Amazon's (AMZN Stock) poor earnings and its stock

Amazon's numbers

The earnings per share came in at 28 cents, the revenue produced by the company was 127.10 billion vs 127.46 billion. The web services revenue was 20.5 billion against the expectations of 21.11 billion and advertising revenue was 9.55 billion versus the expectations of 9.48 billion.

According to Amazon, it anticipates fourth-quarter revenue to be between $140 billion and $148 billion, up 2% to 8% from the same period last year. Analysts were anticipating sales to total $155.15 billion.

Although sales growth was back in the double digits in the third quarter with a 15% increase in revenue, Wall Street's expectations were not met.

Amazon has had a difficult year thus far, much like the rest of Big Tech, as it deals with macroeconomic challenges, skyrocketing inflation, and rising interest rates. These difficulties came at the same time as a downturn in Amazon's main retail business as customers started going back to physical stores to shop.

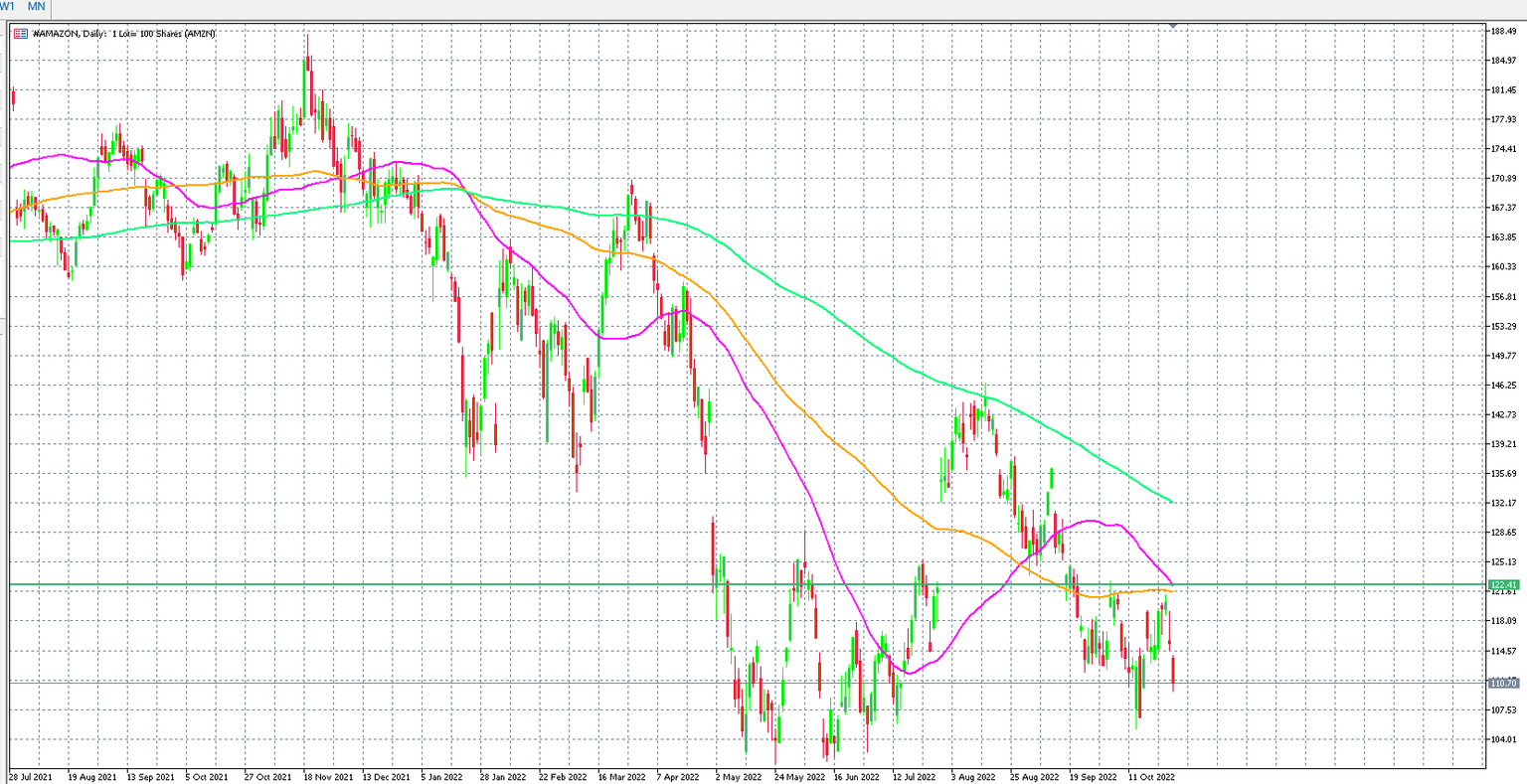

In terms of technical analysis, the stock is trading under the downward trend line and this means that bears are in control of the price. The 50-day SMA is about to drop below the 100-day SMA which is another sign that bears will pick up more steam and there could be more sell off in the store.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.