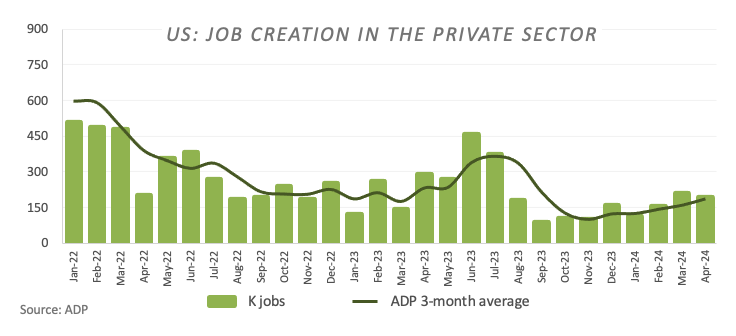

In April, according to data released by Automatic Data Processing (ADP) on Wednesday, private sector employment in the US increased by 192K jobs. Market consensus, in the meantime, was expecting a gain of 175K jobs for that period. Furthermore, the reading came in below March's increase of 208K jobs (revised from 184K).

According to ADP's Chief Economist Nela Richardson: "Hiring was broad-based in April. Only the information sector — telecommunications, media, and information technology — showed weakness, posting job losses and the smallest pace of pay gains since August 2021."

Furthermore from ADP's press release: "Year-over-year pay gains for job-stayers were little changed in April at 5 percent. Pay growth for jobchangers fell from 10.1 percent in March to 9.3 percent, but remains higher than it was at the beginning of the year."

Market reaction to ADP Employment Report

The US Dollar (USD) Index trades slightly on the defensive, albeit it keeps the upper end of the monthly range above the 106.00 hurdle, as cautiousness prevails among market participants ahead of the FOMC event due later in the session and the Nonfarm Payrolls expected on Friday.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.29% | 0.20% | 0.80% | 0.86% | -0.22% | 0.86% | 0.67% | |

| EUR | -0.30% | -0.10% | 0.50% | 0.55% | -0.51% | 0.56% | 0.37% | |

| GBP | -0.19% | 0.10% | 0.59% | 0.66% | -0.41% | 0.66% | 0.48% | |

| CAD | -0.79% | -0.50% | -0.58% | 0.07% | -0.99% | 0.08% | -0.12% | |

| AUD | -0.87% | -0.57% | -0.66% | -0.05% | -1.07% | 0.00% | -0.19% | |

| JPY | 0.22% | 0.50% | 0.40% | 1.01% | 1.04% | 1.06% | 0.88% | |

| NZD | -0.87% | -0.58% | -0.68% | -0.07% | -0.01% | -1.09% | -0.20% | |

| CHF | -0.67% | -0.37% | -0.48% | 0.13% | 0.19% | -0.89% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed May 01, 2024 12:15

Frequency: Monthly

Actual: 192K

Consensus: 175K

Previous: 184K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

This section below was published as a preview of the ADP Employment Report at 07:30 GMT.

- The ADP report is expected to show the US private sector added 179K jobs in April.

- A tight labour market and sticky inflation support the Fed’s tight stance.

- The US Dollar seems to have entered a consolidative phase.

On Wednesday, the United States (US) Automatic Data Processing (ADP) Research Institute is set to unveil private employment data for April. This survey offers insights into job creation within the private sector and typically precedes the official jobs report by the Bureau of Labor Statistics (BLS), which includes Nonfarm Payrolls (NFP) data and is due on May 3.

Market analysts anticipate the ADP survey to reveal the addition of 179K new positions during the last month, slightly below the 184K jobs reported in March. However, it's important to note that previous figures are subject to revisions, and while a robust ADP survey may hint at a similar trend in the NFP report, the correlation between the two reports has been inconsistent.

Nevertheless, the significance of the ADP survey is heightened by the US releasing various employment-related data in the days leading up to the Nonfarm Payrolls release. Collectively, these insights assist market participants in deciphering potential monetary policy moves by the Federal Reserve (Fed).

Many of the Federal Reserve’s (Fed) policymakers have been vocal in the past few weeks regarding the resilience of the US labour market, highlighting at the same time the good health of the whole US economy.

That said, US Treasury Secretary Janet Yellen asserted that they currently have a robust job market and see no indication that labour market conditions are contributing to inflation. Austan Goolsbee, President of the Chicago Fed, emphasized the need to assess whether strong GDP and job numbers signal overheating that might be fueling inflation, noting that not all data suggests overheating in the labour market. Fed Chair Jerome Powell remarked that the labour market is progressing towards a healthier equilibrium despite ongoing strength, and broader wage pressures are gradually easing. In addition, San Francisco Fed Mary Daly remarked that the labour market remains strong, although inflation is not declining as rapidly as it did last year.

When will the ADP Survey be released, and how could it affect the USD Index?

The upcoming release of the ADP job creation survey, scheduled for Wednesday, May 1, is anticipated to reveal an addition of 179K new positions in the private sector for April. Should the actual figure significantly exceed this estimate, it may indicate a persistently robust labour market. Coupled with rising wages, such results are likely to stimulate demand for the USD. Conversely, if job creation falls short of expectations and wages show signs of moderation, it could hurt the sentiment around the Greenback and probably exert some downside pressure on the US Dollar Index (DXY).

Speaking about techs around the USD Index (DXY), Pablo Piovano, Senior Analyst at FXStreet, argues: “If downward pressure intensifies, the USD Index (DXY) is anticipated to encounter initial support around the critical 200-day Simple Moving Average (SMA) at 104.13, followed by the April low at 103.88 (April 9). Further weakness could breach this level, leading to a test of the temporary 100-day SMA at 103.77, preceding the March low of 102.35 (March 8).”

On the other hand, Pablo notes that the resumption of bullish momentum may seek to retest the 2024 peak of 106.51 (April 16). Surpassing this level could encourage market participants to contemplate a move towards the November high at 107.11 (November 1), just prior to the 2023 top at 107.34 (October 3).

Considering the broader perspective, the prevailing constructive tone is expected to remain as long as DXY maintains its business above the 200-day SMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trims losses and approaches 1.1380

The US Dollar now succumbs to the re-emergence of the selling pressure and allows EUR/USD to recoup part of the ground lost and approach to the 1.1380 zone on Thursday. Earlier on Thursday, the ECB matched estimates and lowered its rates by 25 bps.

GBP/USD extends the daily recovery, looks at 1.3300

The upside impulse in the British pound remains everything but abated and now propels GBP/USD to the upper end of the range, shifting its attention to recent yearly peaks near 1.3300 the figure.

Gold breaks below $3,300, daily troughs

Further improvement in the sentiment surrounding the risk-associated universe put Gold prices to the test on Thursday. Indeed, the troy ounce of the precious metal faces increasing downside pressure and breaches the key $3,300 mark to hit new daily lows.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.