Alibaba Stock Price and Forecast: Why is BABA stock surging?

- BABA is set to surge on Monday. Is risk back on?

- Chinese tech stocks look undervalued after serious falls in September.

- China tech names still face increased regulatory scrutiny from Chinese authorities.

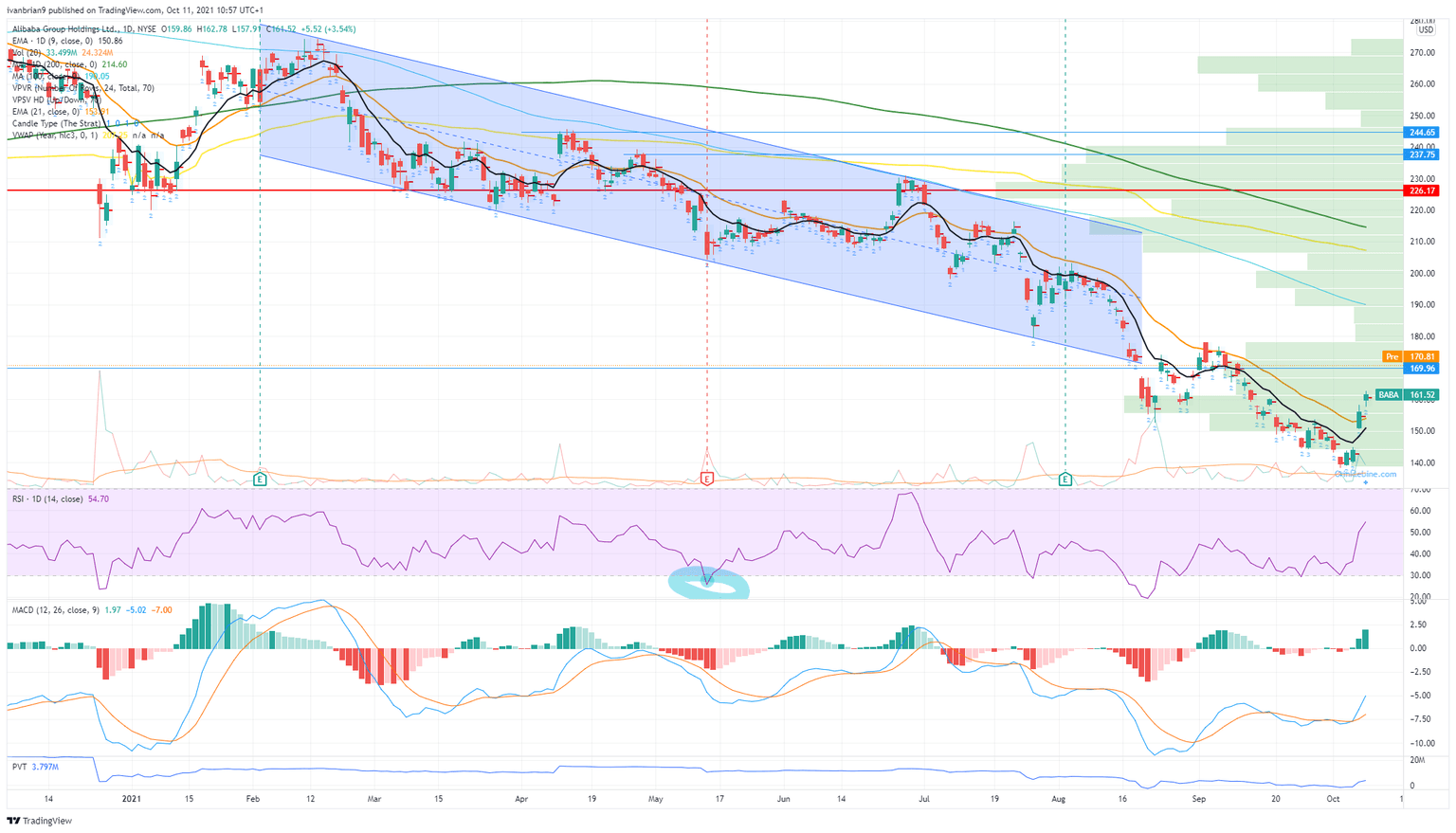

Alibaba (BABA) stock has surged recently and that looks set to continue on Monday if movements in Hong Kong overnight are anything to go by. We had issued our buy-the-dip recommendation on October 5 at $134, but unfortunately the stock appears to have bottomed out at $139, so we have missed the boat. Risk aversion was the theme for much of September, and this followed through into October. Some bargain hunting appeared to be back on the cards with some more retail risk on trading pushing a strong rally in Chinese tech names last week. This helped BABA stock in particular surge from below $140 to over $160 on Friday.

Alibaba (BABA) 15-minute chart

What we always look to see in a trend is who is in charge of that trend. Large candles show who is in charge, and the small body candles are indicative of a lack of power. Clearly above, the green candles have large bodies showing bulls are definitely in charge of this recent move. The red candles are smaller with short bodies. The bears have no power here.

Alibaba (BABA) stock news

Friday's rally was even more impressive (BABA stock closed up over 3%) as Goldman Sachs had cut its price target for the stock on Friday. Goldman cut its price target from $303 to $253. Monday has seen fellow Chinese tech stock Meituan surge in Hong Kong as the Chinese regulator fined the company less than analysts had feared. This has led to a relief rally for many Chinese tech names in Hong Kong. As we have repeatedly said, markets hate uncertainty more than bad news. This removed uncertainty from Meituan.

Separately, it also came to light that Charlie Munger, he of Berkshire Hathaway fame, has increased his investment in Alibaba (BABA) stock in the last quarter via his Daily Journal Corp. Daily Journal Corp increased its holding by over 83% in Q3 2021 by purchasing an additional 136,740 shares.

Alibaba (BABA) stock forecast

We have to turn bullish on BABA following the move on Friday. Baba stock is now trading above the 9 and 21-day short-term moving averages. The Relative Strength Index (RSI) is above 50, and the Moving Average Convergence Divergence (MACD) has crossed and is giving a bullish signal. Volume has also increased during the move higher. Breaking $170 will really add to the move and attract more traders to chase BABA higher, possibly some longer-term investors also.

FXStreet View: Bullish but would like to see $170 broken this week to confirm.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637695422394922025.png&w=1536&q=95)