AMC Entertainment Stock Price: Amazon buyout reports make it a box-office blockbuster

- AMC Entertainment Holdings Inc. is eyed for a buyout by Amazon.

- The struggling theater chain has been struggling amid the coronavirus crisis.

- NYSE: AMC is trading some 40% higher as the new week begins.

People may hesitate before returning to see movies on the big screen, but shares of AMC Theaters are on the rise. The world's largest chain of movie theaters is in business for just over a hundred year, and the coronavirus crisis threatened to bring it down. Social distancing measures – some imposed by state governors and others only by people taking action – have meant that fewer people are spending hours in a close cinema, sitting next to strangers.

However, the firm, valued at less than a billion dollars, may be a bargain for Amazon, worth over a trillion. According to the Daily Mail, a British media outlet, Jeff Bezos' behemoth firm has shown interest.

Back in 2018, AMC had a revenue of some $5.4 billion, yet CEO Adam Aron may have felt that such results are unlikely to return for a substantial time. Even when restrictions are fully removed, the lack of a vaccine may keep people away from theaters. Moreover, the leap in unemployment – as seen by Friday's horrific Non-Farm Payrolls report – could make Americans think twice before spending money on a night out.

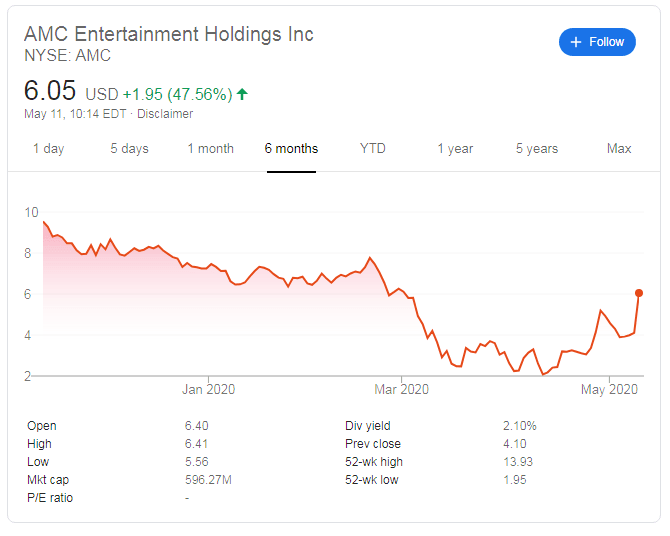

AMC Stock Price

AMC, trading on the New York Stock Exchange, is trading at around $6 per share, up over 40% or nearly $2 dollar higher than the close price on Friday, which stood at $4.10. The 52-week low was seen in March, as the stay-at-home orders were imposed, while the 52-week high of $13.93 was recorded before the COVD-19 era.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.