AMC Entertainment Stock News and Forecast: AMC sustainable bounce?

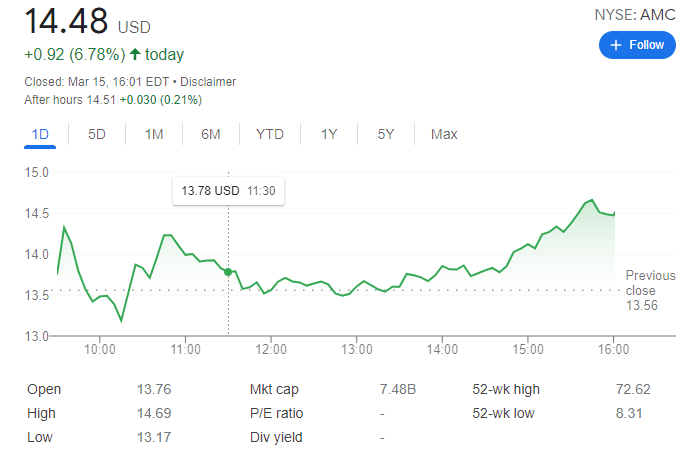

- AMC Entertainment turns green for the week, adding roughly 7% on Tuesday.

- We remain with our sub-$10 target on AMC Entertainment.

- The theater company announces an investment in gold miner Hycroft.

Update: AMC Entertainment added 6.78% on Tuesday, ending the day at $14.48 per share. The company benefited from the positive momentum of Wall Street, up ever since the day started. Equities advanced ahead of the US Federal Reserve monetary policy decision, expected to announce a 25 bps rate hike on Wednesday. At this point, a quarter-point hike has been long ago priced in, and such a decision will likely be considered dovish. Stocks may give up if US policymakers surprise market players with a 50 bps move. The Nasdaq Composite was the best performer, up 2.92%, while the Dow Jones Industrial Average added 573 points.

Meanwhile, tensions between Russia and Western nations continues after the first invaded Ukraine 20 days ago. Moscow's attacks on Ukrainian cities continue despite the international community keeps adding sanctions on Russian oligarchs and entities. As a response, Moscow announced a series of sanctions on US authorities, including President Joe Biden and banned Canadian Prime Minister Justin Trudeau from entering the country. At the same time, President Vladimir Putin said that Kyiv is not serious about finding a mutually acceptable solution, while a senior Ukrainian Presidential advisor later noted that there is room for compromise, announcing talks will resume on Wednesday.

Previous update: AMC stock has lost its 6% surge from Tuesday's open, but is still hanging onto a 2% gain about 90 minutes into the session. After announcing its $28 million investment in gold miner Hycroft Mining overnight, shares spiked to $14.59 at the open but have since drifted back to the $13.90s. Many seem to think the investment, which gives AMC Entertainment a 22% stake in the gold and silver concern, is something of an attention-seeking strategy. HYMC has been a sort of meme stock of its own in recent weeks. The fact that HYMC has already filed a prospectus that would allow it to sell $500 million worth of shares at its leisure may have disgruntled at least some AMC apes since this would dilute AMC's stake. For its part, HYMC is now trading up 25% at $1.75, though it opened as high as $2.71 on Tuesday.

AMC Entertainment stock (AMC) continues to trade very negatively and fell another 5% on Monday. AMC stock was in a worse position not long after the open when AMC traded down 8%, so perhaps the remainder of the day can be taken in a slightly more positive light. News this morning of an investment in another meme stock does not exactly seem reassuring and is more a case of trying to deflect attention and go after the latest trend.

AMC has been trying to follow every hot sector recently. It moved into accepting crypto and also dabbled in the NFT space. AMC Entertainment is no doubt trying to keep up with its new investor base, the AMC apes. Crypto appears to have worked well though, with AMC CEO Adam Aron recently implying it has worked well and that AMC may look to launch its own cryptocurrency in the future if the conditions are right. This latest venture into a gold miner is a slightly left-field one and does not make much sense in our view.

AMC stock news

AMC announced this morning it was taking a stake in Hycroft Mining (HYMC). Both AMC and Eric Sprott will make equal investments.

Hycroft announced on Tuesday morning that AMC and Eric Sprott were taking a $56 million joint stake in HYMC.

"AMC and Mr. Sprott will each invest $27.9 million in cash in Hycroft in exchange for 23,408,240 units, with each unit consisting of one common share of Hycroft and one common share purchase warrant," AMC said in a press release.

Shares were purchased at $1.193, and each warrant is exercisable at $1.068 per share. Unexercised warrants expire after five years. AMC will own about 22% of the post-investment stock before including warrants.

"Our strategic investment being announced today is the result of our having identified a company in an unrelated industry that appears to be just like AMC of a year ago," said CEO and chairman Adam Aron. "[Hycroft], too, has rock-solid assets, but for a variety of reasons, it has been facing a severe and immediate liquidity issue. Its share price has been knocked low as a result. We are confident that our involvement can greatly help it to surmount its challenges — to its benefit, and ours."

The 71,000 acre Hycroft Mine in northern Nevada has some 15 million ounces of gold and some 600 million ounces of silver, according to third-party auditors. Experienced precious metal investor Eric Sprott is taking an equal 22% stake in HYMC.

HYMC has a decent retail following so may have retail shareholders in common between the two companies, but the miner has not turned a profit since 2013. Gold mining is expensive and depends on the quality of the recoverable gold. The mine may have proven resources, but are they recoverable at all price levels? Also, what quality is the gold?

Gold is certainly a trending asset given the inflationary backdrop, but HYMC is not something I would be looking to invest in. To the end of 2020, HYMC is carrying way too much debt, nearly $150 million worth. This is not a favorable environment for companies carrying debt. Interest rates are rising and the appetite for refinancing is dropping.

Read more on Hycroft Mining (HYMC) stock

AMC stock forecast

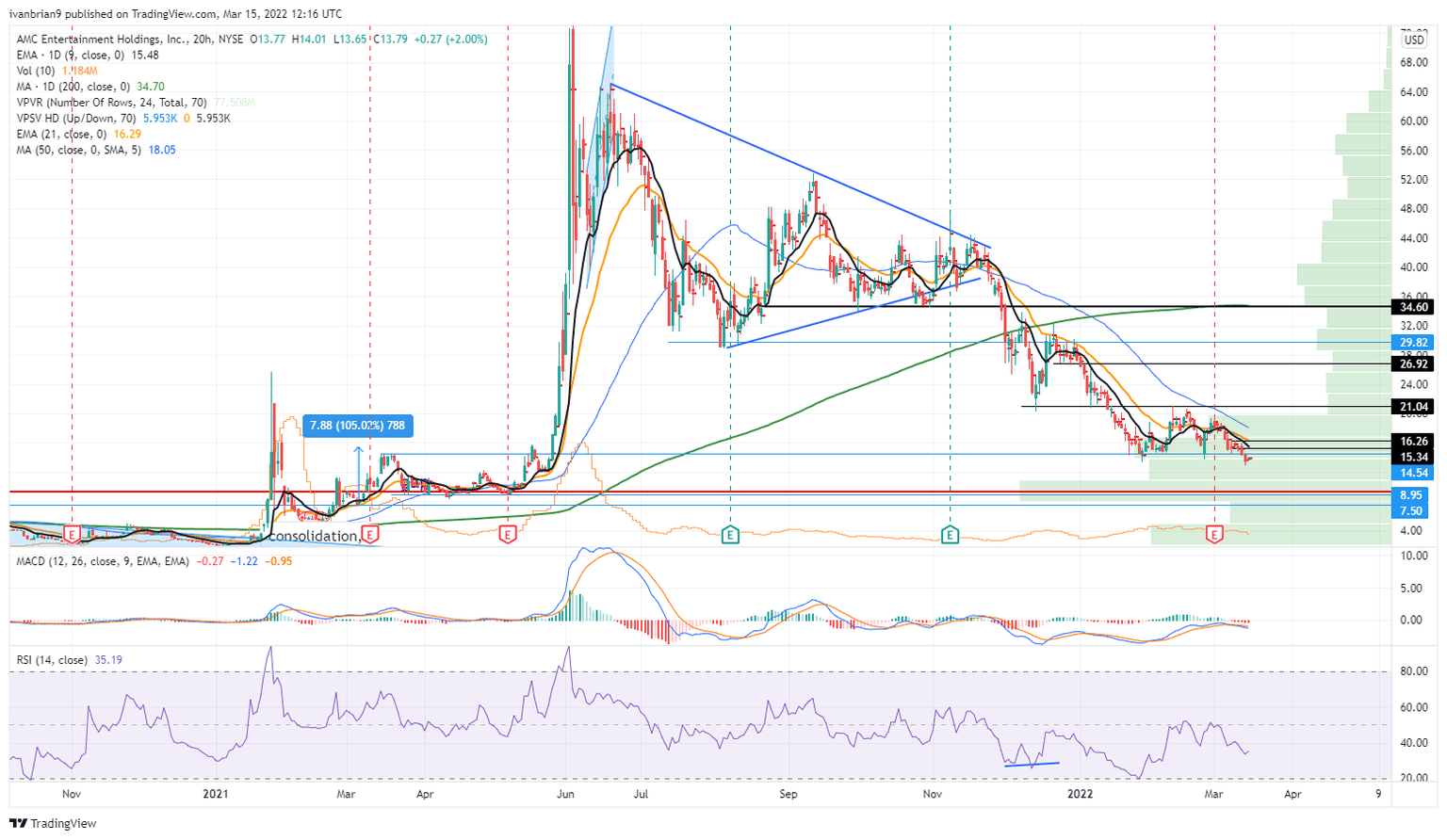

Expect this move to merely accelerate the AMC stock sell-off. Analysts and large investors will not appreciate it, and we expect this to speed the move in AMC to below $9. Breaking $14.54 was already quite telling and set up the technical picture for another leg lower. $8.95 is the next target of support. Only breaking above $21.04 ends the current bearish setup.

Benzinga also just reported that Hycroft has issued a prospectus in order to sell up to $500 million worth of common shares at its own discretion.

AMC chart, 20-hour

Prior Update: AMC stock has already surged nearly 6% higher in the first few minutes of the regular session as traders digest the latest piece of news. AMC has invested in a gold mining company as it diversifies its business. A bit out of left field in our view and not a great fit or investment. But obviously traders are taking a different view as the push AMC stock higher on tuesday. AMC stock is currently trading at $14.16 for a gain of 4.5%. HYMC stock has had a much more impressive though and is trading up 55% at $2.12. HYMC stock did trade over 100% higher in the premarket at $2.97. Bloomberg earlier reported that Hycroft Mining (HYMC) could plan a share offering as early as Tuesday. We assume this means Tuesday next week and not today. The author is currently long HYMC puts.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.