-

NYSE:AMC gains over 2% on Monday as market weakens.

-

AMC results were poor, but retail traders love the name and the CEO.

-

Meme stocks and the Reddit short squeeze are the focus of the SEC’s new chair.

Update May 11: AMC shares bucked the trend on Monday rising nearly 3% and putting $10 firmly in their sights. The Nasdaq and most other retail interest stocks dumped but AMC bucked the trend. It was one of the few stocks in the green on Monday. Traders had been impressed with the conference call comments after releaseing results for Q1.

Update May 10: AMC Entertainment Holdings (NYSE: AMC) has kicked off the trading week with an upwards swing towards the $10 mark. The move could be attributed to Adma Aron, who praised Reddit investors who have been supporting the company throughout the period. While the company has significant debts – causing concerns in Wall Street – retail buyers remain content with the firm's prospects and those of America's reopening. The next level to watch is the late April peak of $11.50.

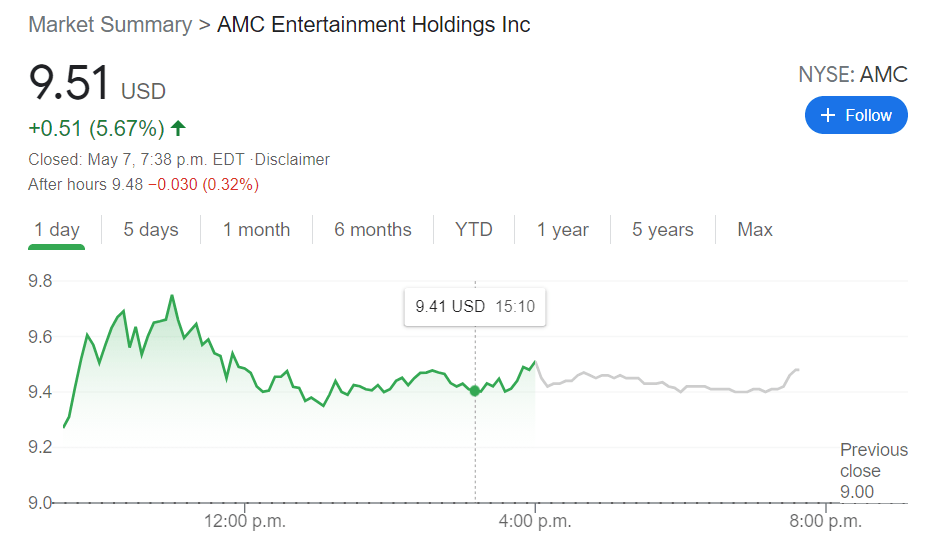

NYSE:AMC has ridden the wave of Reddit investors for months, but after another ominous earnings call, investors may be getting tired of this rerun. Friday came with some optimism though as shares gained 5.67% to close the week at $9.51. The stock is now trading below its 50-day moving average, and has suffered a drastic drop in daily average trading volume as the Reddit phenomenon slowly begins to fade away.

Stay up to speed with hot stocks' news!

AMC saw its stock rise on Friday after an optimistic earnings call from its CEO Adam Aron on Thursday after the closing bell. AMC reported massive losses and an 84% year-over-year decline in revenues, and yet investors bought into the positive guidance that Aron provided for the rest of 2021. Aron said that over 7 million moviegoers came by an AMC theater in the first quarter, and that with the rising rates of COVID-19 vaccinations in the United States, he is hopeful of a full recovery for AMC. Another positive that Aron revealed is that due to other theater closures during the pandemic, AMC now owns a near 25% market share of all movie theaters in the U.S.

AMC stock news

AMC joins the meme stock leader GameStop (NYSE:GME) as the focal point of new regulations being proposed by the newly sworn in new Chair of the SEC. It seems that the Reddit short squeeze event and subsequent debacle with the Robinhood trading platform have left a bad taste in the SEC’s mouth, and it is determined to not let an event of this magnitude take place again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0500 ahead of FOMC Minutes

EUR/USD trades marginally higher on the day near 1.0500. The US Dollar struggles to preserve its strength amid a modest improvement seen in risk sentiment, helping EUR/USD hold its ground before the Fed publishes the minutes of the November policy meeting.

GBP/USD struggles to hold above 1.2600

GBP/USD loses its traction and trades below 1.2600 after rising above this level earlier in the day. Nevertheless, the pair's losses remain limited as the US Dollar struggles to find demand following mixed data releases. Markets await FOMC Minutes.

Gold stabilizes above $2,600 after sell-off on hope of ceasefire in Lebanon

Gold fluctuates above $2,600 on Tuesday after sliding almost three percent – a whopping $90 plus – on Monday due to rumors Israel and Hezbollah were on the verge of agreeing on a ceasefire. Whilst good news for Lebanon, this was not good news for Gold as it improved the outlook for geopolitical risk.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.