Alphabet Inc. (GOOGL) Stocks Elliott Wave technical analysis [Video]

![Alphabet Inc. (GOOGL) Stocks Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Economic-Indicator_Recession-5_XtraLarge.png)

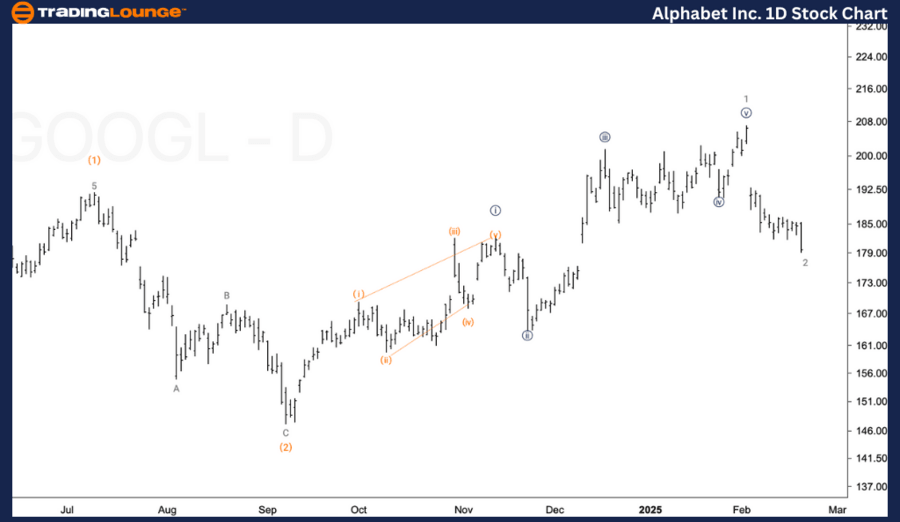

GOOGL Elliott Wave Analysis – Trading Lounge Daily Chart.

Alphabet Inc. (GOOGL) – Daily Chart.

GOOGL Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Minor Wave 1.

-

Direction: Bottom in Wave 2.

Details:

-

A sharp pullback is expected in Minor Wave 2 after a top in wave 1 of (3).

-

Possibility that wave (1) may need to be repositioned, potentially signaling a larger correction.

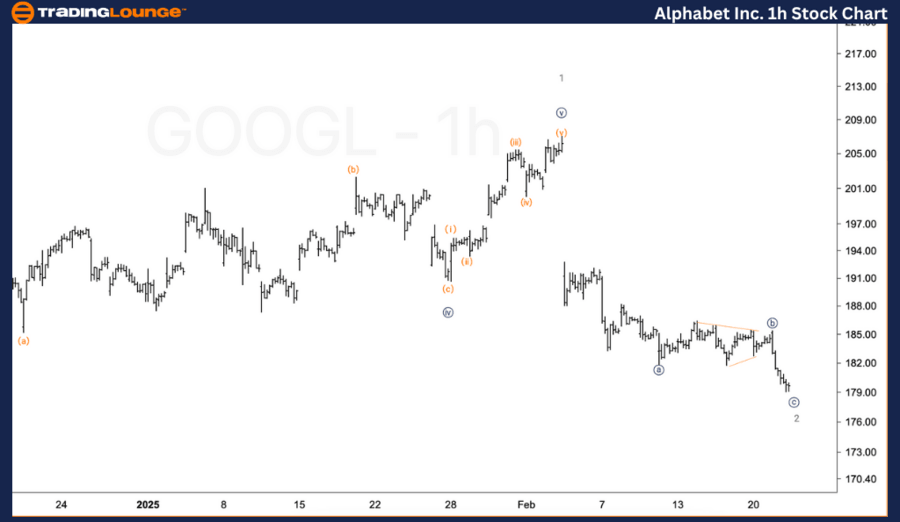

GOOGL Elliott Wave Analysis – Trading Lounge 1H Chart.

Alphabet Inc. (GOOGL) – 1H Chart.

GOOGL Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave {c} of 2.

-

Direction: Bottom in Wave 2.

Details:

-

Looking for a potential bottom in wave 2, either already in place or forming soon.

-

A three-wave move in wave 2 is visible, suggesting the end of the current corrective phase.

GOOGL Elliott Wave technical analysis – Summary

Daily chart

-

GOOGL is in an impulsive trend within a motive structure, currently observing a correction in Minor Wave 2.

-

After reaching a top in wave 1 of (3), the stock is undergoing a sharp pullback, possibly indicating the beginning of a larger corrective phase.

-

Wave 2 pullback should ideally set the stage for the next upside movement once completed.

1H chart

-

GOOGL is nearing the completion of wave {c} of 2, marking the end of the current corrective phase.

-

A three-wave structure is forming in wave 2, suggesting a potential bottom is either already in place or developing soon.

-

This could signal the start of a new impulsive wave in the next upward trend.

Technical analyst: Alessio barretta.

GOOGL Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.