- NYSE:AMC added 17.56% on Tuesday as it largely outpaced the broader markets.

- Governor Cuomo of New York announced that movie theaters could reopen on March 5th.

- AMC will implement new health and safety protocols to try and prevent the spread of COVID-19.

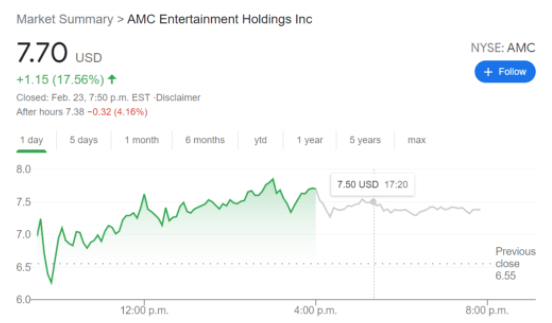

NYSE:AMC has had an eventful two-day streak as some excellent news in one of the biggest cities in America re-invigorated investor interest in the movie theater company. On Tuesday, AMC continued its rally as the stock added 17.56% to close the turbulent trading session at $7.70, the highest price level the stock has seen since the tail end of the Reddit movement against Wall Street at the end of January. While CEO Adam Aron confirmed that the added capital removed the threat of imminent bankruptcy, AMC is still banking on a future where movie theatre traffic is as high as it was pre-pandemic.

AMC did receive a boost on Monday when New York Governor Andrew Cuomo announced that movie theaters would be able to reopen in the state as of March 5th. The plan sees a limit of 25% capacity per theater or 50 people per screen, as well as assigned seating and increased health and safety protocols to be carried out by AMC staff. These protocols were created with the help of Clorox and Harvard University, which will look to increase the sanitation level of public outlets.

AMC stock price

Despite the reopening plan, AMC still has a long way to go to persuade people to once again choose going to a movie theater over watching the movie at home. The thirteen theaters located in New York City will be amongst the first to reopen come March 5th, but AMC still remains a volatile investment for the future, especially if COVID-19 and its variants end up becoming recurring virus strains each year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD draws support from bearish USD; trade tensions to cap the upside

AUD/USD edges higher on Tuesday as concerns about a tariff-driven slowdown in US growth and bets that the Fed would cut rates multiple times this year keep the USD depressed near a multi-month low. That said, the risk-off mood and escalating US-China trade war act as a headwind for the Aussie.

USD/JPY hangs near multi-month low despite weaker GDP print from Japan

USD/JPY languishes near a five-month low following the release of revised Japan's Q4 GDP print, which showed that the economic growth slowed to 2.2% on an annualized basis and complicates BoJ's plans for a further rate hike. However, the risk-off mood continues to underpin the safe-haven JPY and exert pressure on the pair.

Gold price remains depressed below $2,900; downside potential seems limited

Gold price trades with a negative bias around the $2,885 region, though the downside seems limited amid trade war fears and the risk-off environment. Moreover, bets for more interest rate cuts by the Fed and the prevalent USD selling bias could be a tailwind for the yellow metal.

Solana short traders deploy $730M leverage as SOL price hits seven-month lows: Hold or Sell?

Solana price tumbled towards $115 on Monday, posting 24.5% in losses over the last five days. Derivative markets data suggest SOL bears could press for more downside in the coming sessions.

February CPI preview: The tariff winds start to blow

Consumer price inflation came out of the gate strong in 2025, but price growth looks to have cooled somewhat in February. We estimate headline CPI rose 0.25% and the core index advanced 0.27%. The moderation in the core index is likely to reflect some giveback in a handful of categories that soared in January.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.