Adani Ports and SEZ Elliott Wave technical analysis [Video]

![Adani Ports and SEZ Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/stock-market-performance-9668321_XtraLarge.jpg)

ADANIPORTS Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 5 Grey.

Details: Minor Wave 5 Grey is progressing higher within Intermediate Wave (5) Orange against 1160. Alternatively, Minor Wave 5 Grey already terminated around 1630 (truncation) and the stock has turned lower.

Invalidation point: 1160.

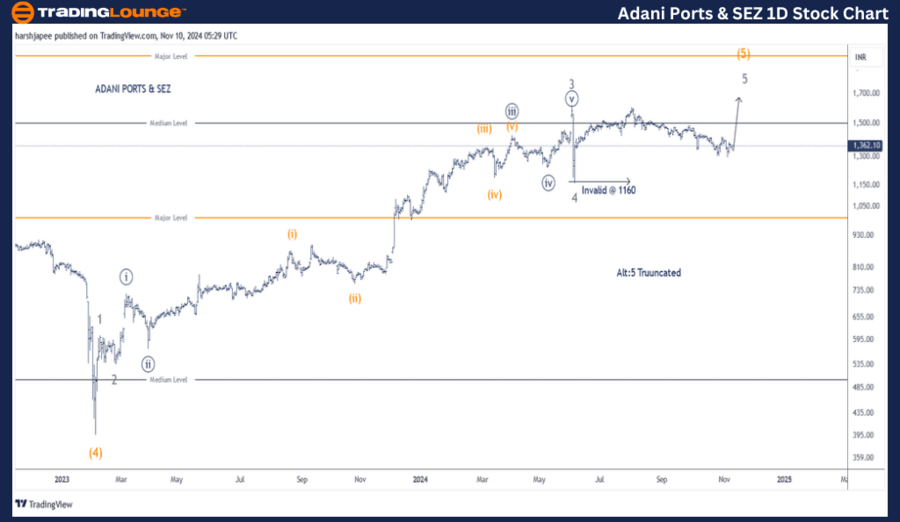

Adani Ports and SEZ daily chart technical analysis and potential Elliott Wave counts

Adani Ports and SEZ daily chart is indicating a progressive rally, which is into Minor Wave 5 of Intermediate Wave (5) Orange, and targeting above 1600 high going forward. Bottom line for bulls to remain in control is 1160 low; Minor Wave 4 termination.

The stock earlier terminated Intermediate Wave (4) Orange around 395 mark in February 2023. Since then, the rally could be clearly sub divided into five waves. Minor Waves 1 through 4; and Wave 5 is now underway. Minor Wave 3 was extended, which is ideally the case.

If the above holds well, prices should turn higher from here (1360), and continue pushing through 1600 high going forward. Alternatively, a drop below 1160 would indicate a potential trend reversal ahead.

Adani Ports and SEZ Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 5 Grey.

Details: Minor Wave 5 Grey is progressing higher within Intermediate Wave (5) Orange against 1160. Minute Waves ((i)) and ((ii)) might be complete around 1600 and 1300 levels respectively. If correct, Minute Wave ((iii)) should be underway soon. Alternatively, Minor Wave 5 Grey already terminated around 1630 (truncation) and the stock has turned lower.

Invalidation point: 1160.

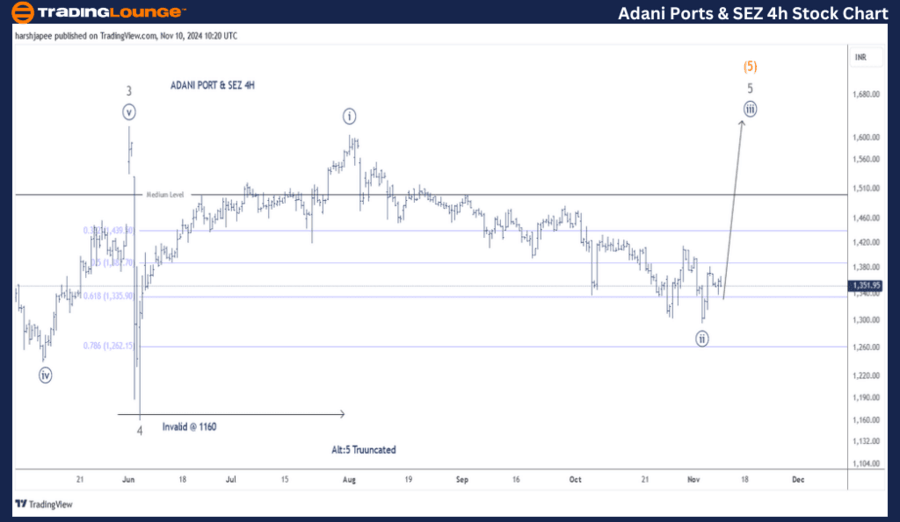

Adani Ports and SEZ four-hour chart technical analysis and potential Elliott Wave counts

Adani Ports and SEZ 4H chart highlights the sub waves after Minor Wave 4 completed around 1160 mark on June 06, 2024. Minute Waves ((i)) and ((ii)) also within Minor Wave 6 look complete 1600 and 1300 respectively. If correct, prices should stay above 1160 as Minute Wave ((iii)) gets underway.

Conclusion

ADANI PORT & SEZ is progressing higher within Minor Wave 5 of Intermediate Wave (5) against 1160, targeting above 1600 high.

Adani Ports and SEZ Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.