- AMC stock falls over 3% on Friday in a broad market sell-off.

- AMC falls in line with the indices so not quite as bad as it sounds.

- If the new covid variant is more transmissible, travel and leisure will be hit hardest.

AMC shares fell on Friday but for such a volatile name a loss of 3% was actually not that bad a performance. Everything was swamped in a sea of red as panic ensued the discovery of a new covid variant in South Africa. The new variant is apparently more transmissible than the delta variant and looks to be able to avoid the current suite of vaccines. AMC fell 3% but given the sector, it operates in we felt it held up relatively well. In the event the worst fears over Omicron are realized, travel and leisure stocks have the most to lose. Airlines collapsed on Friday with American Airlines (AAL) down 9% and cruise stocks also suffering. Cinema stocks though would take a disproportionate hit from any more restrictions. If the logic to punish airline and cruise stocks is sound then the same logic should have seen entertainment and cinema stocks similarly hammered. Lockdowns will have a huge impact. AMC barely survived the last lockdown. By comparison, Cineworld (CINE) fell 8% on Friday in London. Cineworld is the second biggest cinema operator behind AMC.

Our AMC chart above shows just how much this one has gained from the meme stock madness in 2021 so some AMC apes would be forgiven for taking some profits ahead of year-end surely.

AMC stock news

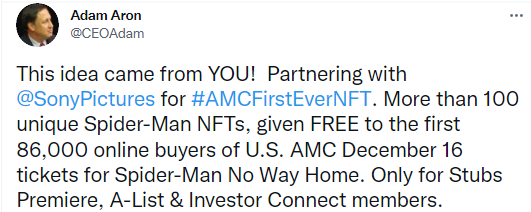

However, the good news just keeps on coming. We note news out this morning that Spider-Man No Way Home ticket sales crashed numerous box office sites as demand soared. The holiday season is upon us and that means peak cinema attendance. AMC also announced an entry into the Non-Fungible Token (NFT) space to coincide with the Spider Man release. AMC has teamed up with Sony Pictures to offer 86,000 NFT's for the Dec 16 release of the latest Spider-Man movie. CEO Adam Aron credited retail investors with the idea.

AMC stock forecast

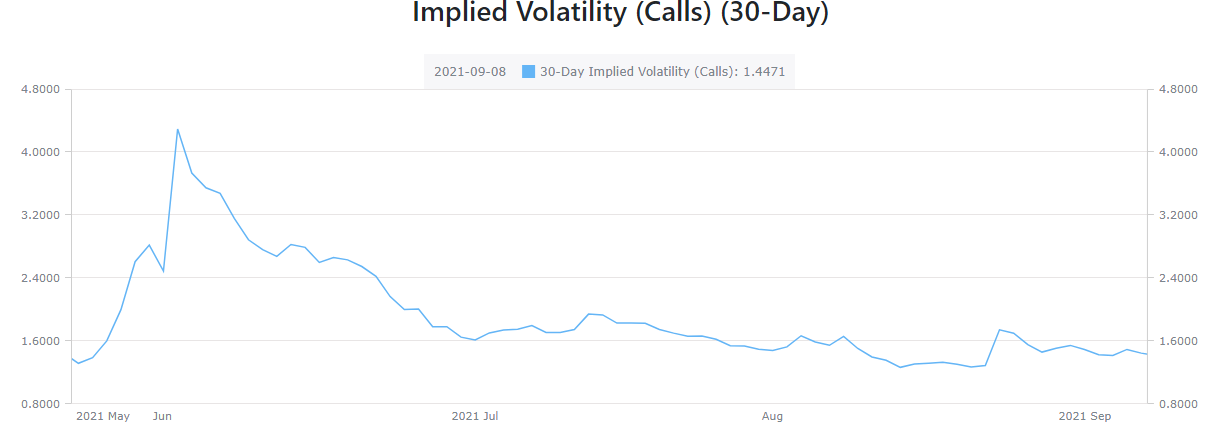

When a stock reacts well to bad news it usually leads to a bullish breakout. While falling 3% is not exactly reacting well it was when you consider the background on Friday. Stocks in Europe collapsed and things got panicky. AMC held the line quite well then. $34.60 remains the line in the sand support. Above this and there is hope. The problem is volatility and momentum have died so we are left with fewer and fewer opportunities. Shorts have been scared away and no new longs can be tempted in, so we are left with a stalemate. We still feel the temptation to cash in some gains will be too hard to avoid from some AMC holders and with a lack of new impetus for buyers, AMC is set for a slow steady decline into year-end. Other names have taken the volatility such as Rivian (RIVN). Even with today's bounce on for US futures, AMC is barely moving in the premarket. We have set a series of higher lows but also a series of lower highs ie stalemate and a triangle. Usually, a triangle results in a powerful breakout but we just cannot see a catalyst if even Friday failed to provide one.

As mentioned volatility is falling sharply. Depending on your view this may make buying out of the money calls or puts more affordable if you suspect a breakout.

Source: Alphaquery.com

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637737855501772695.png)