AMC Entertainment Holdings (AMC) Stock Price and Forecast: When will it break $48?

- AMC still waiting to break key resistance at $48.

- TradesTrey predicts it will take four goes to break through.

- AMC needs to break it this week or else it turns lower.

AMC shares have been knocking on the door of the $48 resistance for a while now and so far have not broken through. The door opened slightly during the intraday session when AMC stock got to $49.40, but the volume was light and there was little follow-through. This is actually a slight negative and is making us doubt the apes' ability to push solidly above $48. Also on the negative side is the fact that the options volume is steadily decreasing across AMC strikes and that has been a significant driver of the price increase. Options have been a feature of many meme stock rallies this year as retail traders like the guaranteed loss protection of premium and the unlimited profits offered by buying calls. AMC option volume is now below its 30-day average and the open interest is also below its 30-day average. This means most likely that call buying is decreasing and resultant share purchase hedging by market makers (the infamous gamma squeeze) is also drying up.

Now AMC is not taking things lightly and has unveiled an ambitious advertising campaign to capitalize on the success of Labor Day weekend attendances. AMC set a revenue record for Labor Day weekend, surpassing that of 2013 and also for the first time beating pre-pandemic attendance. Now AMC is launching a $25 million national advertising campaign to encourage customers to return to cinema. The advertising campaign features Nicole Kidman. Also, AMC CEO Adam Aron teased a potential tie-up with fellow meme stock king GME in an interview yesterday with Liz Clayman of Fox Business. CEO Aron said,"We have made contact with GameStop on a partnership. We're not ready to say what it is." Is there a movie in the works, an advertising or promotional tie-up? Who knows, but retail investors are certainly talking about it on social media.

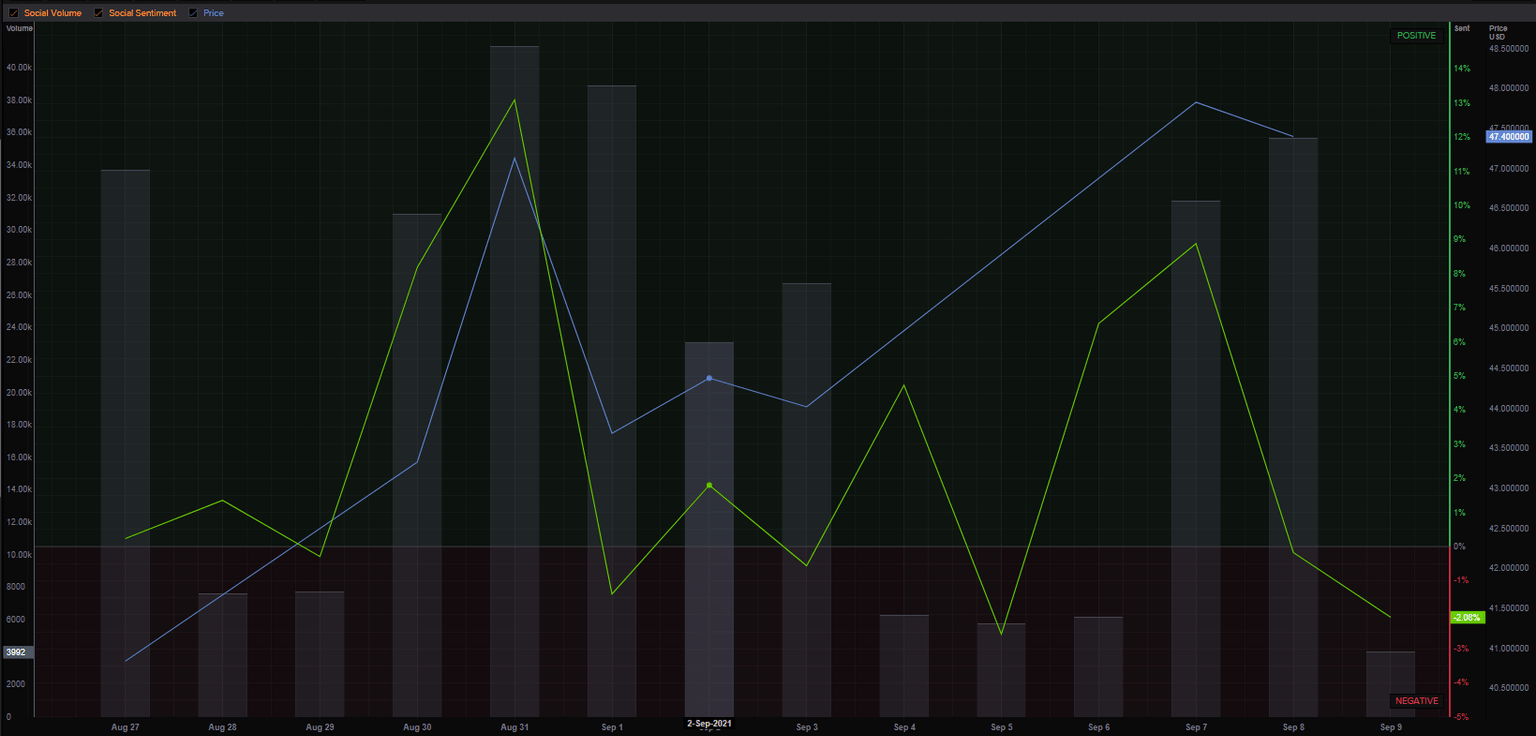

Speaking of social media, the Refinitiv social media sentiment monitor has dipped into negative territory for the first time this month, perhaps a reflection of failing to break $48? Interest and mentions remain high as we can see from the bars behind the line graph. The price correlation is starting to fade though.

AMC key statistics

| Market Cap | $22.6 billion |

| Price/Earnings | |

| Price/Sales | 3 |

| Price/Book | |

| Enterprise Value | $36 billion |

| Gross Margin | -0.74 |

| Net Margin |

-3.15 |

| 52 week high | $72.62 |

| 52 week low | $1.91 |

| Average Wall Street Rating and Price Target | Sell $5.44 |

AMC stock forecast

Our theory on breaking $48 remains intact. Volume is lighter up there, so gains should be easier and make a move to the next volume equilibrium zone at $60 easier. This consolidation phase is taking too long. Consolidation phases are fine, but they cannot go on too long or else they become range or choppy trading with no trend. This empowers sellers. Yesterday's intraday move above $48 twice is also negative as sellers were waiting to push the price lower. Really we have to get through this week or the stock is neutral in our view.

The call: just about bullish above $45 for this week only, neutral next week if $48 is not broken, neutral this week if $45 is broken and bearish below $40.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637667765930379510.png&w=1536&q=95)