Amazon Stock Price and News: Amazon (AMZN) eyes steep drop on Q3 earnings miss

- Amazon reports earnings miss after the close on Thursday.

- AMZN stock has been struggling for momentum.

- Can earnings provide the catalyst to push the share price of Amazon higher?

Update October 29: Amazon (AMZN) snapped gains and tumbled 4.05% in post-market trading after the company reported Q3 earnings after the closing bell on Thursday. The online retail giant reported sales and earnings results, which fell short of the Wall Street estimates, with Earnings Per Share (EPS) arriving at $6.12 vs. $8.96 expected and Revenue coming in at $110.8 billion vs. $111.81 billion expected. The company also projected additional costs as a result of supply chain challenges in the fourth quarter. Therefore, AMZN shares are likely to witness deep losses in Friday’s trading.

Amazon (AMZN) shares have been a bit lackluster of late sitting out the rally to all-time highs from many tech peers and the broader S&P 500. The stock is some 10% away from its all-time high, so a strong earnings report after the close tonight could help provide the stock with a much needed boost. It was really the last earnings report in July that has been the cause of this lack of momentum. On that occasion AMZN beat on earnings per share (EPS) but missed on revenue. This was in stark contrast to the strong beats posted by the majority of big tech names and the overall market. The bar is set similarly high this quarter. So far nearly 84% of S&P 500 companies have beaten earnings estimates.

Amazon (AMZN) stock news

| Market Cap | $1.7 trillion |

| Enterprise Value | $1.8 trillion |

| Price/Earnings (P/E) | 59 |

|

Price/Book | 18 |

| Price/Sales | 4 |

| Gross Margin | 41% |

| Net Margin | 6% |

| EBITDA | $58 billion |

| 52 week low | $2881.0001 |

| 52 week high | $3773.0782 |

| Average Wall Street rating and price target |

Buy $4169.50 |

Amazon (AMZN) releases earnings after the close on Thursday. Earnings per share (EPS) is expected to come in at $8.90 with revenue expected to hit $111.5 billion.

Amazon (AMZN) stock forecast

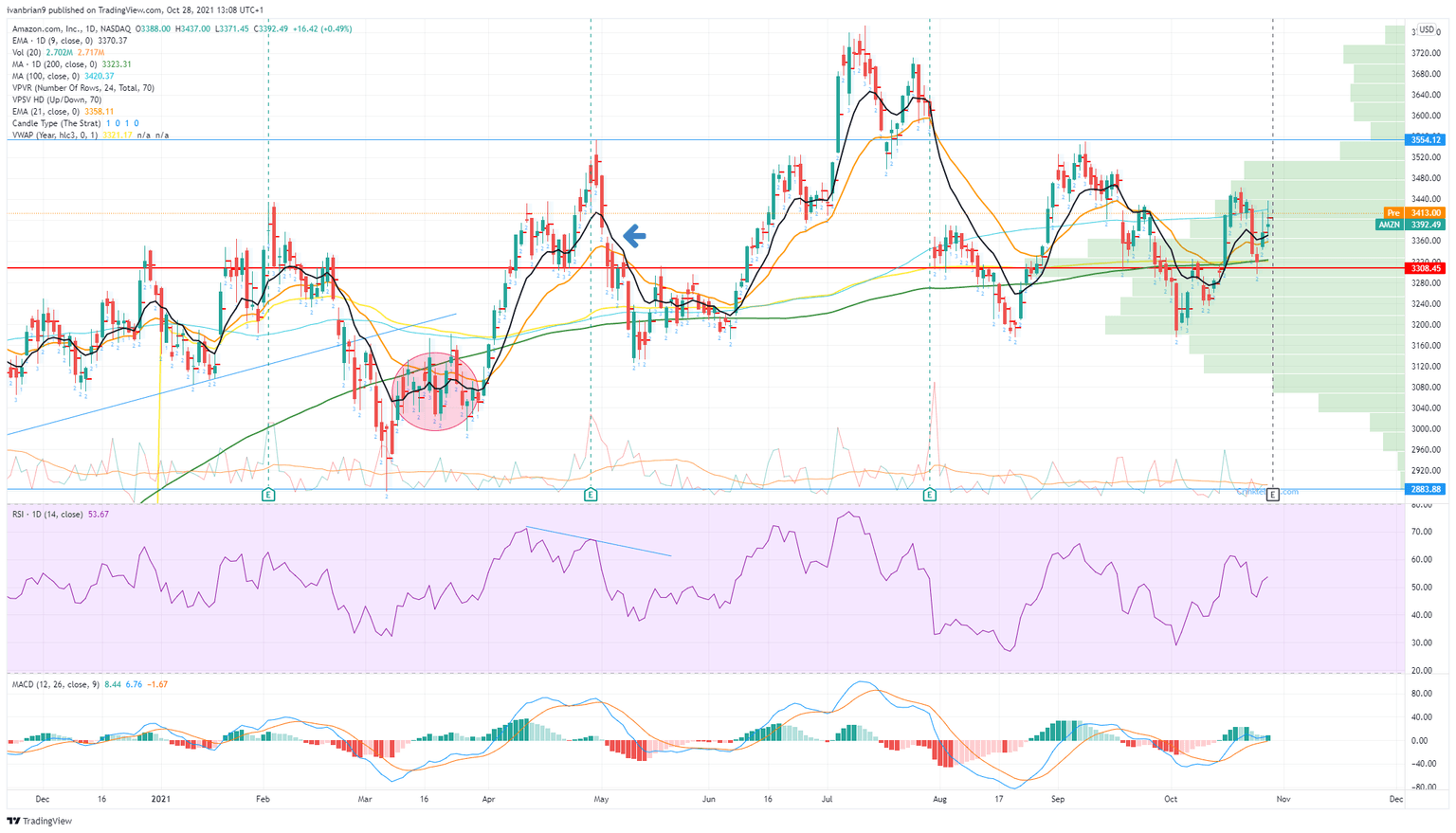

Earnings will really dictate things going forward, but watch out for some key levels. $3,554 is the high from September 2020 and was tested again in April and again in September of this year. That is the first resistance should Amazon (AMZN) stock start to really roar ahead. Once that level is cleared, there should not be too much in the way of a fresh all-time high. So far, $3,190 has held and formed a perfect double bottom. Any sell-off should stall here and is a potential buying point in our view.

Ahead of earnings, Amazon has not run too much unlike some other big tech names, so the potential is there for a strong earnings report to give the stock a decent pop. Amazon has recaptured the key moving averages and is now above the 9, 21 and 200-day moving averages. Only the 100-day at $3,420 remains. We will update immediatley on the results release, so stay tuned for more information later today.

AMZN 1-day chart

Update: Amazon (AMZN) reported earnings after the close on Thursday. Earnings Per Share (EPS) missed estimates, coming in at $6.12 versus $8.92. Revenue also missed estimates, coming in at $110.8 billion versus the $111.6 billion estimate.

Update: Amazon (AMZN) added 1.59% on Thursday, to settle at $3446.57 per share. Market participants are eagerly waiting for Q3 results data. Meanwhile, worse than anticipated US Q3 GDP underpinned equities. The S&P 500 and the Nasdaq Composite closed at record highs, while the DJIA added 239 points or 0.67%.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.