AMC Entertainment Holdings (AMC) Forecast: Why is AMC stock up today?

- AMC stock surges 6% on Monday as retail back in.

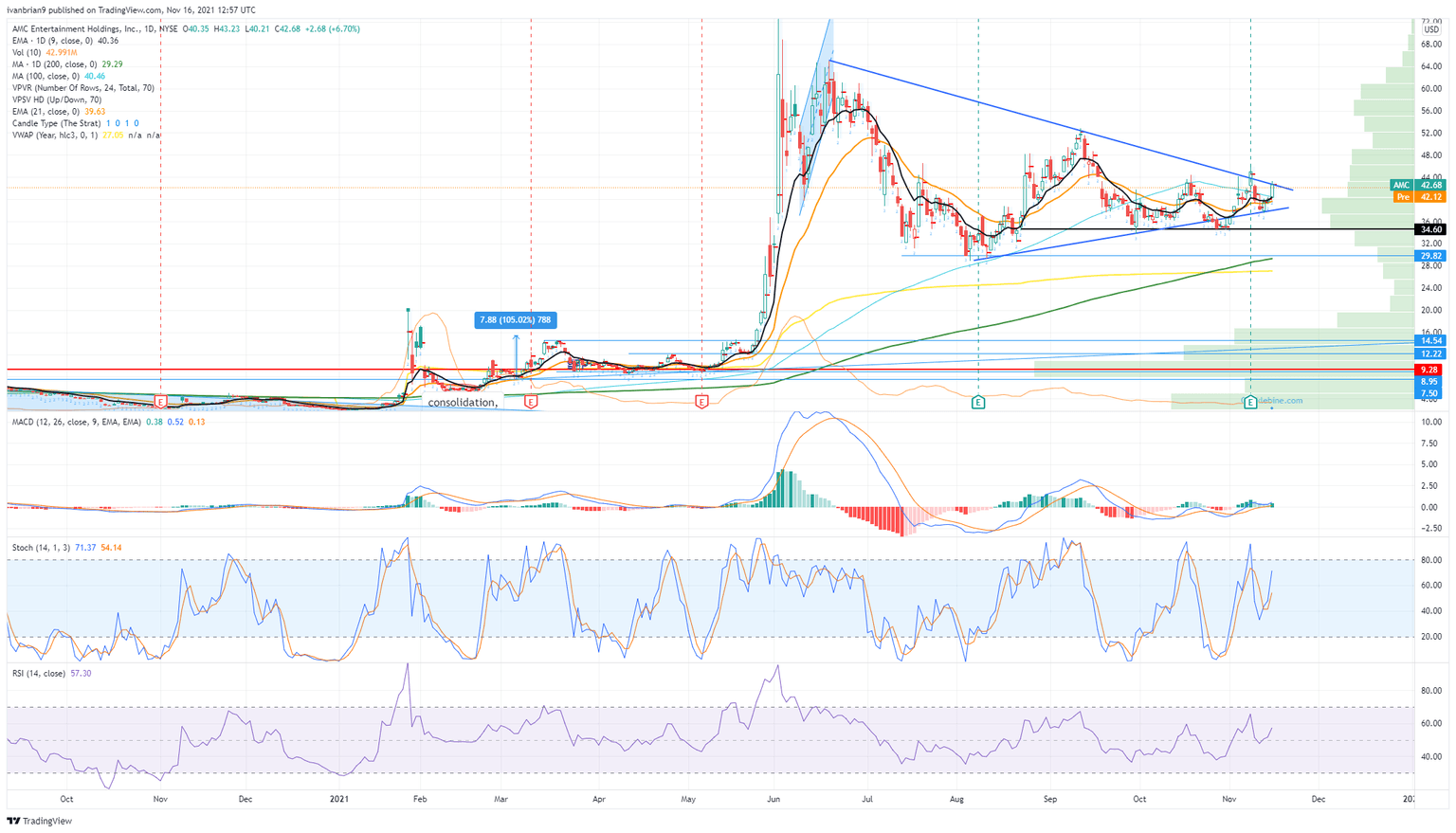

- AMC shares trade up to the top of the triangle formation.

- AMC stock still needs confirmation with more gains needed on Tuesday.

AMC shares rallied strongly on Monday with the stock surging over 6% to close at $42.68. In the process, the shares remained inside the triangle formation and avoided breaking to the downside, which had looked like a possibility.

AMC graph, 15-minute

As we can see, the AMC stock was strong for most of Monday and even closed near the high of the day, often a sign of a continuation into the following session. However, so far that is not working out as AMC stock is down nearly 1.5% in the premarket.

AMC stock news

Recent share sale news from both the CEO and CFO have dented investor enthusiasm somewhat, with CEO Adam Aron selling the stock for the first time in six years. This was followed up with the CFO, Sean Goodman, selling over 160k shares. Insider sales are never taken well by investors even if they are part of a pre-arranged plan. This news was then followed up with rival Cineworld saying on Monday that sales hit 90% of pre-pandemic levels in October.

AMC has also announced this morning that it will soon accept payment in the Shiba Inu cryptocurrency in the next 120 days. AMC will partner with BitPay to accept the crypto payment. AMC will accept Bitcoin, Etherum and Dogecoin from the first quarter of 2022, the CEO previously told CNBC. Some cynics suggest jumping on the crypto bandwagon is a sign of trying to keep the fizz in the share price, while others say it is a sign that AMC is ahead of the curve and moving with the times. Either way, it makes for an interesting development and is likely well received by the AMC apes.

AMC stock forecast

The move on Monday brought AMC up to the top of the triangle formation, which has been in place since the summer. The range is ever-tightening and usually triangles lead to fierce breakouts or a price explosion. So is AMC ready to break up or down? That is the main question.

Right now the stock is falling back in Tuesday's premarket, so it is not looking rosy for a break higher today. Support at $38 is at the lower end of the triangle, and if that breaks then $34.60 and $29.82 are the next levels targeted. $29.82 is strong support with the 200-day moving average also at this level. If that goes, there is a serious volume vacuum until $16, so bear that in mind. Breaking higher will see a test of $52.79 and then the top of the triangle at $64.96.

AMC daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637726636348970451.png&w=1536&q=95)