AMC Entertainment Holdings (AMC) Stock Forecast: Is a Bond bounce due?

- AMC stock has been languishing and struggling for form.

- Can the new Bond movie revitalize the stock?

- AMC apes still lurk in the background, and pre-orders for Bond is strong.

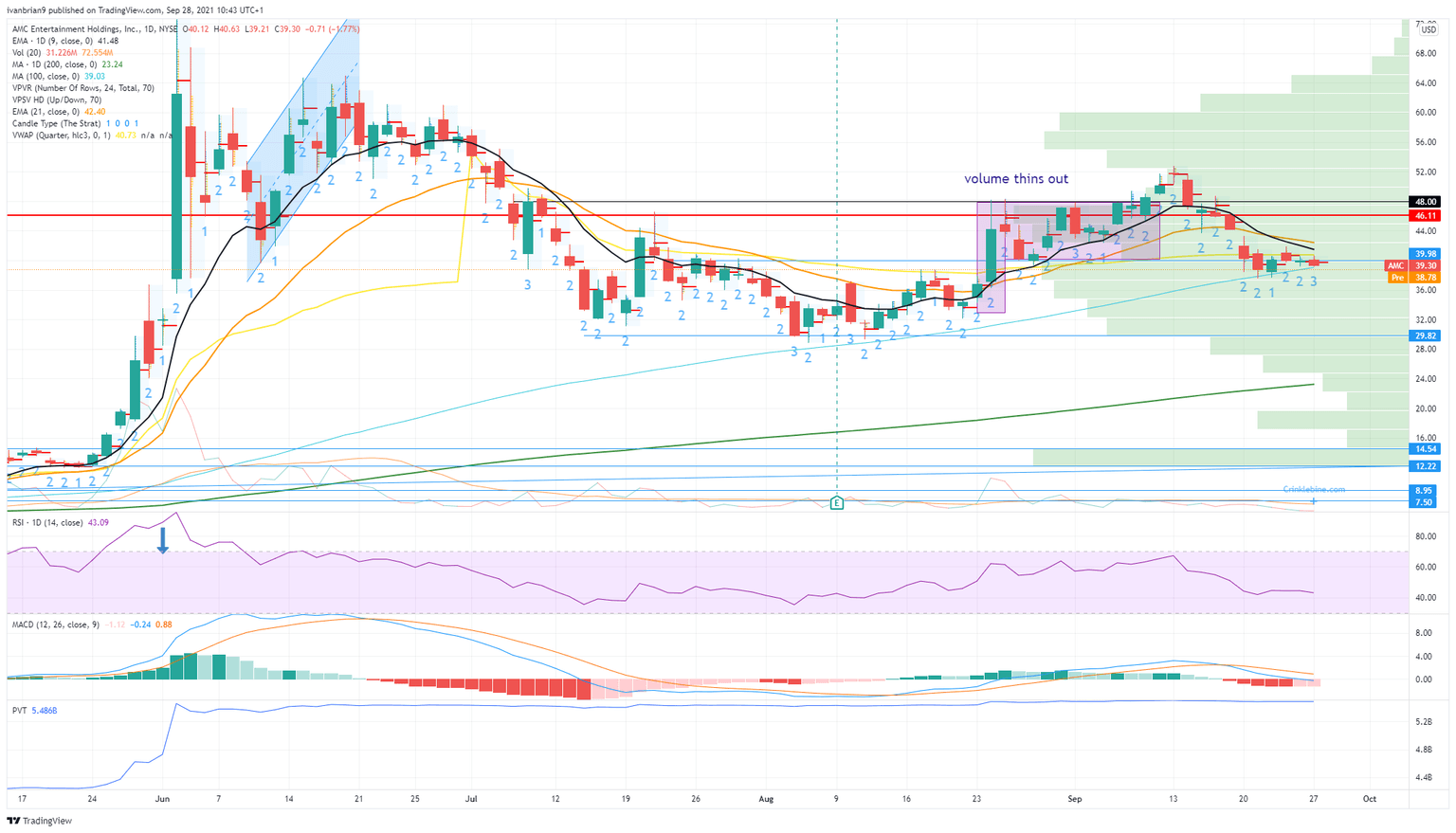

AMC stock settled for further losses yesterday with the stock closing down nearly 2% on the day to below $40.

It was a fairly uneventful day for AMC stock as the 15-minute, intraday chart above shows. The daily range was more or less a tiny $1 from high to low, and volume was also light as a result. The stock has been struggling lately ever since failing to hold the impressive break above $50. Now it has retreated and found support from the 100-day moving average with the volume profile also lending support to this zone just under $40. This raises an interesting support ahead of the new James Bond release, which is expected to greatly increase ticket sales.

AMC key statistics

| Market Cap | $20.7 billion |

| Price/Earnings | |

| Price/Sales | 3 |

| Price/Book | |

| Enterprise Value | $36 billion |

| Gross Margin | -0.74 |

| Net Margin |

-3.15 |

| 52 week high | $72.62 |

| 52 week low | $1.91 |

| Short Interest | 18.9% Refinitiv |

| Average Wall Street Rating and Price Target | Sell $5.44 |

AMC stock news

We reported yesterday that advance ticket sales for the new Bond movie were looking strong with Reuters reporting that an AMC unit in London has witnessed ticket sales over 175,000 already. AMC cinema chain rival Cineworld has also backed that up, saying that pre-selling for the Bond installment "No Time to Die" is the highest since Marvel's Avengers: Endgame in 2019. Cineworld (CINE.L) added that there were already several sold-out screenings and that ticket sales in the first 24 hours have only been surpassed by two films in the last half decade. Cineworld shares were up nearly 12% in London on Monday and are positive again on Tuesday.

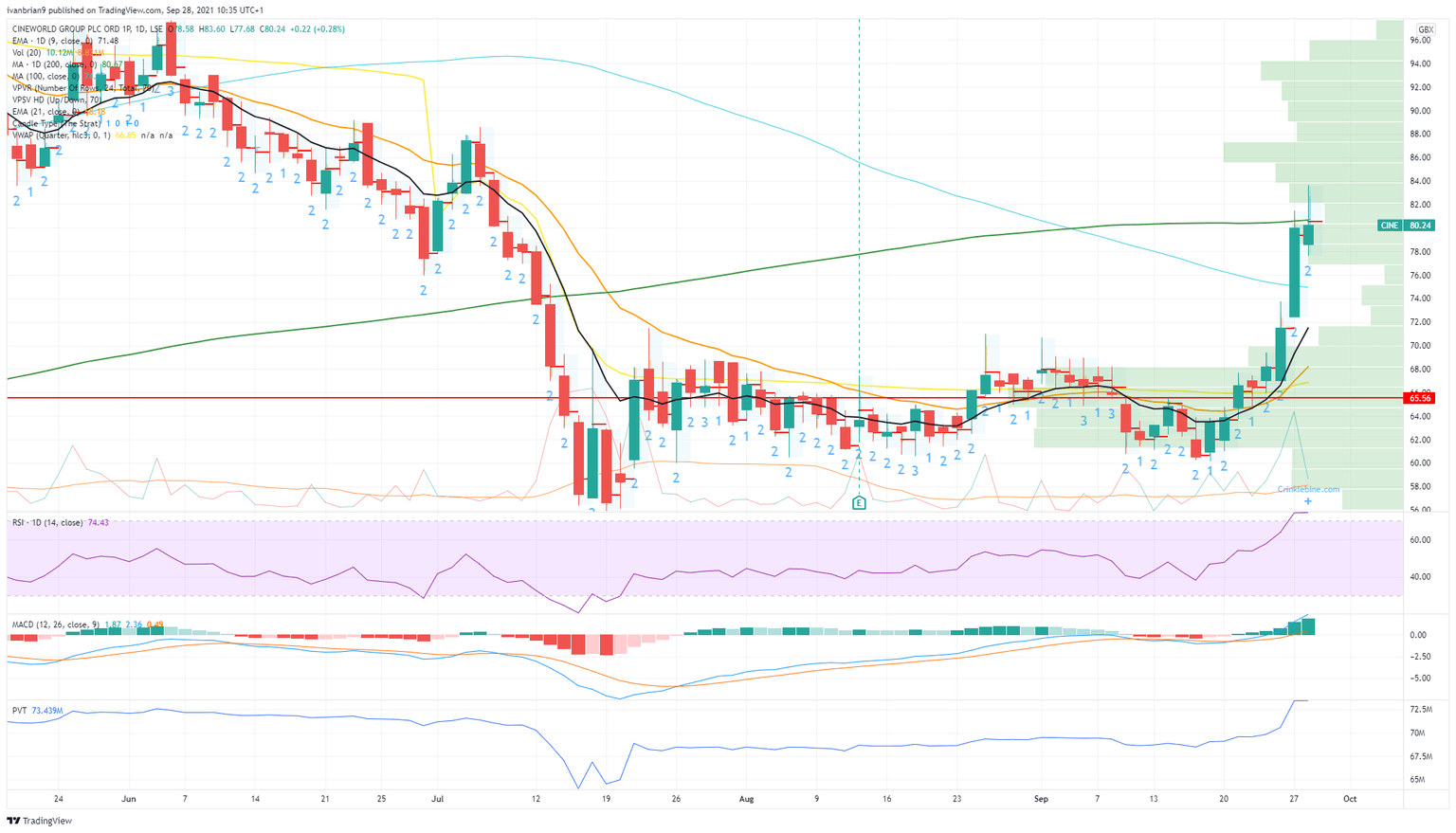

Cineworld (CINE.L) daily chart

AMC stock forecast

What works for Cineworld should also see a boost for AMC, but so far the usually vocal retail crowd has not picked this one up on social media. Bond is a uniquely British institution, so perhaps the attention will shift from London to the US once screens in the US fill up. Or perhaps US viewers are not as interested? We do not think that is the case. AMC is at an area of high volume, so high support despite the volatile nature of this one. Stock markets are under pressure, but given the rise in CINE we feel the risk-reward is skewed here to trying a long position.

FXStreet View: Neutral, bullish on a break of $48, bearish on a break of $30.

FXStreet Ideas: Still stick with our call from Monday on buying the Bond dip. Increased news flow is likely. We would buy below $40 for a Bond-induced pop, but always use stops. Alternatively, a $48 call for October 8 costs $0.63 per contract.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637684178712098726.png&w=1536&q=95)