You must have caught the frenzy that surrounds AI firms if you are an investor or if you feel like investing soon. The shares of those companies are on the rise. The AI market size is expected to show an annual growth rate of 28.46% and reach $826.70bn in 2030, so this is not a short-lasting trend.

However, where exactly are you supposed to start when it comes to investing in such a field? What kind of knowledge and skills should you possess in order to make money through AI stocks? Follow along as we explore these and other related issues in this article.

Before you start

First of all, there are several ways to earn money through AI stocks. You can either trade or invest in them. If you have no experience in these activities whatsoever, consider learning the basics of investment first. We recommend you try out this trading course for free — it was created by Andre Witzel, an experienced trader who knows all the peculiarities of financial markets.

If you already have some knowledge about the markets, there are a few things you should know about investing in AI:

- The artificial intelligence sector is not only about robotics. AI is much broader — it includes voice assistants and data analysis tools, among others. Do not confine your mind to just robots.

- It is quite unstable. Similarly to any other sector in technology, there can be enormous volatility in the AI market. Buckle up for a rough journey.

- There are many players in this field and everyone wants some share from it; thus there are numerous alternatives but also many firms that may fail.

Having understood this, we will now discuss ways to invest in this area.

Step 1: Educate yourself

Before you invest, you need to do your homework. Here's a quick to-do list:

- Read AI news daily. Follow websites or even social media pages that focus on tech news.

- Learn the industry’s lingo. Understand terms like machine learning, neural networks, and natural language processing.

- Study successful AI companies. Look at their business models, products, and growth strategies.

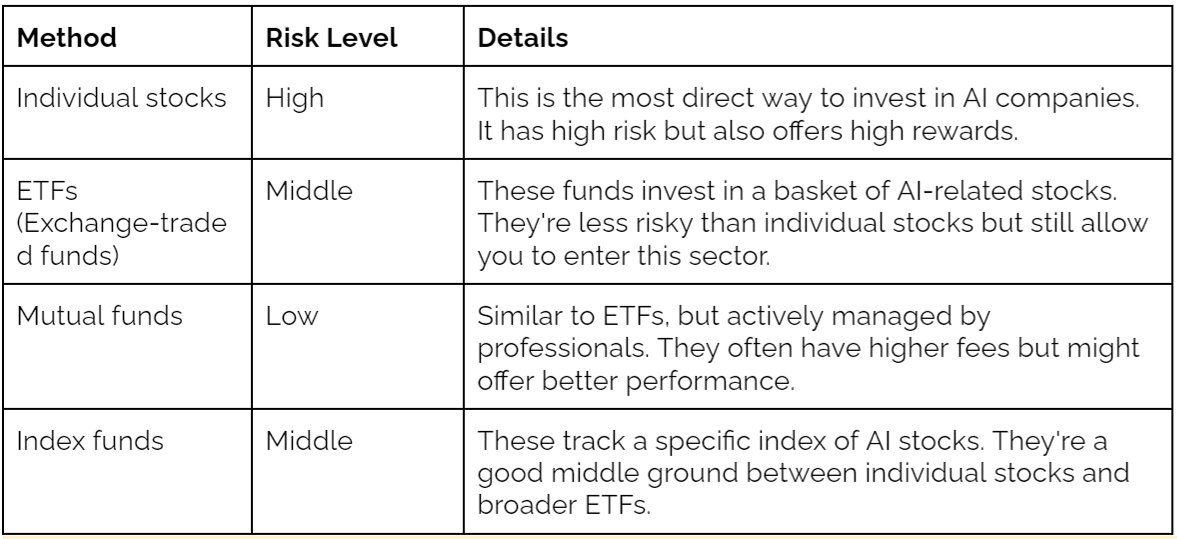

Step 2: Choose your investment method

There are several methods of investing in artificial intelligence. Choose the one that suits your risk tolerance and style:

Step 3: Pick your stocks or funds

If you want to buy individual stocks, you can pick from both big tech and small, new companies. These top AI players have shown consistently high performance:

- NVIDIA (NVDA): They have taken the lead in the artificial intelligence chip, GPU, and software development.

- Microsoft (MSFT): The partnership with OpenAI, the creator of ChatGPT, has brought Microsoft to the forefront of this field.

- Amazon (AMZN): Amazon provides machine learning and AI services to businesses and employs artificial intelligence in Alexa.

- Taiwan Semiconductor Manufacturing (TSM): Since AI increases the demand for powerful processors, investing in such an established chipmaker may be less risky than other investments. A less flashy but crucial player.

For ETFs, check out options like:

- iShares Exponential Technologies ETF (XT)

- Defiance Machine Learning & Quantum Computing ETF (QTUM)

- ROBO Global Robotics & Automation Index ETF (ROBO)

Step 4: Determine your investment amount

You wouldn’t want to risk your entire portfolio when investing in this new market. Here are the main rules for choosing the right amount to invest:

- No more than 5-10% of your capital should be invested in one sector (which includes AI).

- No more than 5% should be put into one stock within the chosen sector.

Step 5: Monitor and adjust

How fantastic would it be to just invest and move on? Not with AI stocks — you’ll have to stay involved.

- Set up news alerts for your stocks or funds.

- Review your investments quarterly. Are they performing as expected?

- Be prepared to sell if a company's fundamentals change or if your investment thesis no longer holds.

Lastly, there is no guarantee in the stock market. Research and try out different risk management strategies and follow the news carefully to secure your finances.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

BinaryOptions.com will not be held liable for the loss of money or any damage caused from relying on the information on this site. The information and strategies contained on this website are the opinions of the author only. Binary options trading involves high risk and is not suitable for all investors

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.