- BABA shares have fallen sharply on fears over delisting.

- Alibaba stock is now down at 5-year lows.

- $100 is the next major support as $110 is held for now.

Alibaba (BABA) continues to suffer from repeated selling pressure as the original Chinese tech stock suffers backlash effects. Alibaba can be said to have set off the whole Chinese regulatory crackdown. Alibaba was due to spin off its payment subsidiary ANT Group about 14 months ago. The deal fell through, however, after Alibaba CEO Jack Ma appeared to question the Chinese hierarchy. This was the catalyst for a reexamination by China of its burgeoning tech space.

Most notably, intense regulatory scrutiny focused on the huge amounts of data generated and stored by Chinese tech names. China saw this as a matter of concern over national security. DIDI was next in the crosshairs. It had IPO'd successfully in New York in early 2021. The stock had listed in New York in apparent defiance of Chinese officials. Once China set its sights on DIDI, panic soon ensued among Chinese tech investors, and BABA and others suffered contagion effects. The trend has been powerful with momentum completely vanishing. BABA shares are down 25% in the last three months, taking total losses for 2021 to 48%.

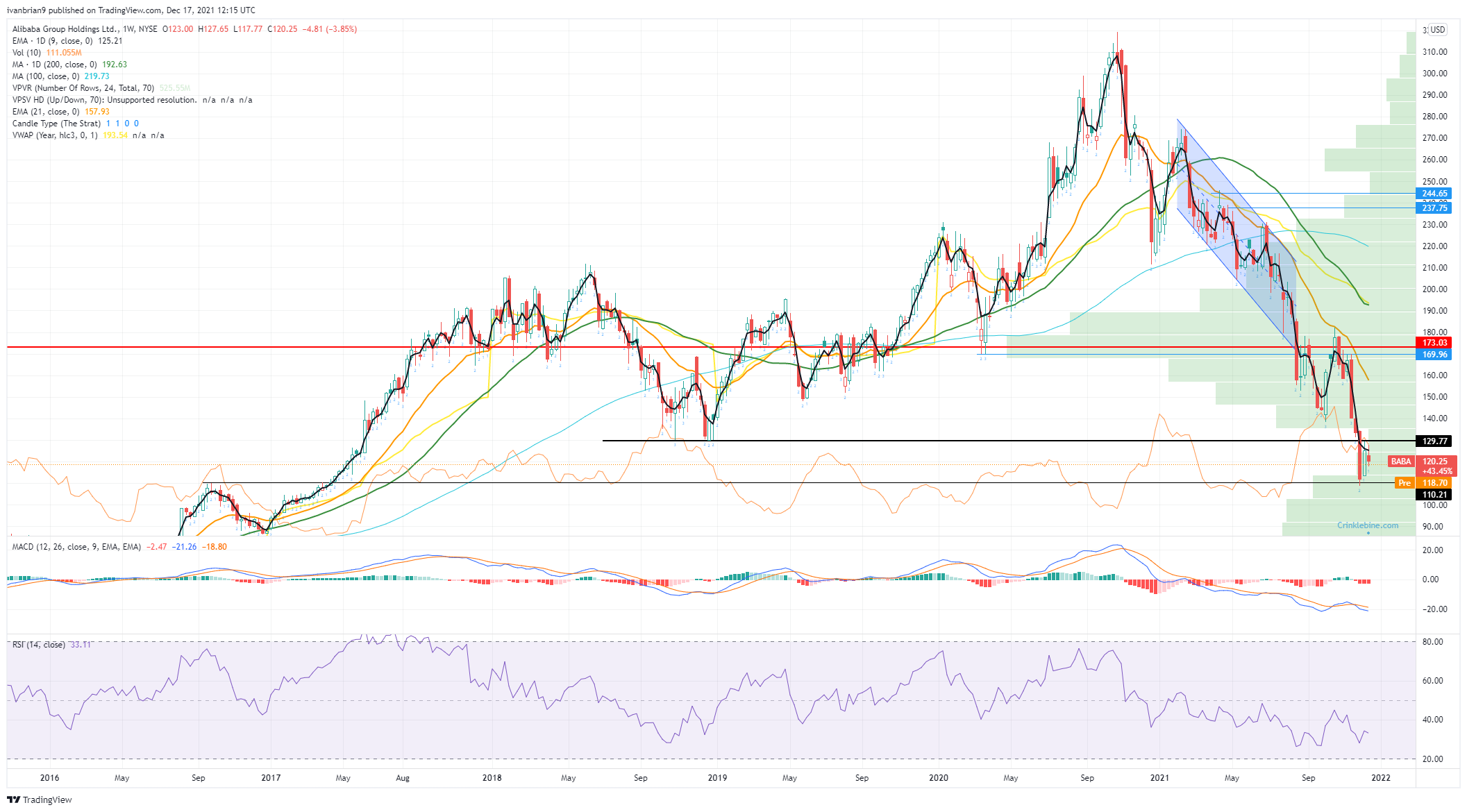

Alibaba (BABA) chart, daily

Alibaba (BABA) stock news

Alibaba was once known as the Chinese Amazon, and for good reason. The company is still highly profitable. Revenues have grown from $158 billion in 2017 to $717 billion in 2021. This represents a growth rate of nearly 50% from 2020. Despite this, the share price is down a similar amount as mentioned. Gross profit grew 30% to March 2021. Revenue continued to grow as the Chinese tech bubble burst. Revenue is forecast to remain strong, growing by 22% in 2022 and 17% for 2023 and 2024. Revenue will, if those targets are met, have grown to $1.2 trillion by 2024. This represents a near doubling from current levels.

Alibaba was hit with a heavy fine by the Chinese authorities after the ANT Group debacle. Investors had hoped the matter was finally settled, but the power of investor fear resurfaced once China restarted its scrutiny of US-listed names, this time with DIDI being the poster child. This fear is likely to remain elevated as Chinese and US tensions are unlikely to subside anytime soon. China is also not likely done with its crackdown and delisting plans for some of its tech names.

This presents opportunities and challenges. BABA may be overvalued fundamentally with strong revenue growth, but momentum and fear are powerful factors. More important is uncertainty. Markets hate uncertainty, and that is currently the main headwind for Alibaba and other Chinese tech names.

Alibaba (BABA) stock forecast

Breaking support at $130 has led to an obvious fascination with $100. Before that, there is a last chance saloon support at $110. This is the September 2016 high.

The daily chart has registered an oversold Relative Strength Index (RSI) reading. The Moving Average Convergence Divergence (MACD) has also crossed into bullish territory. A close above the 9-day moving average is needed to get short-term traders interested. Long-term players will need to see a move above $170. The short-term trend is bearish until the 9-day moving average is broken. The stock remains bullish in the short term on a break of $130 in our view. This is high risk, so please use stops.

BABA 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold sits at fresh record high above $3,300 as US Dollar wilts on trade woes

Gold price remains within a striking distance of new record highs above $3,300 on Wednesday. Persistent worries about the escalating US-China trade war and US recession fears revive brroad US Dollar downtrend, boosting the traditional safe-haven Gold ahead of Fed Powell's speech.

EUR/USD holds firm above 1.1350 amid renewed US Dollar weakness

EUR/USD is storngly bid above 1.1350 in European trading on Wednesday. The pair draws support from a fresh round of selling in the US Dollar amid persistent fears over US-China trade war and a lack of progress on EU-US trade talks. US consumer data and Powell speech are in focus.

GBP/USD hangs close to fresh 2025-high above 1.3250 after UK CPI data

GBP/USD holds its six-day winning streak and stays close to its highest level since October above 1.3250 in the European session on Wednesday. The data from the UK showed that the annual CPI inflation softened to 2.6% in March from 2.8% in February but had little impact on Pound Sterling.

BoC set to leave interest rate unchanged amid rising inflation and US trade war

All the attention is expected to be on the Bank of Canada this Wednesday as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637753388861440359.png)