AMC Share Price: Market manipulation on the way down but all good on the way up

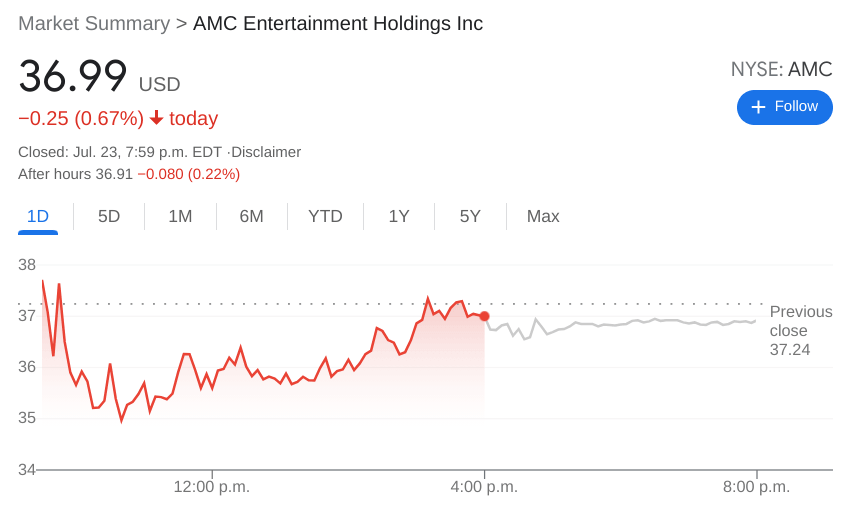

- NYSE:AMC falls 0.67% on Friday to cap a poor week.

- AMC Apes point to market manipulation in dark pool charts with a new hashtag.

- AMC pops on Monday as apes regenerate over thew weekend.

Update: Funny how it is market manipulation on the way down but all rosy on the way up. The apes may be right or not but they are winning the battle on Monday as the stock surges 7% in the first hour of trading. Cinema attendances have a long way to go before all is rosy with AMC's balance sheet and this debt burden may lead to problems down the road for shareholders. For now though all is forgotten and it is to the moon is back as the war cry of the AMC apes.

NYSE:AMC closes out another week of losses as the short squeeze from earlier in June fades into a distant memory. AMC Apes will argue that this is a dip worth buying, but what happens when the dip keeps on dipping? On Friday, shares of AMC dropped 0.67% to close out the tumultuous week of trading at $36.99. The stock has now given back nearly all of the gains made on the 25% surge it had on Tuesday, and it doesn’t look to be seeing any sign of support on the way down.

Stay up to speed with hot stocks' news!

AMC Apes have come up with some pretty outrageous theories in Reddit forums, and the latest one takes aim squarely at market makers. The hashtag #DarkPoolAbuse has been trending on Twitter for the past couple of days, as loyal AMC investors point to large blocks of trades that institutional investors make in the dark pool. The dark pool is a separate market where large trades can take place that won’t have a direct effect on the public markets. Apes are certain that market makers are using these dark pools to manipulate the price of AMC’s stock.

AMC stock forecast

The great irony with AMC is that the loyal shareholders who voted against the company selling 25 million shares to raise further capital, may be nudging AMC closer to bankruptcy. Several analysts have labelled this a missed opportunity for AMC, as the company currently had future debt obligations in the neighborhood of $5.4 billion. Unless AMC can come up with the cash in some other way, AMC Apes may have just unknowingly sealed the fate of the company.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet