- Amazon Web services (AWS) does a deal with Palantir (PLTR).

- Amazon and Palantir to offer Palantir's platform to all AWS customers.

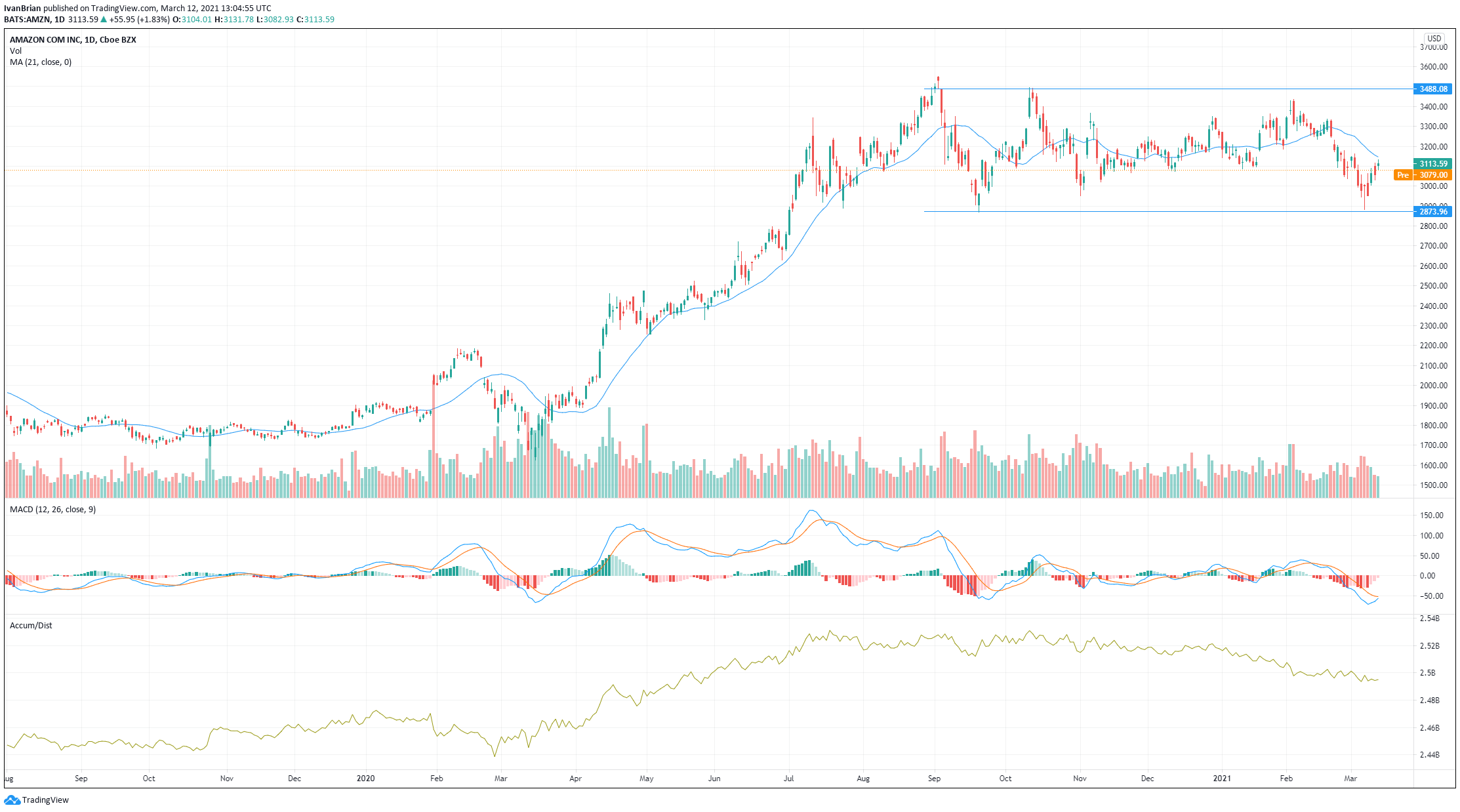

- Amazon's share price fell 14% in the recent tech sell-off.

Amazon shares have weathered the recent tech sell-off better than most big tech companies as investor concerns over rising inflation and lofty tech valuations hit the sector hard. The tech sector had seen strong appreciation in 2020 and profit-taking was evident as was a shift into consumer cyclical and discretionary names, as investors bet on the reopening of the US and global economies.

Stay up to speed with hot stocks' news!

Amazon was one of the biggest beneficiaries of the global pandemic as brick and mortar retail was shuttered for most of 2020, leaving Amazon as the last man standing in the retail space. AMZN was growing strongly for the last number of years but the pandemic merely sped up the increasing move to online shopping.

Amazon's revenue growth has been impressive.

| 2016 | 2017 | 2018 | 2019 | 2020 |

| $136 billion | $178 billion | $233 billion | $281 billion | $386 billion |

Quarter on Quarter growth has been even more impressive with the pandemic effect clearly feeding through. December 2019 revenue was $87 billion versus $126 billion in Dec 2020, a gain of nearly 50% from an already high level.

Q4 2020 results blew Wall Street analyst estimates out of the water. Earnings Per Share (EPS) was forecast to be $7.23 but nearly doubled to $14.09. The average analysts price target for Amazon is now $3999 a premium of 29% above Amazon's current share price.

Forward guidance from amazon is for revenue growth of between 33-40% in 2021, so still continuing the strong gains seen in 2020.

Palantir Amazon contract

Amazon has been driving most of its revenue from its online store, and this segment still accounts for over 50% of its revenue. But its cloud business has been growing steadily in a highly competitive market. Amazon Web Services (AWS) now accounts for 12% of revenue, a 33% increase over the last five years.

Amazon and Palantir (PLTR) announced a partnership on Friday, March 5. Amazon Web Services (AWS) will make Palantirs Enterprise Resource Planning (ERP) system available to all AWS customers.

Palantir's ERP system will be able to run on AWS and enables customers to better utilize data analysis to increase cost savings, working capital, revenue, etc.

The ERP Suite “uses a Palantir Foundry data connector developed for ERP applications to improve data discovery, accelerate the time-to-value of ERP data, democratize workflow creation and drive faster business outcomes,” ERP “has already been adopted by a number of enterprises, including BP and Lanxess, to enable significant cost savings within weeks", “Within two weeks of installing the ERP Suite, BP was able to unlock approximately $50 million in working capital and has the potential to unlock further savings if applied across their worldwide supply chain,” Palantir stated in a blog post.

Amazon Stock News

Amazon is also diversifying into other areas such as brick and mortar grocery. In a move that may seem to go against its online origins, Amazon has been opening Amazon Fresh grocery stores across America, with plans for Europe as well. The move is seen as taking advantage of traditional rivals' struggles, as well as further boosting its Amazon Prime offering. Amazon Fresh is testing a "Just Walk Out" cash and cashier-less technology with all purchases presumably integrated with the shoppers' Amazon Prime account.

Amazon announced during its Q4 earnings that its FIRE TV service now has over 50 million customers.

AMZN Stock Forecast

Looking at the long-term growth rate of Amazon, the guidance for 33-40% revenue growth this year should give investors confidence that the stellar growth is not showing any signs of maturing just yet. Amazon has a cash pile of $84 billion and can easily pivot into other areas it may see as profitable such as AWS or its Fresh food offering.

Longer-term on the chart, the strong appreciation seems to have steadied of late and a sideways pattern, consolidation is in evidence, will eventually be broken. Amazon had a brief flirtation with the low of the range on March 5 but was quickly rebuffed, a bullish sign. MACD is looking like it may flag a bullish crossover and Amazon has recently broken through short-term 8 day Moving Average. The 21 day Moving Average is just holding Amazon stock for now, but a break above increases bullish sentiment and likely ends the recent series of lower highs.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.