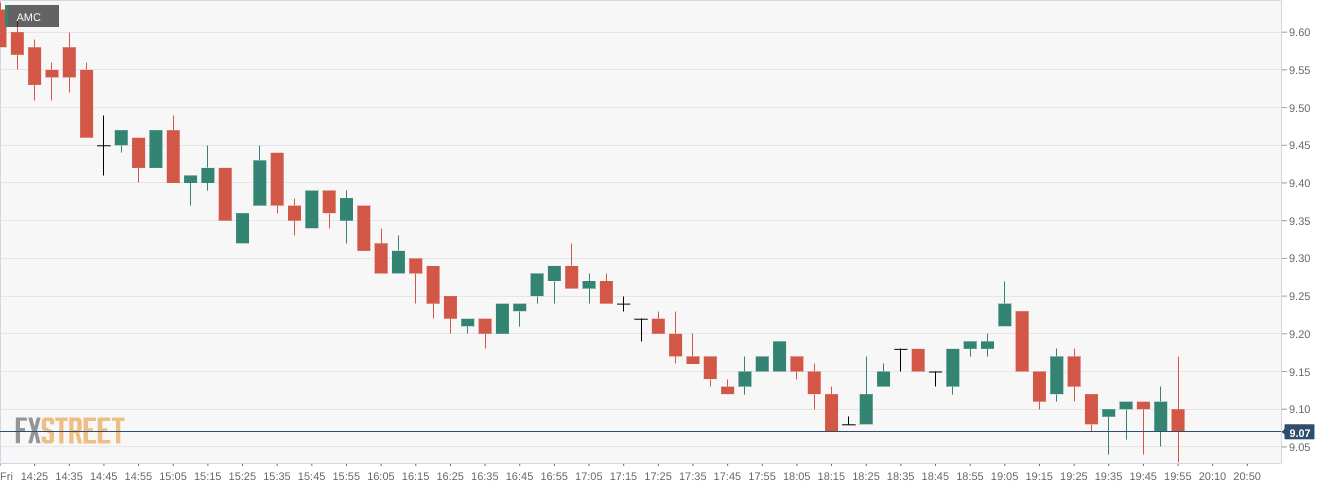

AMC Stock Forecast: AMC Entertainment rebounds but stays below $10 mark

- NYSE: AMC ends Monday up 2.23%, reversing early losses.

- Meme stocks tumble during another volatile week of trading.

- AMC and other theaters are stuck in a late-summer lull.

Update: NYSE: AMC started kicked off the week on the right footing, having staged a late rebound to settle at $9.18. In doing so, AMC stock price gained 2.23% on the day, bouncing off weekly lows at $8.85. Despite the upturn, AMC shares failed to recpature the $10 mark. Shares of AMC Entertainment Holdings tracked the Wall Street recovery in the final hour of trade on Monday, as investors continued assessing the impact of super-sized Fed rate hikes. The benchmark US 10-year Treasury yield surged to its highest level since April 2011 at 3.518%, limiting the rebound in alternative higher yielding assets such as stocks. The Fed is set to hike its key policy rates by 75 bps this week but its projection of the terminal rate is likely to rock the market.

NYSE:AMC sank lower yet again on Friday, as the meme stock posted a weekly loss of more than 10%. Shares of AMC tumbled by 9.11% on Friday and closed the trading week at a price of $8.98. Stocks made a late-session rally but all three major indices once again posted a losing day making it four losing weeks out of the last five for Wall Street. Overall, the Dow Jones lost a further 139 basis points, while the S&P 500 and NASDAQ dropped lower by 0.72% and 0.90% respectively ahead of the key September rate hike from the Fed next week.

Stay up to speed with hot stocks' news!

Meme stocks have certainly seen better times as the sector saw another volatile week of trading. GameStop (NYSE:GME) saw its stock fall by nearly 1.5% this week, while Bed Bath and Beyond (NASDAQ:BBBY) fell by more than 11%. Shares of AMC’s preferred share stock Ape (NYSE:APE) tumbled by more than 13% as the total value of AMC’s stock continued to trend lower. The true value of AMC’s share price now sits at just $13.88, one of its lowest levels since the release of the APE shares in late August.

AMC APE preferred stock price

AMC’s stock price isn’t the only that is struggling. Movie theaters around the country are seeing ticket sales dry up as the industry goes through a massive late-summer lull. Last weekend was the year’s second worst weekend in terms of movie goers, which highlights the lack of Hollywood summer blockbusters this year. The second largest cinema operator in the world, Cineworld (LON:CINE) officially filed for bankruptcy earlier this week, which gives a clear indication of how much the sector is struggling right now.

Previous updates

Update: NYSE: AMC managed to change course on Monday, ending the day at $9.18 per share after adding 2.23%. Wall Street started the day with a soft tone, but major indexes ground higher as the session developed. The Dow Jones Industrial Average added 197 points to settle at 31,019, while the Nasdaq Composite was the best performer, up 0.76%. The S&P 500 turned positive in the last hour of trading, up 23 points or 0.61%.

Generally speaking, market players remain cautious after US data released last week indicated that stubbornly high inflation refuses to give up, particularly as the US Federal Reserve is scheduled to decide on monetary policy this week. At the time being, another 75 bps has been already priced in, with fed funds seen above 4% before year-end. The potential effects of higher rates on economic growth, however, are yet to be seen, although they are also the main reason why Wall Street suffered its worst week in three months.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet