ADI Elliott Wave technical analysis [Video]

![ADI Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/dow-jones-industrial-average-on-iphone-4-stocks-app-16978003_XtraLarge.jpg)

ADI Elliott Wave Analysis Trading Lounge.

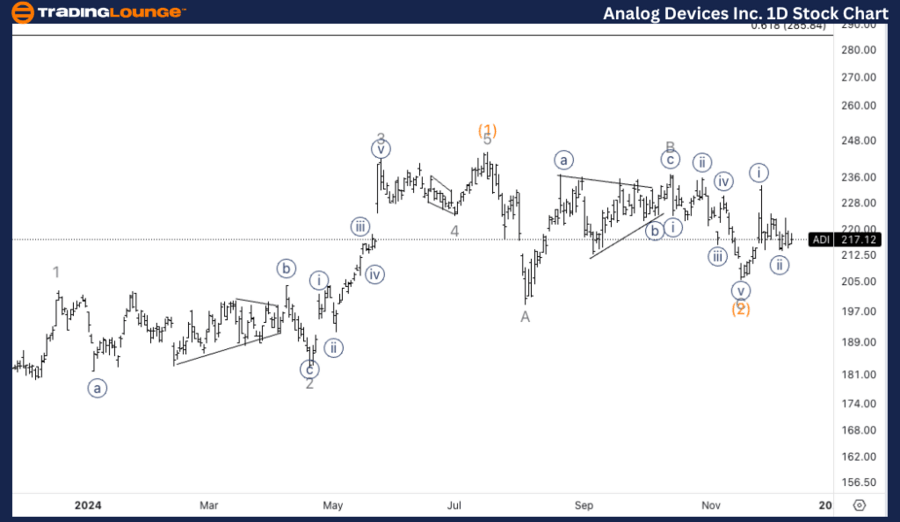

Analog Devices Inc., (ADI) Daily Chart.

ADI Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {ii} of 1.

Direction: Upside into wave {iii}.

Details: Looking for a bottom in wave {ii} to then continue higher as we are currently trading within the range of Minor Group1 at 210-230$.

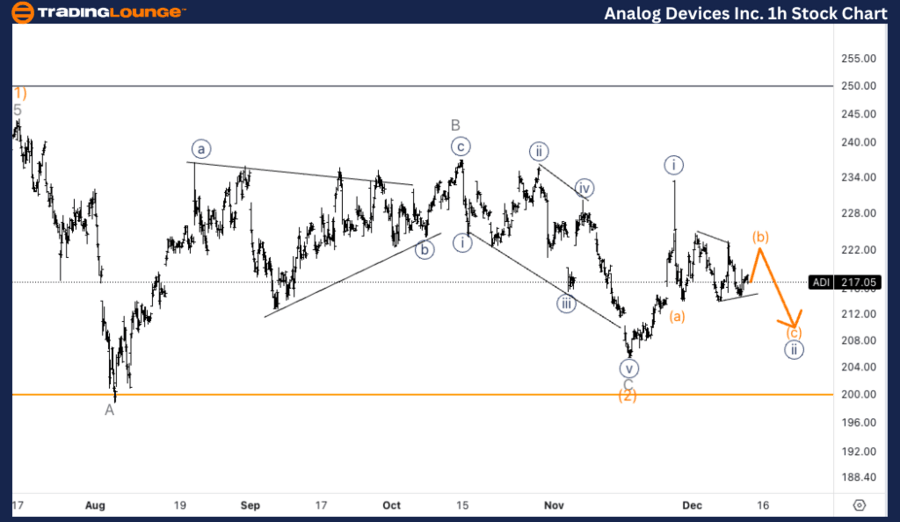

Analog Devices Inc., (ADI) 1H Chart.

ADI Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (b) of {ii}.

Direction: Bottom in wave {ii}.

Details: This would be the only scenario suggesting we ae in a wave {ii} and we are headed towards the end of {ii} in wave (c) after a triangle in wave (b).

This Elliott Wave analysis of Analog Devices Inc., (ADI) outlines both the daily and 1-hour chart structures, highlighting the current trends and possible future price movements.

ADI Elliott Wave technical analysis – Daily chart

The daily chart suggests that ADI is in wave {ii} of a larger impulsive structure. The current price action is within the MinorGroup1 range of $210-$230, indicating that a bottom may be forming soon. After this, we expect wave {ii} to complete, leading to a strong move upward into wave {iii}.

ADI Elliott Wave technical analysis – 1H chart

The 1-hour chart shows that ADI is currently in wave (b) of {ii}, and a triangle pattern seems to have formed in this corrective wave. The next move is expected to be a drop into wave (c) of {ii}, completing the correction before a bullish reversal takes place in wave {iii}.

Technical analyst: Alessio Barretta.

ADI Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.