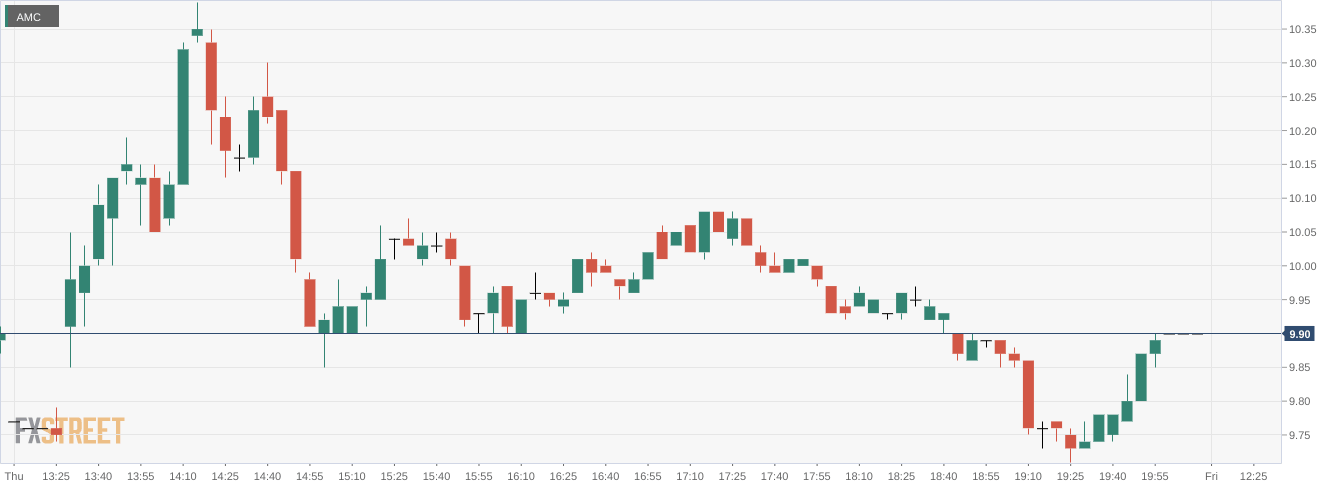

AMC Stock Forecast: AMC Entertainment closes lower despite early morning surge

- NYSE:AMC fell by 0.30% during Thursday’s trading session.

- Meme stocks are mixed as Bed Bath and Beyond provides more details on turnaround.

- Short interest borrowing fees rise higher for AMC yet again.

NYSE:AMC edged lower on Thursday and stayed below the key $10 price level when not including the additional value of the APE (NYSE:APE) preferred shares. Shares of AMC fell by 0.30% and closed the trading session at a price of $9.88. It was another losing day for Wall Street as FedEx (NYSE:FDX) provided the latest blow to investor’s hopes of a late-year market rally. FedEx is slashing costs and stated that global deliveries are lower all around as shares fell by more than 16% in after hours trading. Overall, the Dow Jones lost 173 basis points, the S&P 500 dropped lower by 1.13%, and the NASDAQ posted a loss of 1.43% during the session.

Stay up to speed with hot stocks' news!

Meme stocks were mixed on Thursday, following a recent mini uptrend that countered the broader market sell-off from recent economic data. Despite AMC falling, Ape shares rose higher by 0.75% to hit $5.40. This brings the cumulative value of AMC stock to about $15.28. GameStop (NYSE:GME) shares gained 1.71% and Bed Bath and Beyond (NASDAQ:BBBY) added 0.34% despite an early morning spike that mirrored AMC’s. The reason for the surge was likely BBBY’s announcement that it will close 150 stores across the country, while the interim CEO will remain in place for at least one year.

AMC APE preferred stock price

Short interest borrowing fees in AMC’s stock are rising yet again as meme stock traders speculate on another short squeeze. Borrowing fees are what short sellers pay to borrow shares of the stock from a broker to hold a short position in the stock. Short interest rates are currently at about 18-20%, but they peaked at a yearly high level of 30% earlier in September. Any rebound in the broader markets could result in another mini short squeeze from AMC’s stock.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet