- AMC stock accelerated its slide as risk appetite receded.

- GameStop (GME) stock is down roughly 7% on Thursday.

- AMC was trending heavily on social media last week but failed to rise.

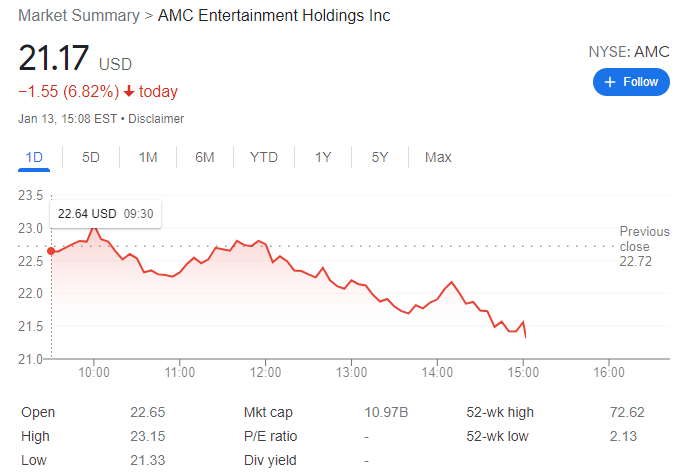

Update, January 13: AMC extended its decline on Thursday amid fading risk appetite resulting in most US indexes losing ground on the day. The shares trade at $21.17, down 6.82% heading into the close. Wall Street accelerated its decline in the final hour of trading, with the Nasdaq Composite being the worst performer, down roughly 300 points at the time of writing.

Previous update: AMC shares continue to trade on thin ice, as bears gather pace before the next push lower. Despite maintaining the bearish consolidative mode for the fourth straight day on Wednesday, AMC stock price lost 0.31% to settle at $22.72. The downside pressure remains intact, as AMC Entertainment CEO Adam Aron sells another $7 million of stock in the movie theatre giant, although said that he is done selling for now. Aron has sold more than $40 million in stock since November. Meanwhile, the overall optimism on the Wall Street indices did help cap AMC’s losses.

AMC shares closed lower on Friday with a steep 3% fall as the stock shows signs of further waning momentum. Meme stocks had suffered as 2021 came to a close and so far early signs in 2022 are of more pain in the meme stock space. Now that the pandemic is hopefully coming to a close is this the end for meme stocks? This was after all the prediction for H2 of 2021 when economies reopening was due to curtailing retail frenzy trading. The advent of delta and other covid curtailments may have prolonged the meme party. This time is it finally over?

AMC stock news

Holders are pointing to strong fundamental data for AMC with movie attendance growing and this trend is set to continue with covid hopefully out of sight soon. However, let us face it AMC was never a fundamental investment. I think we can all admit this one trades at a huge fundamental valuation that is hard to justify. No this was pure momentum. The trick with momentum names is to get out early. Get in late to make sure the train is moving but get out early before it comes to a shuddering halt.

AMC stock forecast

AMC has never recovered from the key $34.60 level we identified in October. Once this broke it was straight through the 200-day moving average and AMC has not yet managed to recover. Now some hope identifies itself on the chart in the form of a potential double bottom. Friday's low at $20.80 exactly matched the low from December 14. Double bottoms are powerful reversal signals so if AMC can hold this may be a staging point for a rally. So this is the key short-term pivot in our view. Break and it is onward to $14, but hold and a test of $30 wouold be the next technical step.

AMC stock chart, daily

Previous updates

Update: AMC shares ended the day down some 0.3% and fell from a high of $23.36 to a low of $22.05. Overall, stocks that were widely monitored by retail investors in the Reddit forum were a mixed bag on Wednesday.

There was a lack of news from the company and instead the technical outlook is on focus again. A break of $20.40 opens the risk of a move all the way into $14.50 for the days ahead where resistance is seen near $29.20. From an hourly perspective, the bears will be seeking a break of the dynamic trendline support and then $22.06. To the contrary, a break of $26.10 would be significant for the bulls.

Update: AMC shares witnessed another up and down session on Tuesday before finishing the day flat at $22.78. The bulls finally gained control amid a broad relief rally across the Wall Street indices, as the US Treasury yields retreated after Fed Chair Jerome Powell showed no haste to reduce the balance sheet during his confirmation hearings. Despite a bit of a reprieve on Tuesday, AMC shareholders are losing 16% so far this year, as the stock price extends its five-month losing streak.

Update: AMC shares are down 1.58% ahead of Tuesday's close, trading at $22.42 per share, down, despite the better tone of Wall Street. Stocks recovered after a soft start to the week on the back of comments from US Federal Reserve chair Jerome Powell, who testified before Congress on the hearing for his next term as head of the US central bank. Powell was confident about economic Congress, but cautious on reducing the balance sheet, which somehow brought relief to financial markets.

Update: AMC shares extended its run of losses into the seventh straight day on Monday, losing another 0.96% to end the day at $22.77. AMC stock price fell as low as $21.25 during one point in Monday’s trading but managed to stage a decent comeback amid a broad recovery on Wall Street indices. Surging Treasury yields on the Fed’s tightening frenzy knocked down the meme stocks, with AMC roughly losing 17% so far, this 2022. Focus now shifts to the corporate earnings season in the US, Fed Chair Jerome Powell’s testimony and the critical inflation report for any impact on Wall Street sentiment.

Update: AMC shares are ending Monday in the red, changing hands at $22.46 per share. Financial markets are in risk-off mode ahead of the release of US inflation, foreseen hitting 7% in December. US Treasury yields kept pushing higher, while Wall Street edged lower, with the NYSE down 125 points or 0.73%. The Dow Jones Industrial Average is the worst performer, down 328 points or 0.90%

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold price jumps to fresh record high above $3,200 on US-China tariff war

Gold price sits at all-time highs of $3,219 in the Asian session on Friday. The weakening of the US Dollar and escalating trade war between the US and China provide some support to traditional safe haven asset Gold price amid increased dovish Fed expectations.

USD/JPY recovers losses in sync with US Dollar, retakes 143.50

USD/JPY is trimming losses to retest 143.50 in Asian trading hours on Friday, having tested levels under 143.00. The pair is tracking the US Dollar price action amid persistent trade jitters and US recession fears. The Fed-BoJ divergent policy expectations support the Japanese Yen, keep the weight intact on the pair.

AUD/USD consolidates weekly gains near 0.6250 despite trade tensions

AUD/USD consolidates weekly gains near 0.6250 in Asian trading on Friday. The pair capitalizes on sustained US Dollar weakness even as risk aversion remains at full steam on deepening US-China trade war. The White House confirmed on Thursdayt that the cumulative US tariffs on Chinese goods have risen to 145%.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin dived below $80,000 on Thursday despite US Consumer Price Index data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.