Amazon Stock Price and News: Why are AMZN shares up?

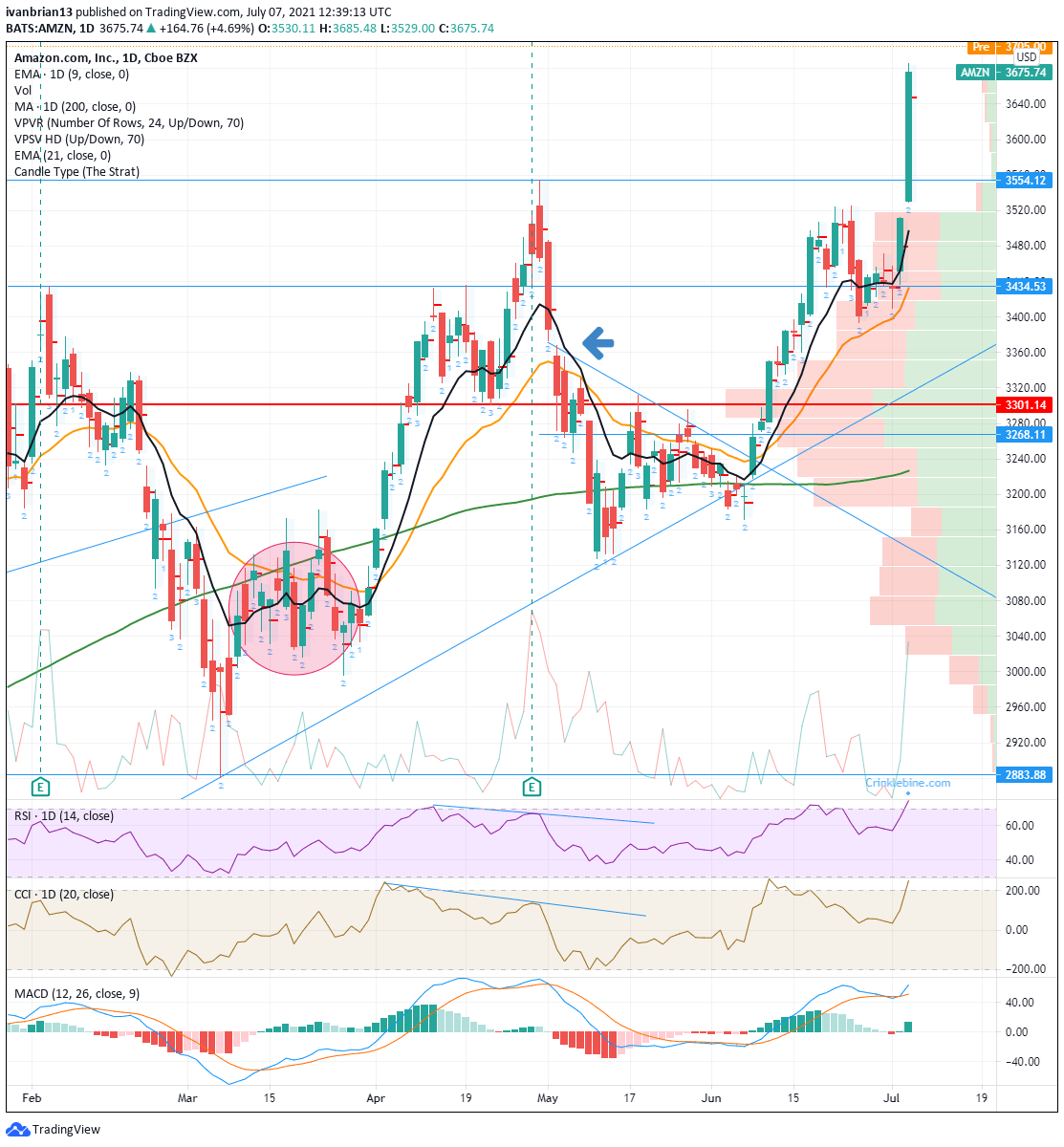

- Amazon shares power to an all-time high on Tuesday.

- Jeff Bezos steps down as CEO and heads for space.

- AMZN gets a new CEO in Andy Jassy, former head of Amazon Web Services.

Amazon (AMZN) shares powered to new all-time highs on Tuesday despite CEO and founder Jeff Bezos formally stepping down and handing the reins over to Andy Jassy. Jezz Bezos is reportedly to focus his attention on his upcoming space flight aboard his Blue Origin venture, as well as the Washington Post. Mr. Bezos is due to head for space in late July. Despite the departure of its long-time leader, AMZN stock powered higher on Tuesday, closing up nearly 5% at $3,675.74.

Amazon statistics

| Market Cap | $1.85 trillion |

| Enterprise Value | $1.61 trillion |

| Price/Earnings (P/E) | 67 |

|

Price/Book | 19 |

| Price/Sales | 4.6 |

| Gross Margin | 0.4 |

| Net Margin | 0.06 |

| EBITDA | $55 billion |

| Average Wall Street rating and price target | Buy $4,241.33 |

Why Amazon (AMZN) stock rallied

The reason is the JEDI. Not the Star Wars kind, and, no, Jeff Bezos has not found them in a distant galaxy on his space venture. The JEDI contract was or is a $10 billion cloud computing contract awarded to Microsoft (MSFT). Amazon had hoped to win the deal and had challenged the awarding of the deal to Microsoft in US courts. The Department of Defense has now scrapped the awarding of the JEDI contract to Microsoft and says it will rebid for the contract. This was a boost to Amazon (AMZN) as it now has the possibility of winning a previously lost, $10 billion contract. AMZN shares powered to all-time highs. Microsoft shares by comparison took the news badly and fell marginally.

The US Defense Department says Microsoft and Amazon are the only cloud providers "capable of meeting the department's requirements." The new contract is expected to be awarded by April 2022, according to a Defense Department official. An official also said the Pentagon will "extend solicitations to other vendors if it determines they meet requirements."

In Wednesday's premarket, Amazon shares are up 0.7% at $3,703.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.