Alphabet Inc., (GOOGL) Elliott Wave technical analysis [Video]

![Alphabet Inc., (GOOGL) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/stock-market-data-18635784_XtraLarge.jpg)

GOOGL Elliott Wave technical analysis

Function: Trend

Mode: Impulse

Structure: Motive

Position: Intermediate (3).

Direction: Upside in wave 3 of (3).

Details: This is quite the bullish scenario for Alphabet, as it would project us into a third of a third. Alternatively we could expect a wave (4) in place where wave (2) stands and now upside within wave (5).

GOOGL Elliott Wave technical analysis – Daily chart

Our analysis indicates a trending function characterized by impulse mode and motive structure, positioned in Intermediate (3). The direction suggests upside movement in wave 3 of (3). This scenario is notably bullish for Alphabet, potentially projecting us into a third of a third. Alternatively, we could anticipate wave (4) formation, considering the possibility that wave (2) has concluded, leading to upside within wave (5).

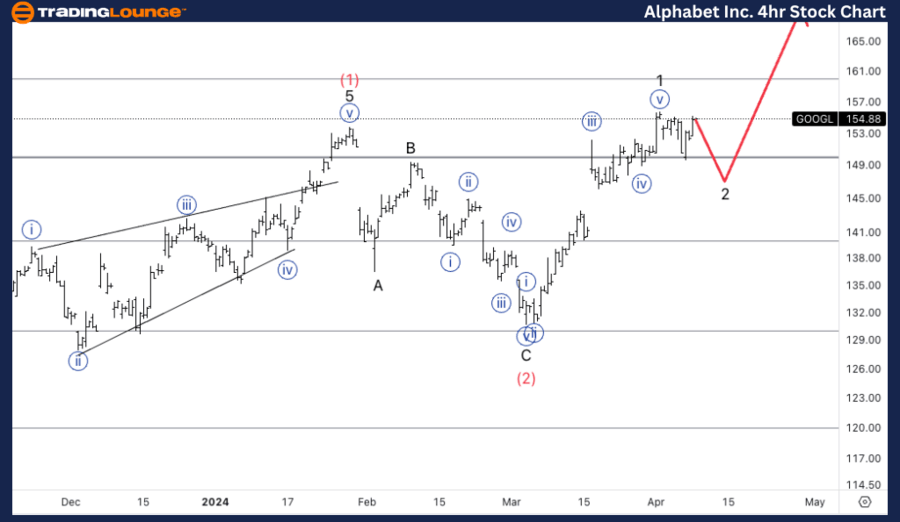

GOOGL Elliott Wave technical analysis – Four-hour chart

Here, we identify a trending function marked by impulse mode and motive structure, positioned in Wave {b} of 2. The direction indicates downside movement in wave {c} of 2. We are observing the possibility of another leg lower into wave {c} of 2, although there is also the potential for upward movement from our current position. Notably, we are finding support atop Medium Level $150, suggesting the likelihood of further upside.

Function: Trend

Mode: Impulse

Structure: Motive

Position: Wave {b} of 2.

Direction: Downside in wave {c} of 2.

Details: Looking for either another leg lower into wave {c} of 2 or else we could move higher from where we are. We seem to be finding support on top of Medium Level 150$ therefore we could see further upside.

Alphabet Inc., (GOOGL) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.