AMC Entertainment Holdings (AMC) forecast: AMC breaks $50 too late for big option expiry

- AMC breaks $50 one session too late as a big options expiry at $50 dropped on Friday.

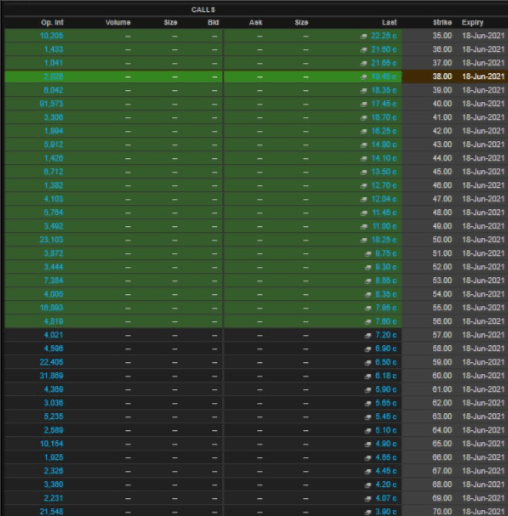

- AMC $40 call for this Friday, June 18 looks to have the biggest interest.

- Options trading driving the recent move higher.

AMC shares drove higher on Friday in a surge of activity. Last Friday saw the expiry of the $50 call and a large open interest was associated with this expiry. Friday saw a large battle, but AMC stock just failed to close above the level needed. Monday sees further examination of the options open interest and a surge in the AMC share price. At the time of writing, the $40 calls expiring this Friday have an open interest of 91,573 contracts. That is 9 million shares of AMC to be purchased on that one option contract alone. Each option contract is for 100 shares. Some serious bullish thoughts surround the $145 call strike for this Friday, which has the second-largest open interest at over 65,000 contracts. That one may not get triggered, but you never know with AMC.

In total for this Friday, the call options near the money from $40 to $70 have approximately 290,000 open contracts or 29 million shares to purchase if AMC settles above $70.

Source: Refinitiv

AMC stock forecast

Clearly, options are having a huge role to play in driving the price and especially around the large open interest and weekly expiries. At some stage, the music will stop, so just make sure to have good risk management in place. This is a given when trading options as a buyer. The maximum loss is the premium paid, making it a smart strategy for risk management.

From the chart above, we can take a closer look at the big one for this Friday – the $40 call. The volume has really only picked up over the last two to three weeks. As the AMC share price has spiked, it has drawn more options purchasers into the stock for pretty obvious and understandable reasons. The bullishness of the purchases though is what is most noticeable. The volume in the $40 call picks up between May 25 to June 3. On May 25, AMC was trading at $13, so buying a $40 call was way out of the money, and the option was trading around $0.60 cents. Now it is trading at $17.45, showing the power of options to accelerate potential profits while limiting losses, assuming you are not writing options. This is a powerful tool to have at a trader's disposal, especially when meme stocks are going parabolic.

The author is long AMC puts.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637593487587562416.png&w=1536&q=95)