- AMC and GameStop both negative on Wednesday.

- AMC and GME both at resistance levels.

- GameStop dropped post results and AMC followed.

Update: Gamestop and AMC are both running into technical resistance currently on Wednesday. Gamestop previously rallied strongly from its 50 day moving average. but now GME faces resistance at $200 and $218.93 see more.

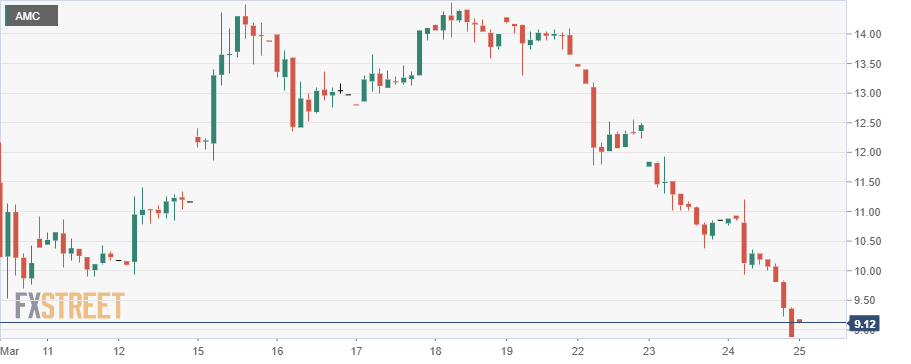

AMC is one of the few stocks in the red so far on Wednesday as shares also struggle with resistance. The 9 day moving average provides the first resistance to be tackled at $10.88 and next $10.96 is the 21 day moving average. The 9 day is close to breaking below the 21 day moving average which is a bearish signal.

.png)

Update: AMC and Gamestop to the moon is working well on Thursday. Gamestop is up 30% at $158, AMC is up 16% at $10.51. Both shares had fallen sharply this week. Gamestop reaches a critical short-term chart point at $177.75, just failing to reach it. This is the gap from the release of the results on Tuesday. A failure here is technically bearish. The close of today's candle is also very important as a close below yesterday's high keeps the bearish trend so buyers need to push harder! Fundamentally this is not a long-term investment but the short term is all about catching trends, riding them, and banking profits through clever risk management.

GameStop and AMC to the moon is the most familiar cry on r/WallStreetBets, Twitter and StockTwits for 2021. Retail traders are the new force in the stock market universe and have taken the market by storm in 2021. The initial thesis was very clever. Find stocks that are overly shorted and cause a squeeze which will then drive the share price higher. This worked spectacularly well with Gamestop, which had a huge short base of over 100%. AMC's short base was not as high at about 30% but still got brought along for the ride. AMC did manage to save itself from bankruptcy as it was able to raise cash on the back of the share price appreciation and high volume traded.

Stay up to speed with hot stocks' news!

Just in case you missed it, GameStop is a struggling brick and mortar retailer that looked destined for failure until a certain Ryan Cohen of Chewy fame took a stake. Ryan Cohen has transformed Chewy from also being a struggling legacy retailer into an e-commerce titan in the pet food sector. The hope was he could do the same for GameStop.

AMC is a cinema operator, so it was in serious trouble during the pandemic as income dried up. AMC is global and so was the pandmic, so no area could provide any income diversification for AMC during the worst of the crisis.

The problem now from an investment thesis is the original plan has changed. The short squeeze is over. Shorts have for the most part covered. The share prices of Gamestop and AMC rocketed. Both are still high historically, but both are also coming down fast.

Shareholders are unlikely to see much dividend reward, from either, any time soon!

AMC and GME price forecast

AMC has reopened theatres and this has emboldened retail investors to have another go. However, headwinds abound here. AMC has a huge pile of debt. Servicing that debt is going to get very difficult. Even if theatres sell out and sales jump, the debt pile is still going to suck up all that cash. AMC has debt due that it is not even paying interest on but rolling over to pay all at once. Companies can do this when yields are low and demand for debt is high. Yields are now rising, however, so rolling over debt will only add to costs.

Added to this, the pandemic has caused a generational, seismic shift in the way movies are being released going forward. The rise of streaming continues, and movie studios either have deals with streaming platforms or have their own such as Disney. Movies are being released on streaming platforms at the same time or with a short delay from cinema release dates. Disney announced this week that predicted blockbusters Cruella and Black Widow will be released on Disney+ the same day as they are released in theatres.

AMC may stumble along refinancing debt for some time and struggling with the threat of bankruptcuy. It is in a tough financial position. As a user of their products, I hope they can do it. But as an investor, I would keep away. The only investment that would be of interest to me is some high-yielding debt if they have to issue some. The shares are not for me.

Cineworld confirmed the problems for the industry when it released earnings today. Similar problems include debt piling up and revenue falling. See Cineworld (CINE) news.

GameStop is now another problem child. Ryan Cohen needs money to realize his e-commerce transformation. To do this, GameStop hinted at a share sale in an SEC filing on Tuesday. This would indeed raise money but dilute shareholders. The valuation is also crazy high for GameStop. The GameStop P/E ratio is 134, but its Refinitiv forward P/E is 1834!

It aims to transform to digital and compete with BestBuy, Target and Walmart, who have P/Es around the 20-30 level. Even Amazon only has a P/E of 75. Nintendo and Sony, which it will compete with for online sales, have P/Es of 17 and 13, respectively. The entire US gaming market is valued at $41.3 billion, according to Newzoo. GameStop's market cap is nearly a third of this at $13 billion.

GameStop released results for Q4 on Tuesday that were disappointing. No guidance was given and GME hinted at a capital raise. The share price has suffered since.

GameStop has all the signs of a bubble. Short-term players can make money in bubbles but must be very careful. It is not a long-term investment for me. Even if Ryan Cohen meets the best-case scenario, the valuation has gone too far.

GME stock quote

GameStop (GME) shares are trading at $122 in Thursday's pre-market session, a gain of 1.4%. GME shares have dropped from a high of $201 just before Tuesday's earnings release.

AMC stock quote

AMC shares are trading at $9.15 for a gain of 1% in Thursday's pre-market. Shares have dropped from $14.54 in the last six trading days.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637522718526596618.png)